Tax deducted at Source (TDS) in Tally prime

Table of Contents

ToggleTDS introduction

The Indian tax structure is broadly a two-dimensional approach toward the payment of tax liabilities. In the first method self-assessment taxes can be paid voluntarily after evaluation of income during a financial year.

In the second method. Tax deductions at source or TDS as the same suggest is the spot deduction of tax from the income source itself at the time of earning. This is to simplify the taxation procedure for the government and to ensure that the payment making and receiving individual company is accounting the same without fail.

TDS is applicable for earning from several financial instruments and business transactions like the sale of property, interest income from bank, Commission and incentives, the payment received for contracts and services vendors, dividends and awards, or prices earned as money.

There is no uniform rate for TDS deduction.Depending on the source of earning,it can range from 1% for sale proceeds to 30%

DUE DATE FOR PAYMENT OF TDS.

It is the responsibility of the organization deducting the TDS, known as the deductor, to duly pay the applicable TDS to the government before the due date. Generally, the due date for TDS payment is always the 7th day of the next month, with a few exceptions.

Challan ITNS 281 is the Challan form for online payment of TDS (Tax Deducted at Source) and TCS (Tax Collected at Source). Challan No. 281 is applicable for Tax Deducted at Source / Tax Collected at Source (TDS/TCS) from corporates and non-corporates. TDS exception is essentially a mechanism developed by the Indian Government where in there is a tax deduction at the source of an income, calculated at a specific rate and thereby becomes payable to the department of Income Tax.

Due Date for Filing TDS Returns FY 2020-2021

Quarter -Quarter Period -Quarter Ending -Due Date

- 1st Quarter April – June -30 June 2020- 31 March 2021

- 2nd Quarter July – September -30 September 2020 -31 March 2021

- 3rd Quarter October – December- 31 December 2020 31 January 2021

- 4th Quarter January – March -31 March 2020 -31 May 2021

TDS Return Forms

The following are the TDS return forms and the purpose for which they are used:

- Form 24Q TDS from salaries

- Form 26Q TDS on all payments apart from salaries

- Form 27Q Subtraction of tax from dividend, interest or any other amount payable to non-residents

- Form 27EQ Collection of tax at source

What is a TDS Certificate?

TDS Certificates are of two types: Form 16 and Form 16A. Under Section 203 of the Income Tax Act, 1961, a certificate must be provided to the deductee showing the amount that has been subtracted as tax. The deductor is liable to provide this form to the deductee.

For salaried class: In case of salaried employees, employers are required to provide them with Form 16 with a mention of the amount that has been deducted as TDS. Form 16 contains a host of details such as the computation of tax, the deduction of tax, and the payment of TDS. Employers must issue this form to their employees before May 31 of the following financial year.

For non-salaried class: The deductor provides the deductee with Form 16A, and it contains all the details regarding the computation of tax, the deduction of TDS, and payments.

List of TDS deducted at source

IT Section | Threshold Limit | TDS rate |

Section 192 | As per applicable income tax | As per income tax slab |

Section 193 | Rs 5000 for debenture payment | 10% of interest earned on security Investment |

Section 194 | Rs 2500 | 10% of proceeds from any deemed Dividend |

Section 194A | Rs.1000 | 10% of proceeds from interest earned On investment other than security |

Section 194B | Rs 10,000 | 30% of prize money on lottery or gaming related winnings |

Section 194BB | Rs. 10,000 | 30% of prize money from horse racing |

Section 194C | Section 194C₹ 30,000 which is for each contract, whereas ₹ 100,000 is for p.a | Proceeds from any contracts / sub contracts • Individuals or HUF @ 1%

• Non-Individual/corporate @ 2% |

Section 194D | ₹ 15,000 | 5% of earning as insurance commissions |

Section 194EE | ₹ 2,500 | 20% of expense in NSS deposits |

Section 194F | NIL | 20% of investment in MF or UTI units |

Section 194G | ₹ 15,000 | 5% of the commission money from lottery ticket selling. |

Section 194H | ₹ 15,000 | 5% of the brokerage earnings |

Section 194I | ₹ 1,80,000 | 2% on rental amount of plant & machinery/ 10% on the rent of land & building |

Section 194J | rs. 30,000 | 10% on the technical/professional services |

Section 194LA | ₹ 2,50,000 | 10% on the transfer money paid to any resident while acquiring an immovable property |

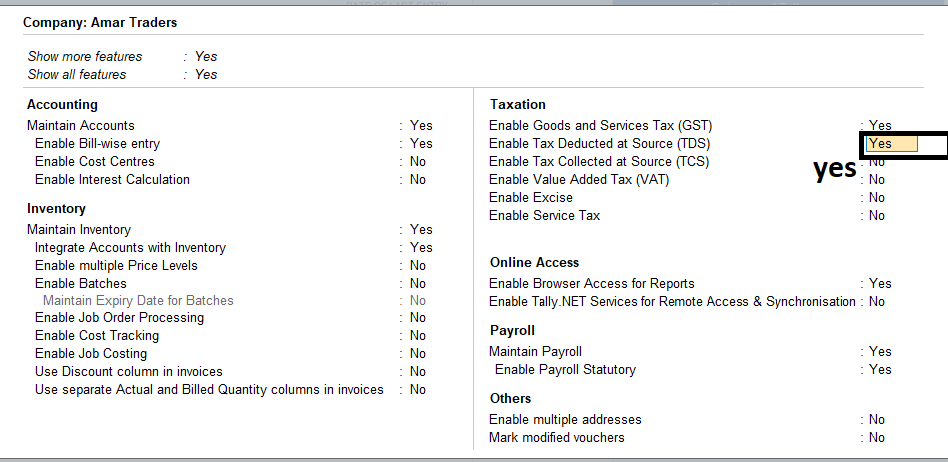

Activate Tax Deducted at source in tally Prime

You can enable the TDS feature, provide surcharge details, record transactions and generate the required reports and returns.

Press F11 (Features) > set Enable Tax Deducted at Source (TDS) to Yes.

If you do not see this option:

Set Show more features to Yes.

Set Show all features to Yes.

The TDS Deductor Details screen appears

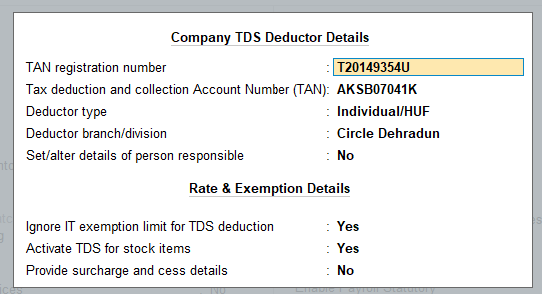

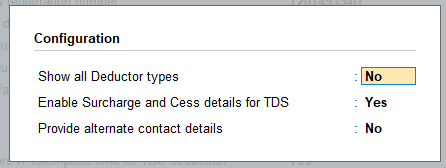

Press F12 (Configure).

Set the option Show All Deductor types to Yes, to view all the deductor types.

Set the option Enable surcharge and cess details for TDS to Yes, to enter the surcharge and cess details.

Set the option Provide alternate contact details to Yes, to enter the company’s STD Code, Phone No. and E-Mail.

Press Ctrl+A to save.

Enter the TAN registration number.

Enter the Tax deduction and collection Account Number (TAN).

Select the Deductor Type.

Enter the details of Deductor branch/division.

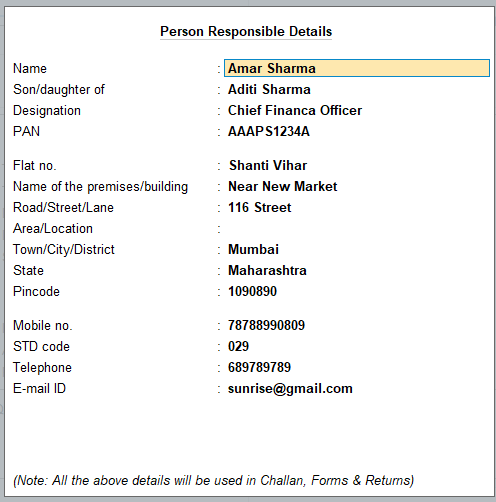

Enable the option Set/alter details of person responsible to display the Person Responsible Details screen. Enter the relevant details:

- Press Enter. The TDS Deductor Details screen appears.

- Set Ignore IT Exemption Limit for TDS Deduction to:

- Yes, if you don’t want to consider the IT exemption limit.

- No, if you want to consider the IT exemption limit.

- Set Activate TDS for stock items to:

- Yes, if you want to define TDS rate in stock item.

- No, if you do not want to define TDS rate in stock item.

- Set Provide surcharge and cess details to Yes.

- In the TDS Deductor Details screen, press F12 (Configure) > set Enable surcharge and cess details for TDS to Yes.

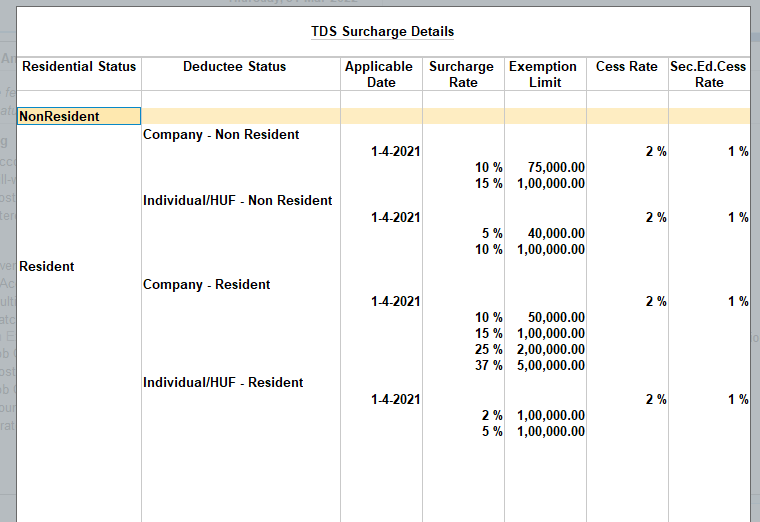

. - Enter the surcharge and cess details for each deductee status. You can enter the required surcharge slab details with the applicability date.

TDS nature of Payment

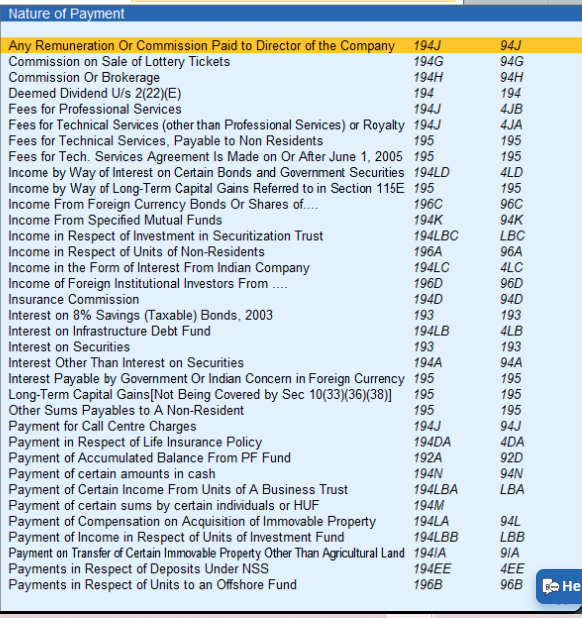

For payments attracting TDS, the relevant nature of payment is defined by the department with associated tax rate, section, payment code, and threshold limit. While creating a TDS Nature of Payment, you can press Alt+H (Helper) to select the required nature of payment.

In this section

TDS Nature of Payment

Create sub-section for TDS Nature of Payment Section 194J

Create TDS Nature of Payment

- Gateway of Tally > Create > type or select TDS Nature of Payments > and press Enter.

- Alternatively, press Alt+G (Go To) > Create Master > TDS Nature of Payments > and press Enter.

Press F12 (Configure). - Set Allow transporter category to Yes, to capture the value of transaction recorded with party having PAN, under Exempt in lieu of PAN available in Form 26Q.

Set Allow tax rate without PAN to Yes, to enter the tax rates for Individuals/HUF for each nature of payment. - Press Enter to save.

Press Alt+H (Helper) to view the list of Nature of Payment.

- Select the required Nature of Payment. The Section and Payment code are displayed automatically.

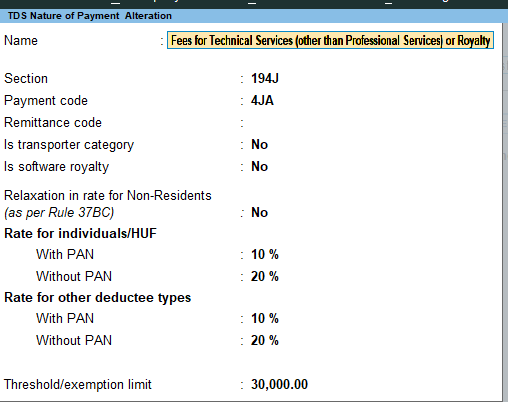

- Enter the Rate of TDS for With PAN and Without PAN.

- The same appears in Rate for other deductee types.

Enter the Threshold/exemption limit as applicable.

- Accept the screen. As always, you can press Ctrl+A to save.

- To view the history of Rate and Exemption Limit Details provided for different dates,

If you need to use this option only for the current master, press Ctrl+I (More Details) > type or select TDS Details (History)> and press Enter.

The details will appear with the breakup of rate With PAN and Without PAN as shown below: