Accounting treatment of interest on Drawings in Tally Prime

Accounting treatment of interest on drawing Tally Prime

Interest on the drawing is Income for Business therefore it is shown in the credit side of the Profit and loss Account to know more go to our blog.

In tally, we have to create two ledgers to create Voucher entry of Interest on Drawing.

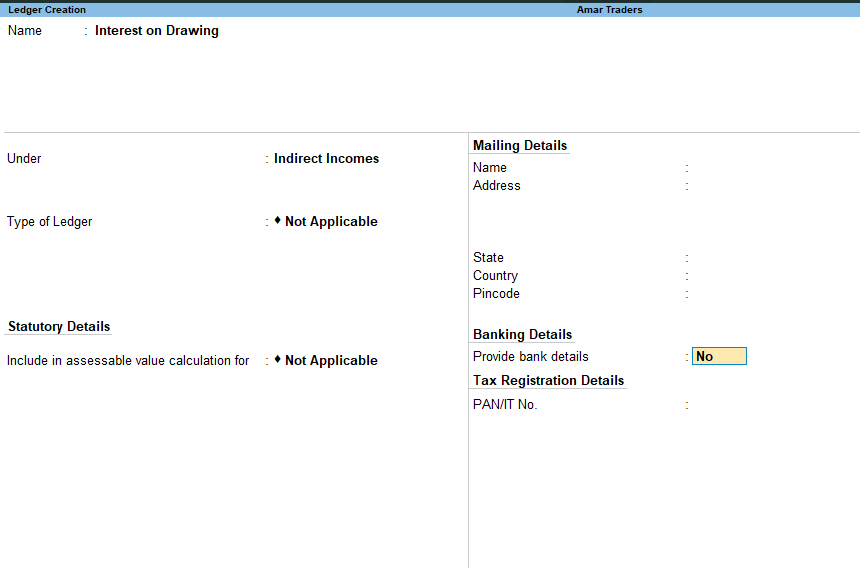

Ledger Creation Of Interest on Drawing in Tally Prime

- Go to gateway of tally >Create>ledger

- Name: Type Interest on Drawing

- Under : Select Indirect Income

- CtrL+ A to save the programme

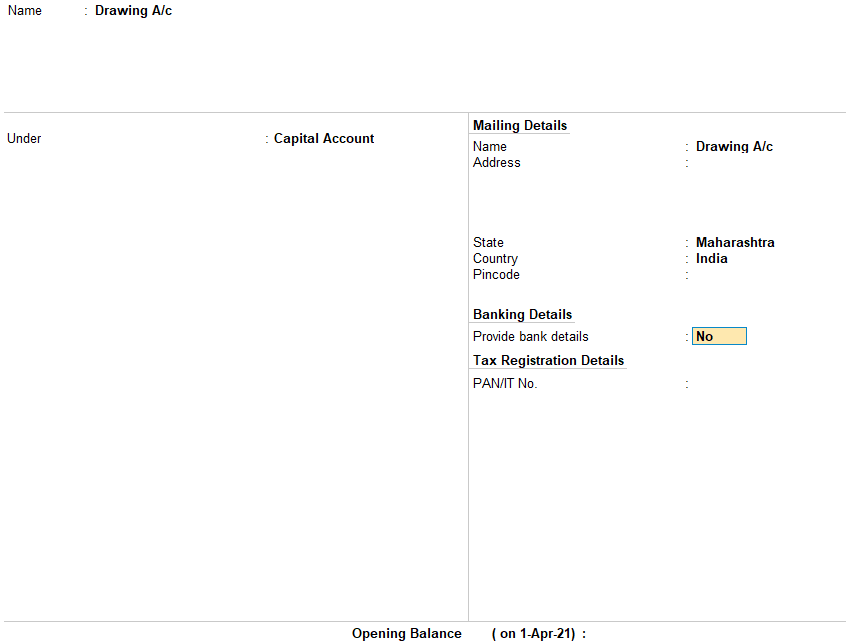

Ledger Creation Drawing in Tally Prime

- Go to gateway of tally >Create>ledger

- Name: Type Drawing

- Under : Select Capital

- CtrL+ A to save the programme

To create voucher entry of Interest on drawing

- Go to the gateway of tally >voucher

- press >f7 from the keyboard

- Press F2 to change the date

Note the entry of interest on the drawing is made on 31 March every year.

- Dr. Drawing A/c as interest in drawing is to be added to Drawing account

- Cr. Interest on drawing accounts as it is income for the firm.

Interest on the drawing will be deducted from Capital in the liability side balance sheet