Journal Entry of Interest on capital and Interest on Drawing in Accounting

Table of Contents

ToggleJournal Entry of Interest on Capital

What is Capital?

When the owner of the business invested money or some asset in business, it is known as capital.

Hence, capital is liability for business when capital is invested in the business

Example:

Started business with cash Rs 1000000.

the journal entry for the same will be

Cash A/c Dr. 1000000

To Capital A/c 1000000

(being business started with cash)

Here is real accounts and it comes in business, therefore, we Debit Cash Accounts and Capital is a Personal account by nature hence as per personal account Credit the giver t, therefore, we Credit Capital Accounts.

Capital accounts is a liability and we increase the liability of our business, therefore, we Credit Capital Accounts also.

From the above transaction, we can understand this is the journal entry in accounting when Capital is introducing in business.

It is the assumption that if a business owner does not invest the amount the business, he will keep it bank and get interest from the bank but if he invests in business, he has taken risk therefore business need to give some profit in result but that depends upon future even what will happen therefore an accounting entry of interest on capital need to be passed in the book of accounts to give some interest to businessman which is not is cash which is just adjusted from the profit or loss of the business.

Interest on capital journal entry

Interest on capital A/c Dr.

To capital A/c

(being adjustment of interest on capital)

Here what we do at the end of accounting year business show its expense interest on capital which is Nominal by nature and expense therefore as per Nominal accounts rule it will be debited and added it to our capital.

Interest on capital On profit and loss Accounts

First of all journal entry of Interest on capital need to be pass

Which is

Interest on capital A/c Dr | XXXX |

To Capital A/c | XXXX |

(being interest on capital) |

Then this interest on capital needs to be pass in Profit and Loss in Final accounts which need to be in debit side of profit and loss accounts because it is an expense of the business and need to be added to the capital of the owner in balance sheet.

DR CR

Particular | Amount | Particular | Amount |

To Interest on capital A/c | XXXX | ||

Interest on capital in Balance Sheet

Interest on Capital on Balance sheet

Liabilities | Amount | Assets | Amount |

Capital A/c XXX (ADD)+ Interest on Capital XXX | XXXX | ||

Interest on capital added to the capital of businessman as he is the one who invested in business so whatever is the interest on capital that is added to its Capital at the end of accounting year

Example of Interest on capital in case of partners

Question :

Mohan and Ramesh share profits and losses in the ratio of 3:1. The capital on 1st April 2021 was ₹ 200000 for Mannan and ₹ 100,000 for Ramesh and their current accounts show a credit balance of ₹ 10,000 and ₹ 5,000 respectively. Calculate interest on capital at 5% p.a. for the year ending 31st March 2018 and show the journal entries.

Solution:

Calculation of interest on capital:

Interest on capital = Amount of capital x Rate of interest

Interest on Mohan’s capital = 200000 x 5/100 = ₹ 10,000

Interest on Ramesh’s capital = 100000 x 5/100 = ₹ 5,000

Note: Balance of current account will not be considered for calculation of interest on capital.

Date | Particular | LF | Amount | Amount |

31/3/22 | Interest on Capital A/c Dr. To Mohan To Ramesh (being interest on capital Provided)

|

| 15,000

|

10000 5000 |

31/3/22 | Profit and loss appropriation A/c TO interest on Capital A/c (being interest on capital closed) |

| 15000 |

15000 |

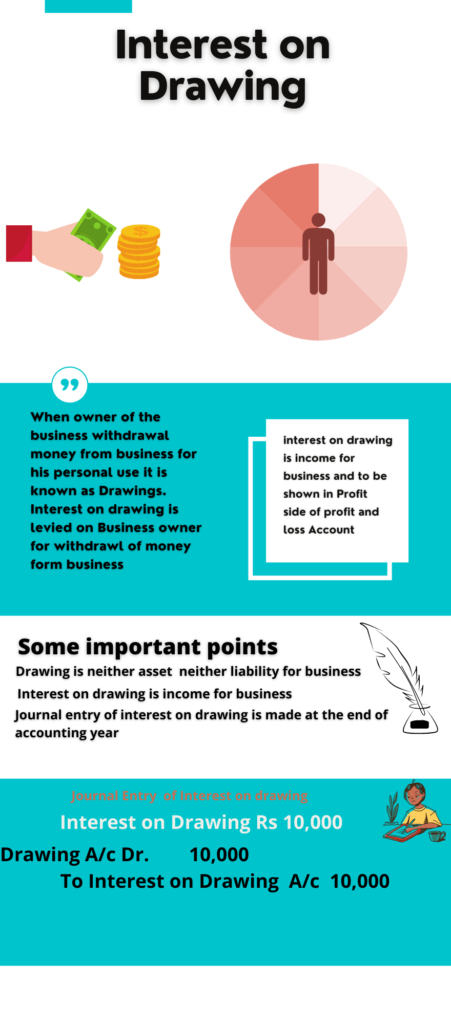

Journal Entry of Interest on drawing

journal entry for interest on drawing

What is drawing?

When the owner withdrawal money from the business for personal use it is known as drawings.

Journal entry of Drawing

Accounting Treatment of interest on Drawing

Example

Drawing A/c Dr. | XXXX |

To cash A/c | XXXX |

(being interest on the drawing) |

Some Accounting Treatment of interest on Drawing

The owner takes away goods for his personal use.

Drawing A/c Dr | XXXX |

To Purchases A/c | XXXX |

(Being goods taken by the owner for personal use) | |

The Owner takes away the computer for his personal use.

Drawing A/c Dr | XXXX |

To Computer A/c | XXXX |

(Being goods taken by the owner for personal use) | |

Under all these conditions interest on drawings, entry is passed as per drawing done by the owner in a business.

If a business keeps on withdrawing money or any other asset of business from the business it affects a business, therefore, to deter business owner to reduce the number of drawing from business interest is charged from the Business owner which is known as Interest on drawing and journal entry of the same will be.

Some entries of drawing when cash is not affected.

How interest in drawing is calculated?

Interest on the drawing is calculated on a certain percentage as described in the business deed. It can be something near to bank interest on FD.

Such as the owner withdrew goods for his personal use, then goods will be affected.

Charge interest on drawings journal entry

Drawing A/c Dr | XXXX |

To Interest on Drawing A/c | XXXX |

(being interest in Drawing) |

Interest on drawing is gain or profit for business and Nominal by nature therefore it will be added to the credited in a journal entry

Interest on Drawing in Profit and Loss Accounts

Interest on drawings

Interest on Drawing is gain or profit for business and Nominal by nature therefore it will be added to the credited in a journal entry

Interest on the drawing is Income by nature therefore it will be shown in the credit side of profit and loss accounts. This is just an accounting entry made at the end of an accounting year in the books of accounts the rate of interest should be mention in the deed which was created when the business is formed. It increases the profit in the books of accounts.

Example

DR CR

Particular | Amount | Particular | Amount |

To Interest on Drawings A/c | XXXX | ||

Interest on Drawing in Balance sheet

Liabilities | Amount | Assets | Amount |

Capital A/c XXX (LESS)- Interest on Drawings XXX | XXXX | ||

Interest on Drawings is Deducted from the capital in the Liability side of Balance sheet.

Example of interest on Drawings

Manoj is a partner in a partnership firm. As per the partnership deed, interest on drawings is charged at 12% p.a.

During the year ended 31st march 2021 he drew as follows:

Calculate the amount of interest on drawings.

1 oct 2020 6000

1 jan 2021 12000

withdrawl on 1 oct 2020 = 6000 X 6/12 X 12/100 = 360

withdrawl on 1 jan 2021 = 12000 X 3/12 X 12/100 =360

total interest on Drawing is Rs 720

Comparison of Journal entry

Interest on capital | Interest on Drawing |

Interest on capital is Expense For business | Interest on drawing is Income for business |

Its is shown in the Dr side of Profit And loss Account as it is an expense. | It is shown in the Cr. Side of Profit and loss Accounts as it Is income. |

It is added to capital in liability side of balance sheet | It is deducted from the Capital in the liability side of balance sheet |

A percentage of interest on capital is decided in the company Deed. | A percentage of interest on drawing is decided in the company Deed. |

Entry Interest on capital A/c Dr xxx To capital A/c xxx | Entry Drawing A/c Dr. xxxx To interest on drawing A/c xxxx |

FAQ interest on Capital and Interest on Drawing

Why is Interest Charged on Capital?

The partner of business have invested fund in business therefore these fund are use to sustain business

if they invested money in bank or invest somewhere else they will get interest as profit now they have invested

in business therefore businesses will pay them some fixed interest on capital as they have taken risks because the business may run or fail in the future.

What is the formula of interest on capital?

Interest on capital = Amount of capital x Rate of interest per annum x Period of interest.

For example if the interest on capital is 10% of Capital Rs 200000

then

200000 X 10/100 = 4000

What is the purpose of charging interest on drawings of the partners?

If partner of business keeps on withdrawing money from a business it’s not good for business

therefore to discouraging partners from withdrawing

excessive amounts from the business Interest is charged from partners known as interest on drawing.

From this, it follows that interest on drawings is a debit entry in the partners’

current accounts and a credit entry in the appropriation account.

Short MCQ

Time’s up