How to make Journal entry for interest on drawing

Table of Contents

ToggleHow to make Journal entry for interest on drawing

What is Drawing?

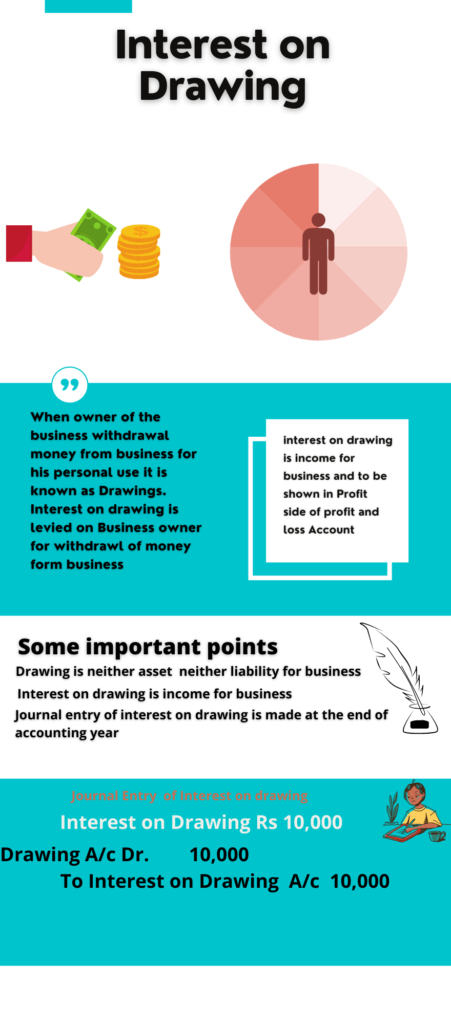

When ower of the business withdrawal money from business for his personal use it is known as Drawings.

But it the business keeps on withdrawing money from the business for personal use it affects it business, therefore, to refrain him from withdrawing money from business a interest is levy on him which is known as Interest on drawing.

Example of Drawing

Suppose Mr A start business with cash Rs 100000 and after a month he withdrew cash from his business Rs 10,000 for his personal use hence the money withdrawal by Mr A is drawing by nature and interest on drawing is 10% .

When a business man withdrawal money from business in form of drawing it means he reduces his capital from business hence automatically in financial year whatever drawing he taken away from business will be deducted from his Capital.As he withdrawal money from business it will effects his business therefore a Interest on capital is imposed on him therefore in ythis case it will be Rs 1000 which is 10% of Rs. !0,000.

Journal Entry of Interest on Drawing

Interest on drawing is Income for business because it is imposed on businessman and to be added to profit side of profit and loss account in book.

Journal entry will be .

Drawing A/c Dr. XXXX

To Interest on Drawing A/c XXXXa

Interest on Drawing in Profit and Loss A/c

Interest on drawing is income for business and income is shown in the credit side of profit and loss account .

let see in the table below

Particular | Amount | Particular | Amount |

|

| By Interest | xxxxx |

Why Interest on Drawing is income for the business?

Interest on drawing is interest levied on businessman for reducing capital of business in form of drawing. When a business man withdrew money from business for personal expenses then that effect Capital of business as Capital get decreases therefore a interest in charge from businessman. It does not mean business man pay interest in form of cash or bank. But it will effect its profit side of profit and loss accounts. It an accounting entry of adjustment of profit and decreasing of capital.

Interest on Drawing in Balance Sheet

Interest on drawing in Balance sheet .

Balance has two side Liabilities and Assets .

Note Drawing is neither Asset neither liabilties it just means reducing the capital of business. To reduce the capital of business drawing is deducted from business similary interest on Drawing is dedected form capital of business because it is because of business man.

Liabilities | Amount | Assets | Amount |

Capital A/c + profit /- loss – Interest on drawing – Drawing |

Goods as Drawing

Example :

Proprietor taken away goods Rs 10,000 for his personal use.

Its means the owner was taken away goods from the business for his personal use.

therefore Journal entry for the above will be

Drawing A/c Dr. | 10,0000 |

To Purchases A/c | 10,000 |

(Being goods taken away by owner for his personal use) | |

Here purchase is credited because when goods are purchased the value of that goods is taken .

Now is Trading Account value of purchase is deducted by Rs 10,000

Particular | Amount | Particular | Amount |

To Purchase A/c – Drawing 10,000 |

In balance sheet drawing will be deducted from Capita a/c

Liabilities | Amount | Particular | Amount |

Capital A/c – Drawing 10,000 |

Asset as Drawing

Example :

Proprietor took away Furniture Rs 10,000 for his personal use.

Its means the owner was taken away Asset from the business for his personal use.

therefore Journal entry for the above will be

Drawing A/c Dr. | 10,0000 |

To Furniture A/c | 10,000 |

(Being Furniture taken away by owner for his personal use) | |

Here a purchase is credited because when goods have purchased the value of that goods is taken.

Now is Trading Account value of the purchase is deducted by Rs 10,000

Particular | Amount | Particular | Amount |

To Purchase A/c – Drawing 10,000 |

In the balance sheet, drawing will be deducted from Capita a/c and from Asset

Liabilities | Amount | Asset | Amount |

Capital A/c – Drawing 10,000 | Furniture -Drawing 10,000 |

Example of interest on drawing

Trial balance as on …..

| Particular | Amount | Amount |

| Capital A/c | 1000000 | |

| Drawing A/c | 100000 |

Owner withdrew drawing from the business on 1 Jan 2021 And interest on the drawing will be 10% per annual.

Now the above question we have to calculate interest in drawing.

Total drawing Rs 100,000

Rate of interest to be charged 10%

100000 X 10/1000= 10,000 this is for year

Now for 3 months interest on drawing will be as drawing was made on 1 Jan 2021.

10,000 X 3 / 12 = 2500.

Interest on drawing will be 2500,

Journal entry will be .

| Particular | Amount | Amount |

| Drawing A/c Dr | 2500 | |

| To Interest on drawing A/c | 2500 | |

| (being interest on drawing) | ||

Interest on drawing in profit and loss accounts

| Particular | Amount | Particular | Amount |

| To Interest on drawing | 2500 |

Balance sheet as on ……………

| Liabilities | Amount | Assets | Amount |

Capital A/c 1000000 – Interest on drawing 2500 – Drawing 100000 |

897500 |

FAQ

Why interest on drawings is deducted from capital ?

Interest on drawing is income for business, and it is to taken from the owner of the business as owner withdrawing money for personal use a interest is imposed on him.On the other hand, it is a personal expense of the owner. … It is also a personal expense of the owner. Therefore, it will be added to the drawings account in the balance sheet and ultimately will be deducted from the capital.

Under what circumstances Average Method of calculating interest on drawings is applied?

nterest on Drawings can be calculated by two methods:-

1.Simple Average Method.

2.Product Method

Average Method of Calculating Interest on Drawings can be used under these circumstances:-

1. When fixed amounts are drawn at equal intervals let say monthly/quarterly/annually.

2. When Fixed amounts are withdrawn in the beginning of the month.

3. When Fixed amounts are drawn at the end of the month

4. When fixed amounts are drawn in the middle of the month.

MCQ

Time’s up