Top 40 Tally prime Interview Questions & Answers (Updated 2023)

Tally Prime Interview Questions

1) Mention what is the difference between Tally ERP 9 and Tally prime ?

Tally ERP 9 | Tally Prime |

Access to Tally Data by specifying the Folder Path | Access to Tally Data by – Specifying the Folder Path OR Navigating to Tally Data Folder Path using Select From Drive option |

Multi-Tasking not possible in a single instance of Tally | Multi-Tasking is easily possible in a single instance of Tally Prime. Open Multiple Reports / Vouchers without opening a new instance of Tally using the New GoTo Button |

Tally Erp works on Windows 7 and windows 10 | Tally Prime works on Windows 10 and above. It runs on a 64-bit operating system only. |

|

|

2.Define group in Tally ?

A group is defined as a compilation of ledgers of the exact nature. In the business, expenses like telephone bills, conveyance, electric bills, etc., are usually included in groups. Ledger based on these expenses is shaped to be used while accounting vouchers are entered.

3) How retrieve Narration from the previous ledger

Press Alt + R in Voucher narration

4) How switch to a different report, and create masters and vouchers in the flow of work

Ctrl+G in gateway of tally

5)Why to do a certification on Tally?

Tally certification helps, and it is an easy and effective way to demonstrate mastery of Tally. It helps employers identify and hire the candidate, and also it contributes to your professional image profile, credibility and career options

6.How open the company menu with the list of actions related to managing your company

Alt + K Top menu

7.What is job costing ?

Job costing is a form of specific order costing, which applies to a job undertaken according to customer requirements and specifications. In Tally, you can track the cost and revenue

8.What is TCS ?

Tax collected at source (TCS) is the tax payable by a seller which he collects from the buyer at the time of sale

9.What are full form of HSN and SAC?

Harmonized System of Nomenclature (HSN) and Service Accounting Code (SAC)

10. Mention what are the types of Tally prime vouchers? Also give the shortcut for creating this vouchers

- Contra Voucher->( F4 ) : It indicates the transfer of funds from bank account to the cash account or cash account to bank account, or one bank to another bank account

- Payment Voucher->( F5) : It describes payment histories like payment of salary or office rental

- Receipt Voucher->(F6) : This voucher describes any transaction that involves the receipt like payment made to the bank

- Journal Voucher->(F7) : It includes the expenses to maintain the business or company running like expenses made after marketing

Sales/Invoice - Voucher->(F8) :This voucher describes the sales made, it displays the sale invoice

- Credit Note Voucher->(Cntrl+F8): Entry in this voucher is made in when customer returns some items due to incorrectly dispensed

- Purchase Voucher->(F9) : Entry in this voucher is made when any item is purchase for running the business

- Debit Note Voucher->(Cntrl+F9) : Entry in this voucher is made when goods are sent back to the suppliers due to damage or goods expired

- Reversing Journals->F10 : It is special journal entry that is automatically reversed after the date of the journal

Memo Voucher->Cntrl+F10: Entry in this voucher is made to display the unknown expense at that moment of time and can be converted to an actual sale voucher, or it can also be deleted.

11. what is data synchronization in tally

You can use data synchronisation to share and update data between two or more locations, including head office, branches/warehouses. At both locations, you must have the same release of Tally prime The transactions recorded at all branches or warehouses can be consolidated at the head office, or a designated branch.

- Go to Gateway of Tally > Create > Ledger or Alt+G (Go To) > Create Master > Ledger.

13. What is a group in Tally ERP 9?

A group in Tally is a collection of ledgers of the same nature.

For instance, a group may include common expense like bills for electricity, phones, travel, etc, incurred by a business.

Tally has 28 groups by default, 15 of which are called primary groups, while the rest are subgroups.

14. Mention the pre-defined ledgers which are available in Tally ERP 9.

The tally includes pre-defined ledgers for cash and profit/loss statements.

Cash ledgers can be created under the group for cash-in-hand, and profit and loss ledgers can be created under the primary group.

15.When do we use income and expense statements instead of profit and loss and how do you choose that option on Tally?

For organizations that do not trade goods or services, and income and expenditure statement is more suitable since their books of accounts mainly record only their income sources and expenditure over time.

NGOs, trusts and other non-profit institutions use this feature generally.

In Tally, one can easily toggle between Income and Expenditure Statement and Profit and Loss A/c by pressing F11 and setting “Use Income and Expenses A/c instead of Profit and Loss A/c” to Yes. It changes the report menu accordingly.

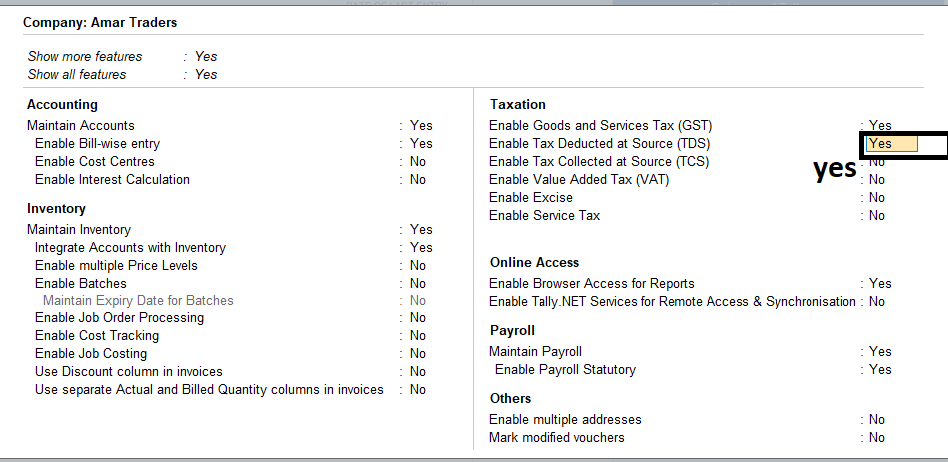

- Press F11 (Features) > set Enable Goods and Services Tax (GST) to Yes.

- If you do not see this option:

Set Show more features to Yes. - Set Show all features to Yes.

fill other details

17.How do you show income and expenditure in Tally prime?

Go to Gateway of Tally > Accounts Info. > Ledgers > Alter > Profit & Loss A/c. Specify Income and Expenditure in the name field as shown.

18.Mention what is the shortcuts for Voucher Creation and Alteration Screen in Tally ?

Tally ERP 9, allows to create master (ledger, stock item) on the voucher by the shortcut Alt+C

19. what is suspense accounts ?

A suspense account is a holding account found in the general ledger. Depending on the transaction , a suspense account can be an asset or liability.

20. How do you create a cost category and cost center in Tally prime?

Go to Gateway of Tally > Accounts Info. > Cost Centres > Create ( under Single Cost Centre) .

Press Backspace to change the default Category , if required. …

Enter the Name .

Select the parent cost centre Under which the cost centre has to be grouped.

Press Enter to save the Cost Centre

21 To delete a voucher/transaction

select voucher or transaction and press Alt + D

22 How to open Company

To open Company top menu

Alt + K or select Top menu

23.How can I use debit note and credit note in Tally prime?

Debit Note can be entered in voucher or invoice mode. Gateway of Tally > Vouchers > press F10 (Other Vouchers) > type or select Debit Note > and press Enter. Alternatively, press Alt+G (Go To) > Create Voucher > press F10 (Other Vouchers) > type or select Debit Note > and press Enter.

24. How do bank reconciliation in Tally prime?

Gateway of Tally > Banking > Bank Reconciliation > and press Enter. Alternatively, Alt+G (Go To) > type or select Bank Reconciliation > and press Enter.

Select the required Bank account from the List of Bank Ledgers and press Enter. The Bank Reconciliation screen of the selected Bank appears.

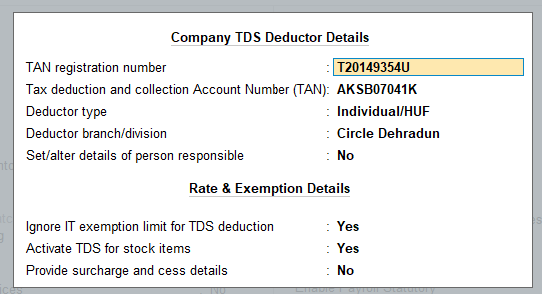

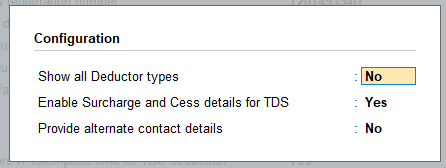

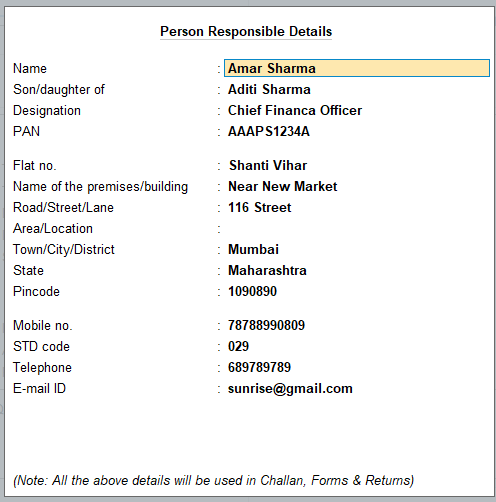

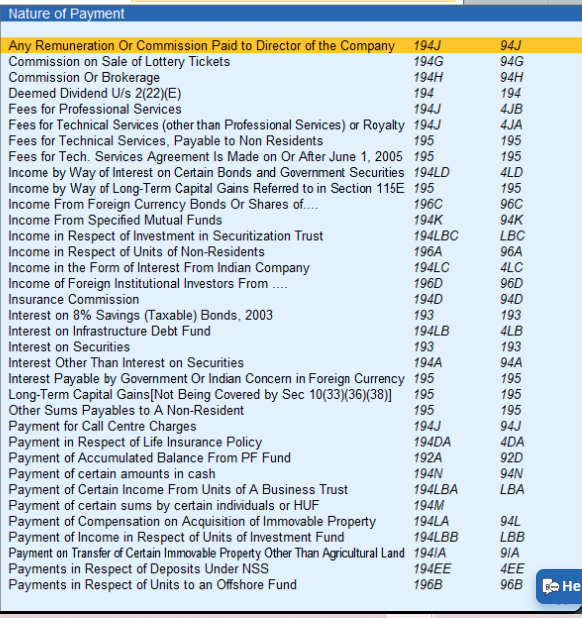

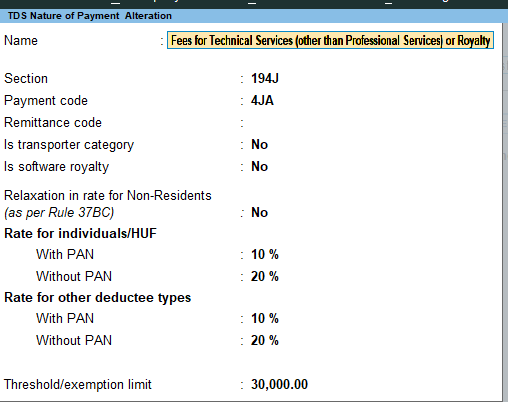

25. How can I get TDS details in Tally prime?

Gateway of Tally > Display More Reports > Statutory Reports > TDS Reports > TDS Outstandings. Alternatively, press Alt+G (Go To) > type or select TDS Reports > TDS Outstandings> and press Enter.

26 What is the shortcut key copy the text from Tally prime?

Answer:

We can use the shortcut Ctrl+Alt+C to copy text and shortcut Ctrl+Alt+V to paste the copied text.

27 How to Export master Data in TallyPrime

Press Ctrl+E (Export) > Masters/Transactions.

Press C (Configure), and configure the options as needed.

To export Masters, set the options as needed.

Select the Type of Masters for export.

28 What is the difference between GST input and output?

Input GST means Input IGST Input CGST Input SGST they are used with purchase means tax paid comes under the category of Current assets.

Whereas Output means Output IGST Output CGST Output SGST means Tax collected which is our liabilty to pay to goverment .

29 what is rate of GST on luxury items?

Rate of GST on luxury item is 28%

30 How set up for Inward Supply Under Reverse Charge in Tally Prime ?

Gateway of Tally > Alter > type or select Stock Item > and press Enter.

Alternatively, press Alt+G (Go To) > Alter Master > type or select Stock Item > and press Enter.

Select the required stock item.

Specify GST applicability.

Set the option GST Applicable to Applicable.

Enable the option Set/Alter GST Details.

Provide GST details.

Press F12 (Configure) > set the option Enable Reverse Charge calculation to Yes > and save the configuration screen.

In the GST Details screen, set the Taxability to Taxable.

Set Is reverse charge applicable to Yes.

Enter the GST rates.

31 What is a reverse charge mechanism?

The supplier of goods or services pays the tax on supply. In a reverse charge, the receiver becomes liable to pay the tax, i.e., the chargeability gets reversed.

Its responsibilty of receiver of goods to pay the tax to goverment by adding rate of tax on goods supplied

32 what is reverse charge in GST ?

if a vendor is not registered under GST supplies goods to a person registered under GST, then reverse charge would apply. This means that the GST will have to be paid directly by the receiver instead of the supplier

33 Reverse charge in Tally prime

Raise the Tax Liability and Claim Tax Credit

Go to Gateway of Tally > Display > Statutory Reports > GST > GSTR-3B .

Press Enter on Reverse Charge Inward Supplies . You can raise the tax liability for the amount shown in this report.

Click J : Stat Adjustment .

Debit and credit the tax ledgers.

Press Enter to save.

34 Preliminary expenses under which head in tally

Normally preliminary expense are treated as intangible asset and shown on the asset side of the balance sheet under the head Miscellaneous asset.

35. What is deferred revenue expenditure in which head in TALLY PRIME

Tally prime provides a special group for deferred revenue expenditure namely “Misc. Expenses (ASSET)”

36 What is E -invocing ?

e-Invoicing’ or ‘electronic invoicing’ is a system in which B2B invoices are authenticated electronically by GSTN for further use on the common GST portal. … All invoice information will be transferred from this portal to both the GST portal and e-way bill portal in real-time

38.What is annual return for normal tax payer

GSTR 9 is an annual return for normal taxpayer and date.

31st December of next financial year.

39. How to create multiple currency in tally prime ?

Select Create or press C to create a new currency.

Gateway of Tally > Create > Currency > and press Enter

40. How to create compostion dealer in tally prime

Press F11 (Features) > Enable Goods and Services Tax (GST) – Yes.

Set/alter GST details? – Yes.

Registration type – select as Composition.

Tax rate for taxable turnover appears as 1%. This rate is applied to your transactions to arrive at the taxable value.

In case of restaurant 5%

41. What is Tally Prime, and how is it different from earlier versions of Tally?

Tally Prime is an advanced accounting software developed by Tally Solutions. It is a significant upgrade over earlier versions of Tally, offering a modern user interface, improved navigation, and enhanced functionalities to make accounting tasks more efficient

42. How can you generate a "Cash Flow Statement" in Tally Prime?

To generate a Cash Flow Statement in Tally Prime, go to “Gateway of Tally” > “Display” > “Cash/Funds Flow.” You can view the Cash Flow Statement in either “Indirect Method” or “Direct Method.”

43. Explain GSTR-1,

GSTR-1 is a monthly or quarterly return that contains details of all outward supplies made by a registered taxpayer. It includes information about sales made to other registered businesses (B2B sales) and sales made to end consumers (B2C sales). GSTR-1 needs to be filed by the 10th of the following month (monthly filing) or the 13th of the following quarter (quarterly filing).