Complete Tally Prime Tutorial on Trading Organization with GST

Table of Contents

ToggleIntroduction of GST in Trading organization

GST is an Indirect tax levied on whole nation .It stand for goods and service tax.

Types of dealers in GST

There are three types of dealers in GST .

- Registered

- Compositions

- Unregistered

Registered dealers are those who who can claim ITC on the GST paid to your supplier and use the same to offset your output tax liabilities.

Composition dealers does not charge GST under law but has to pay GST as flat rate he will not be able to issue a tax invoice to you.

Unregistered dealer When you purchase from unregistered dealer you will be liable to pay GST under RCM.

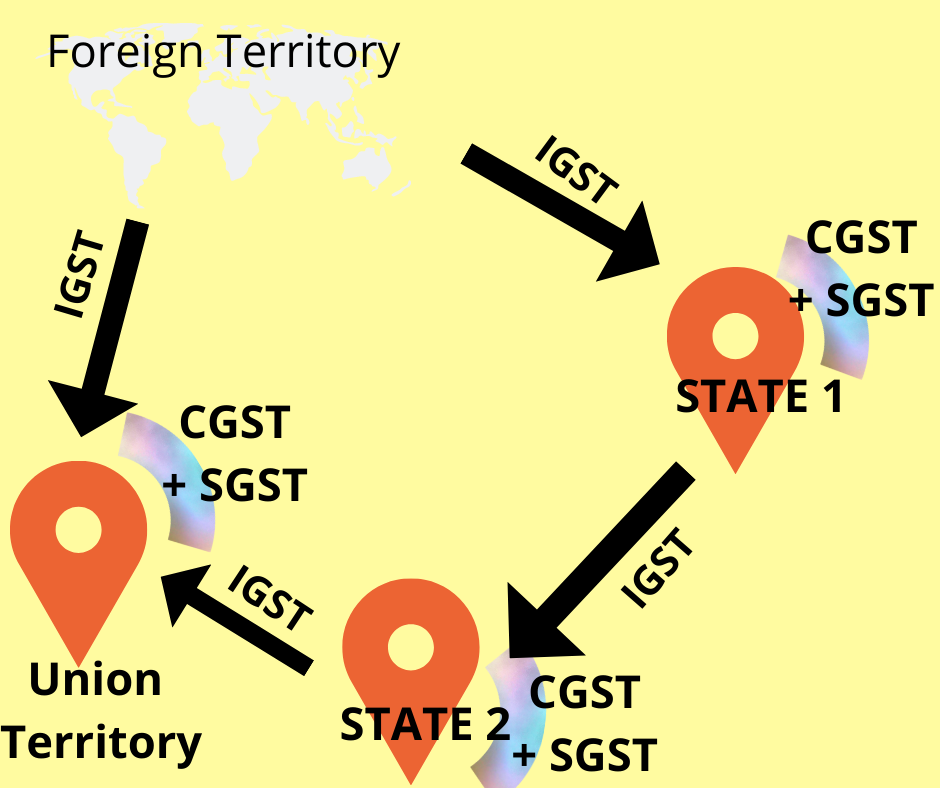

GST is divided into three tax slab

- IGST

- CGST

- SGST

IGST when goods are purchased and sale from other state.

Example IGST 18% which means GST 18%

CSGST and SGST when are goods are purchased or sale within the state

Example

CGST 9% SGST 9% which means GST 18%.

GST Mechanism

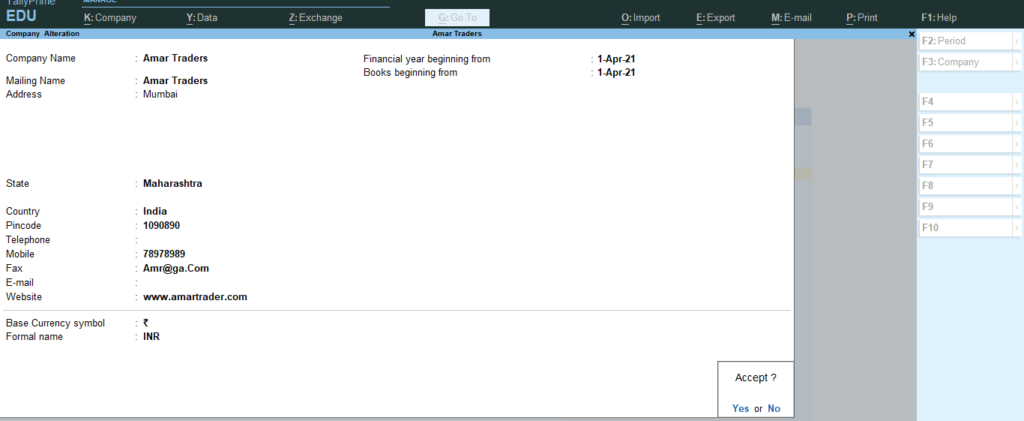

Create company In Tally prime

- Go to gateway of tally > press Alt+K >create

- Type the name of the company

- Email address and all the information

- Select country and state so the tax compliance will be added.

- Save the file.

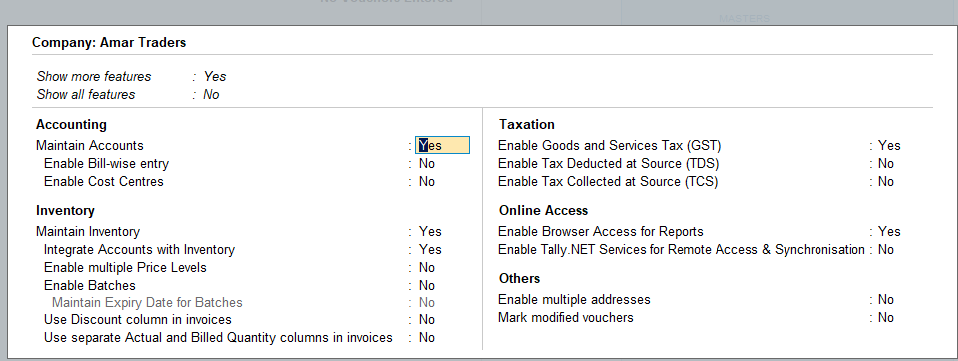

GST compliances on Company

- Go to gateway of tally > press Alt+K >F11

- Maintain accounts YES

- Maintain Inventory YES

- Intergrade accounts with inventory YES

- Enable goods and service tax (GST) YES

- A New widows appear

- State :Maharashtra

- Registration type :regular

- GSTIN/UIN :27AAACB5343E1ZI

- Applicable from : 1 april -21

- Periodicity : Monthly

As bill wise detail and E-way bill we will see later how to implement that .

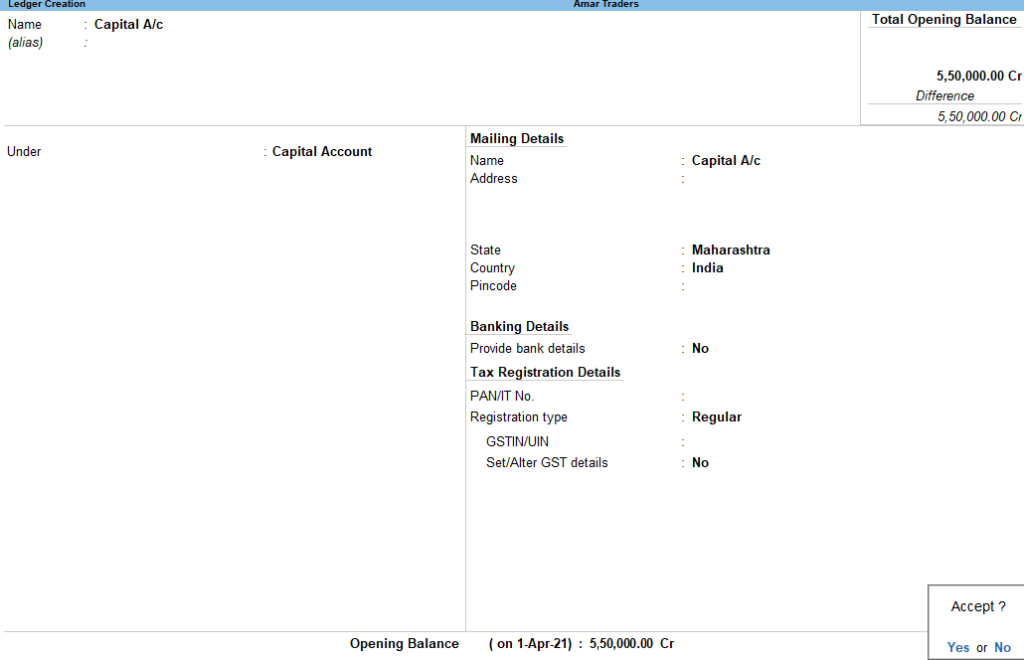

Opening balance Trading company in Tally Prime

In the company we already have Closing balance therefore according to that we have to post opening balances in the Tally Prime.

Balance Sheet as on 31 March 2021

Liabilities | Amount | Assets | Amount |

Capital A/c | 550000 | Fixed Asset (as per List) | 500000 |

Bank OD /OCC A/c ICIC bank Loan A/c | 100000 | Current Asset Closing Stock | 100000 |

Secured Loan Navin Kailash | 200000 30000 | Sundry Debtors (As per list) | 400000 |

Sundry Creditor (Hindustan ltd) | 200000 | Cash | 150000 |

(current liabilities) Provision (as per list) | 50000 | Bank A/c | 250000 |

Unsecured Loan (as per list) | 100000 | Deposits (as per list) | 100000 |

1500000 | 1500000 |

Closing stock at the end of the balance sheet

List- Provision

S.no | Name | Amount |

1 | Electricity Bill Payable/c | 10,000 |

2 | Office exp payable | 10,000 |

3 | Rent Payable | 15,000 |

4 | Salary Payable | 15,000 |

|

| 50,000 |

List- Unsecured Loan

S.no | Name | Amount |

1 | Komal | 30,000 |

2 | Kunal | 20000 |

3 | Sandip | 25000 |

4 | Payal | 25,000 |

|

| 100,000 |

List of Fixed Assets

S.no | Name | Amount |

1 | Computer | 100000 |

2 | Printer | 25000 |

3 | Motor Vehicles | 275000 |

4 | Furniture | 100000 |

|

| 500000 |

List of Sundry Debtors

S.no | Name | Amount |

1 | 5 star Super Market | 25000 |

2 | Apollo Traders | 25000 |

3 | Dhanlaxmi Provision | 20000 |

4 | Dhruv traders | 100000 |

5 | National Distributors | 50000 |

6 | JR Foods | 22000 |

7 | Modi traders | 78000 |

8 | Patel foods | 50000 |

9 | Potdar traders | 50000 |

|

|

|

S.no | Name | state | Registration | GSTIN |

1 | 5 star Super Market | MAHARASHTRA | Compositions | 27AAACIC1681G1ZP |

2 | Apollo Traders | Maharashtra | Compositions | 27AAACB2100P1ZX |

3 | Dhanlaxmi Provision | Maharashtra | Regular | 27AAACB2902M1ZT |

4 | Dhruv traders | Maharashtra | Regular | 27AABCL5045N1Z8 |

5 | National Distributors | Maharashtra | Regular | 27AAACI1195H2ZL |

6 | JR Foods | Maharashtra | Regular | 27AAACC1206D1ZG |

7 | Modi traders | Maharashtra | Regular | 27AAACC1206D1ZG |

8 | Patel foods | Maharashtra | Unregistered | …………………. |

9 | Potdar traders | Uttarakhand | Regular | 05BBEPP1515P1ZI |

|

|

|

|

|

How to create ledger in Tally Prime:

How to create ledger in Tally Prime:

- To create ledger in Tally prime>gateway of tally prime >( Accounting master )create>ledger

- In name type the name of ledger and in under (group) select the group)

- Opening balance type the amount as specified in ledger

- Let the example below

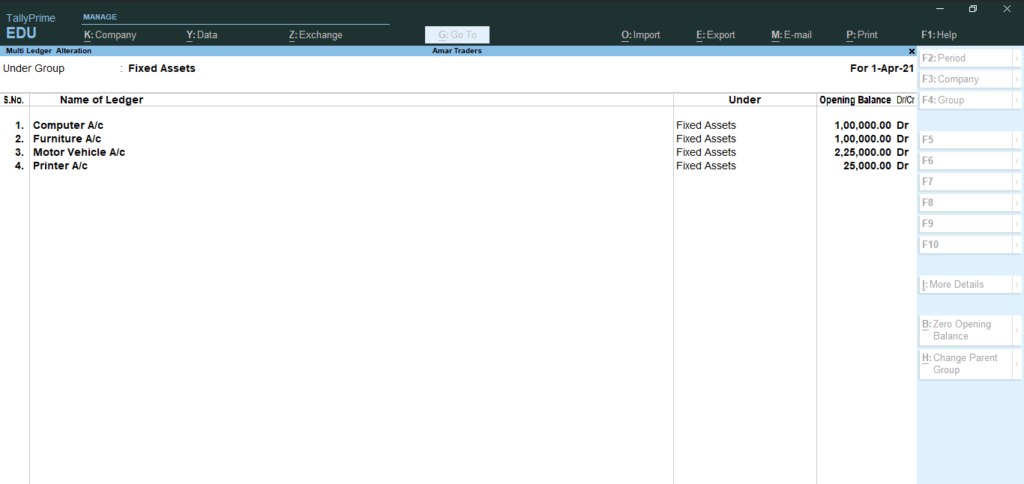

How to create multiple ledgers in Tally Prime:

It means the leger having same group and same nature such as in our case we have fixed asset ,current liabilities debtors etc.

- Go to gateway of tally >chart of accounts

- From chart of Accounts >ledger > Press ALT+H

- Select Multiple Leger

- A screen will open

- Under group select Fixed assets

- Type the name of ledger

- Type the opening balance

- Save

Similar we can create all the multiple leger as mention in the balance sheet .

Inventory Tally Prime

Means stock/goods generally service sector organization does not maintain inventory .

In trading organization inventory means finished goods as they deal with only finished or final product. In manufacturing organization inventory means semifinished and finished goods .

It is known by name stock item in Tally prime.

Stock Group in Tally Prime

Stock group are head of stock item .It contain information about similar inventory and very helpful in classification of inventory .It can be on the basis of common features ,brand name ,product type etc.

Units in tally Prime

A unit is any standard used for making comparisons in measurements such a unit of Numbers which is specified as Nos is Tally prime ,KG signifies Kilo gram ,Mt signifies meter, bag signifies bag etc

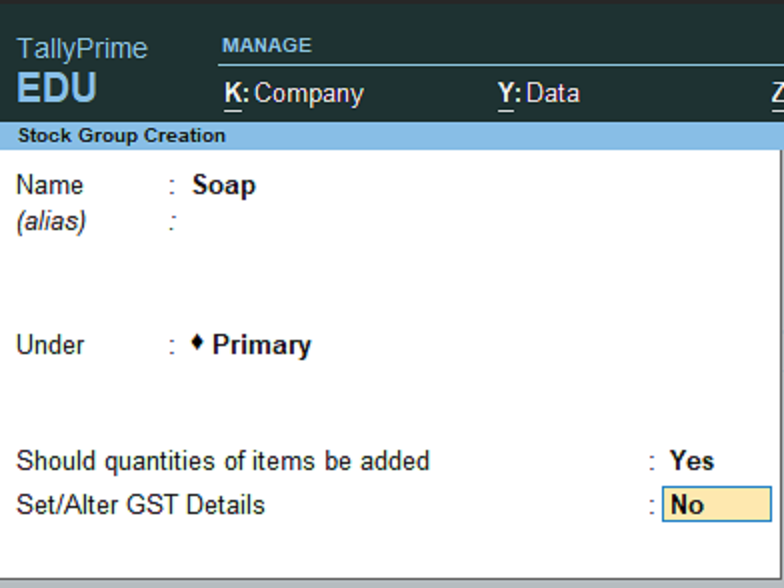

First of all we have create Stock group in Tall Prime.

To create stock group

Go to gateway of tally >create> Inventory masters> Groups.

S.no | Stock Group | under | Can quantities of item to be added | Set alter GST detail |

1 | Soap | Primary | YES | NO |

2 | Bath soap | Soap | YES | NO |

3 | Food | Primary | YES | NO |

4 | Washing bar | Soap | YES | NO |

Now to create group

· Go to gateway of tally >create> Inventory masters> Groups.

· Type the name of the Group > Soap

· Under select > Primary

· Can quantities of item to be added set to YES

· Set alter GST detail set to NO.

See figure below.

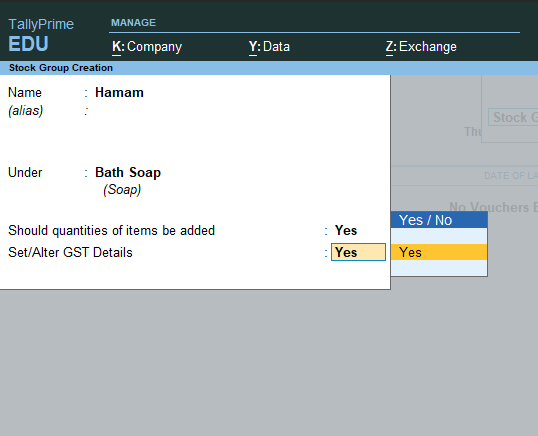

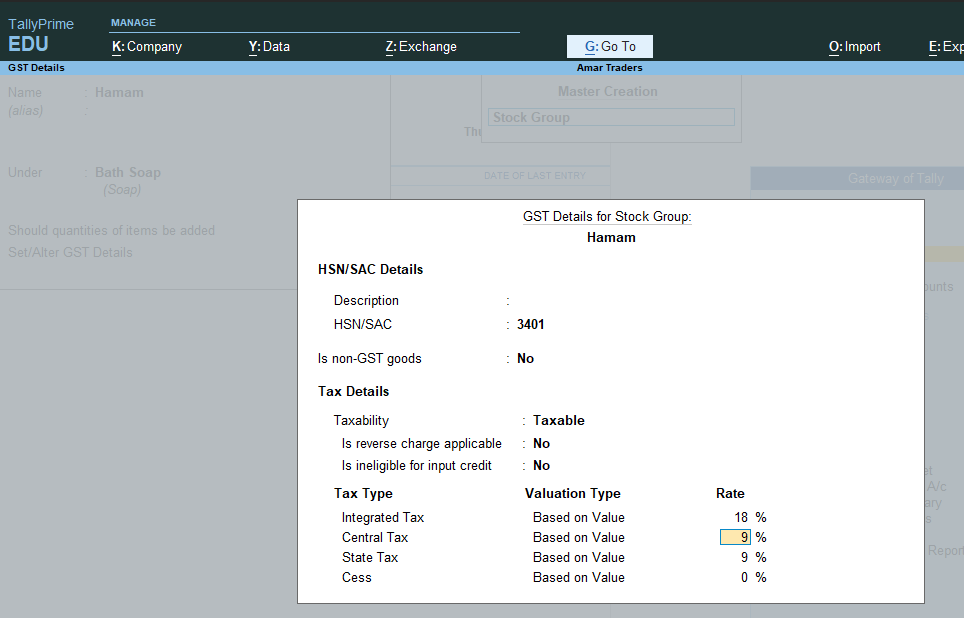

Create subgroup with GST rate and and HSN /SAC

Now we need to Create subgroup with GST rate and and HSN /SAC number

- This method helps us to define GST rate at Sub group level like product have 18% tax rate and some product have 12% tax rate then set rate at group level.

- Under GST all goods and services supplied in India have classified Goods are classified under HSN code and service code .GST rate have been fixed in Five slap namely 0% 5% 12% and 18%.

List of stock group with GST implemented at Group level.

Stock Group | Under | Should quantity be added | Set/alter GST Detail | HSN/SAC | Rate |

Hammam | Bath Soap | Yes | Yes | 3401 | 18% |

Jam | Food | Yes | Yes | 2007 | 12%

|

Juice | Food | Yes | Yes | 2009 | 5% |

Lux | Bath soap | Yes | Yes | 3401 | 18% |

Sauce | Food | Yes | Yes | 2103 | 12% |

Tea | Food | Yes | Yes | 0902 | 5% |

How to Create subgroup with GST rate implemented.

- Go to gateway of Tally prime >inventory Masters >Stock group >

- Type Name > Hammam

- Under primary > select Bath soap

- Should quantity be added >YES

- Set GST /alter detail YES

- A New screen appears

- In HSN //SAC type the code

- Taxability>taxable

- Integrated tax > 18%

- Save

Similarly creates another group in Tally prime as mentioned in list.

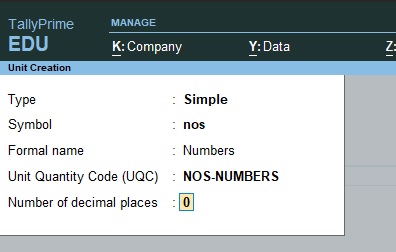

Unit of measurement in Tally Prime

Now We need to create unit of measurement in our case its Nos

How to create Unit of measurement in Tally Prime

- Go to gateway of tally> Inventory >Create

- Select >Units

- Type>simple

- Symbol>nos

- Formal Name: Numbers

- Unit quantity code (UQC)>NOS-Number

- Number of decimal places >0

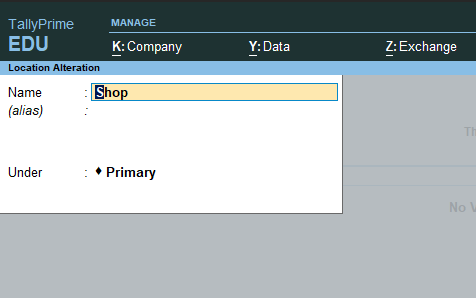

To create location or godown Tally Prime

After creating Nos next thing is to set location /godown of the business where goods are to be placed.

- To create location or godown

- Go to gateway of Tally>Inventory master

- Select location >alter existing location which is by default main location

- Delete main location

- Type >Shop

A new location shop is created similarly create another location warehouse.

Warehouse location is to created not alter.

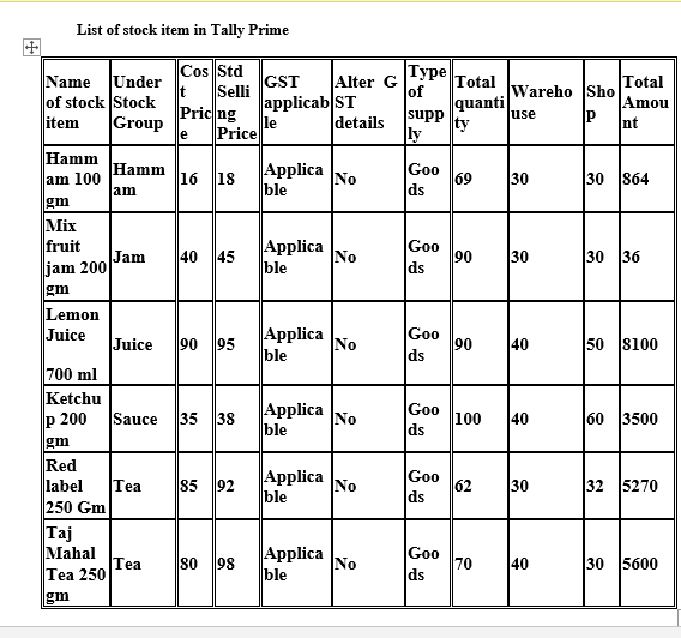

List of Stock item in Tally Prime

Create stock item List in tally Prime

To create stock Item in tally prime

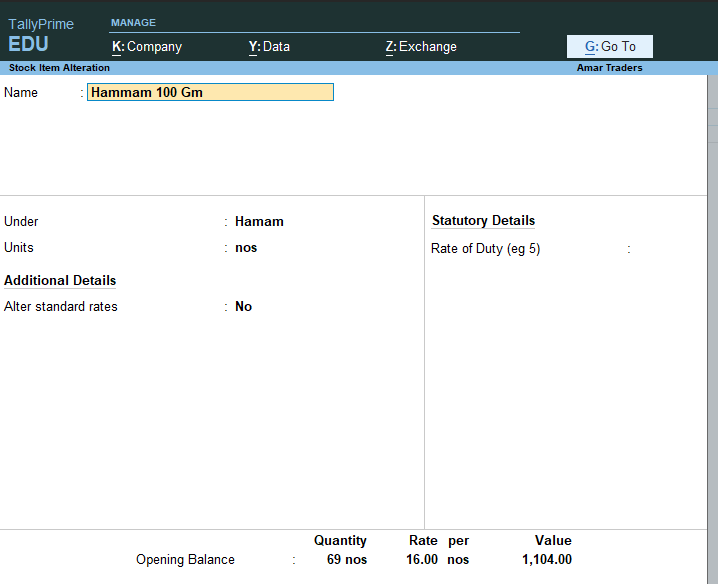

- Go to gateway of tally>Inventory master>Stock Item>create

- A new window appears

- In name Type >hammam 100 gm

- Under > hammam

- Unit >Nos

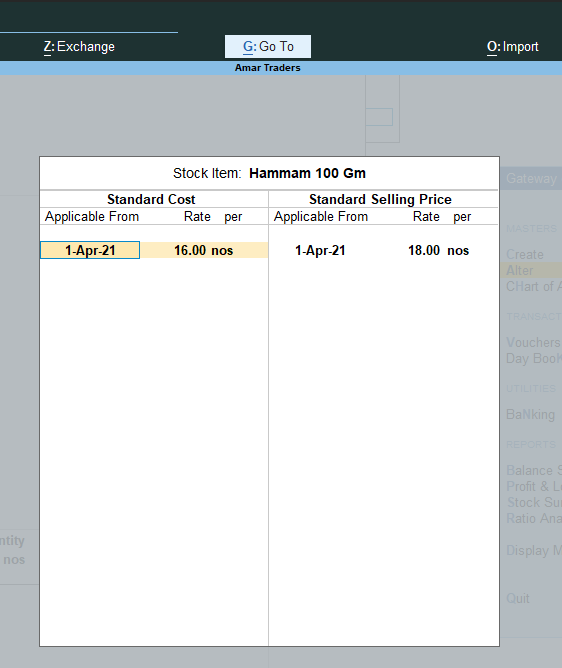

- Set standard rate yes a window appear

- In applicable from Type the date 1/4/21 and in rate standard cost 16

- Type the date 1/4/21 and in rate standard selling cost 18

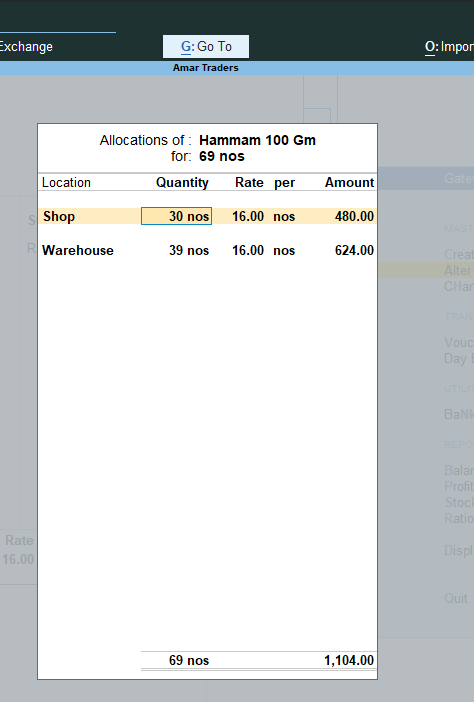

- Now in opening opening balance type 69 a new window appears

- Select shop quantity 30 rate 18

- Similarly select warehouse quantity 39 rate 18

Note :

- Press F12 to check configuration select use group for stock item yes

- Provide opening balance for stock item :Yes

- Provide Unit of measurement of stock item Yes

Now create all other stock item in similar way after creating group as mention above.

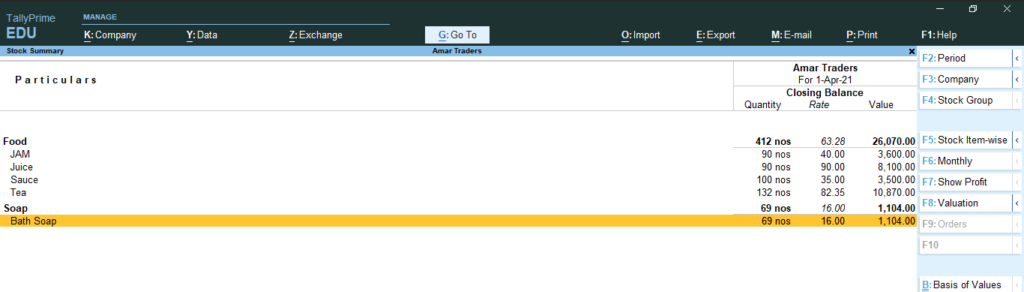

Stock summary in tally prime

After creating all the inventory in tally prime similary next is to see stock summary

To see stock summary there is new feature in tally prime which i

Go to gateway of Tally> Alt+G > show stock summary

Press Alt+f1 for detail reporting

A window will appear

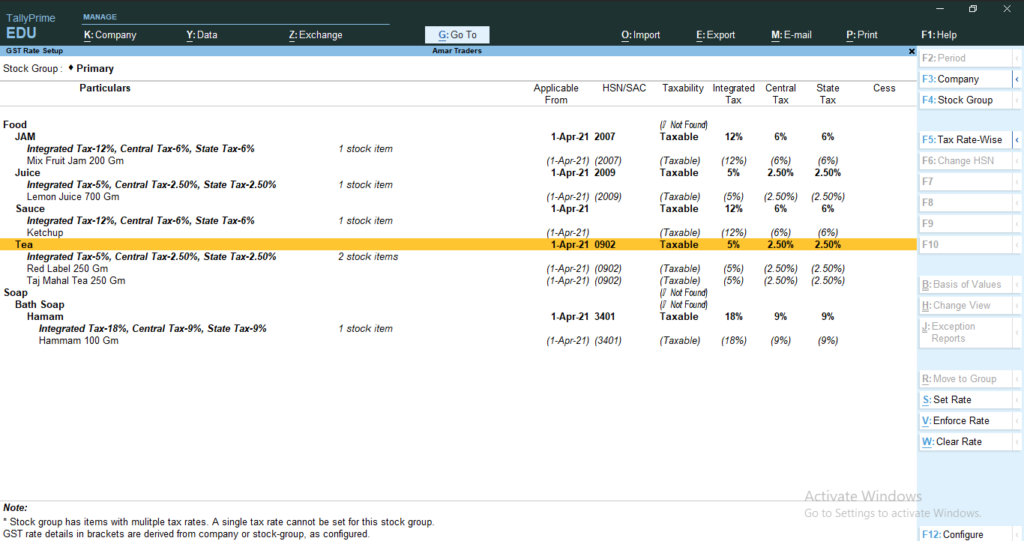

Tax Rate Setup in Tally Prime GST

Now to see the tax rate setup go to gateway of tally >GST reports >GST rate setup>Alt +F1 for detail a new window will appear

As shown here

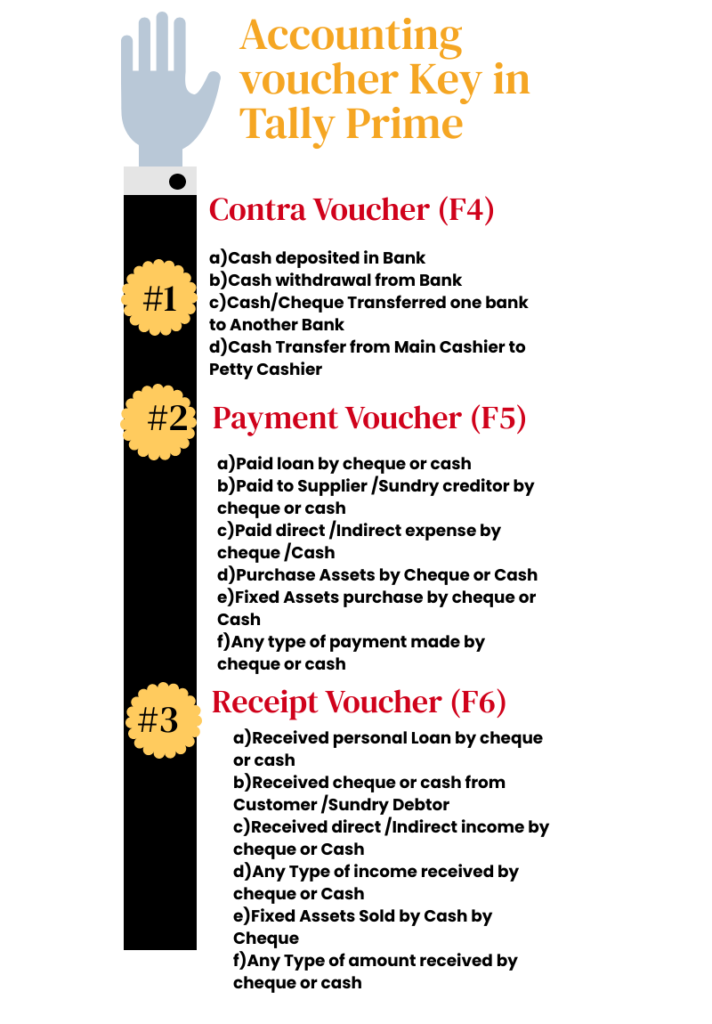

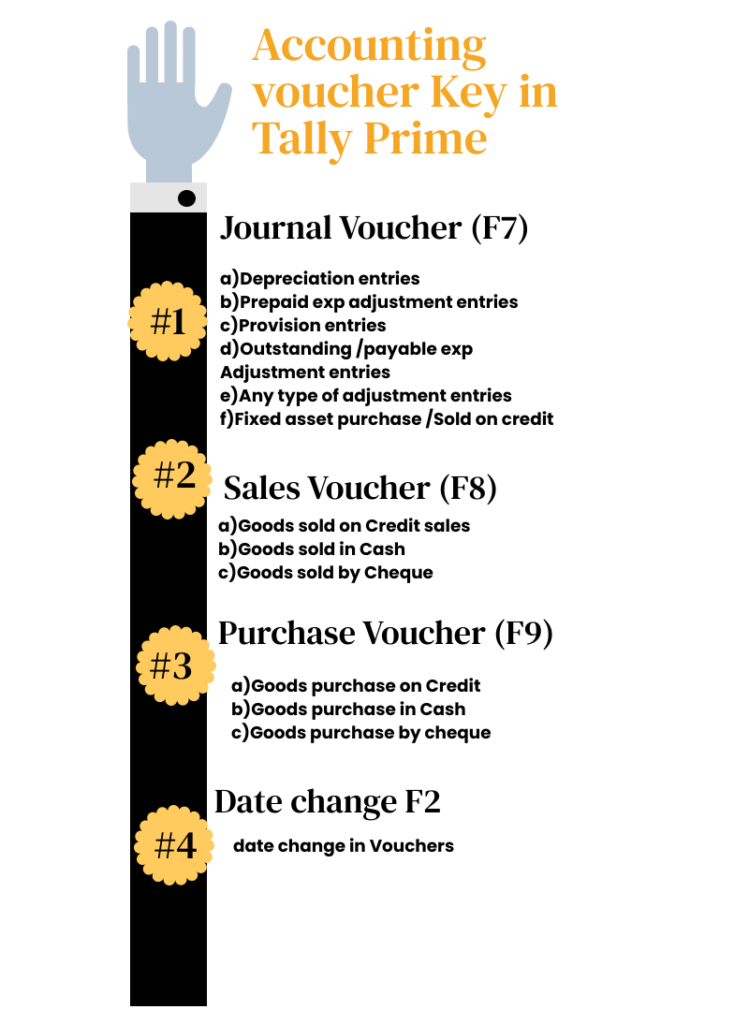

Accounting voucher Key in Tally Prime

Voucher and function Key | Use for |

Contra Voucher (F4) | a)Cash deposited in Bank b)Cash withdrawal from Bank c)Cash/Cheque Transferred one bank to Another Bank d)Cash Transfer from Main Cashier to Petty Cashier |

Payment Voucher (F5) | a)Paid loan by cheque or cash b)Paid to Supplier /Sundry creditor by cheque or cash c)Paid direct /Indirect expense by cheque /Cash d)Purchase Assets by Cheque or Cash e)Fixed Assets purchase by cheque or Cash f)Any type of payment made by cheque or cash |

Receipt Voucher (F6) | a)Received personal Loan by cheque or cash b)Received cheque or cash from Customer /Sundry Debtor c)Received direct /Indirect income by Cheque or Cash d)Any Type of income received by Cheque or Cash e)Fixed Assets Sold by Cash by Cheque f)Any Type of amount received by cheque or cash |

Journal Voucher (F7) | a)Depreciation entries b)Prepaid exp adjustment entries c)Provision entries d)Outstanding /payable exp Adjustment entries e)Any type of adjustment entries f)Fixed asset purchase /Sold on credit |

Sales Voucher (F8) | a)Goods sold on Credit sales b)Goods sold in Cash c)Goods sold by Cheque |

Purchase Voucher (F9) | a)Goods purchase on Credit b)Goods purchase in Cash c)Goods purchase by cheque |

Date change F2 | Date Change |

Accounting voucher Key in Tally Prime

Go to Gateway of Tally >Vouchers>press key any key to create voucher entry

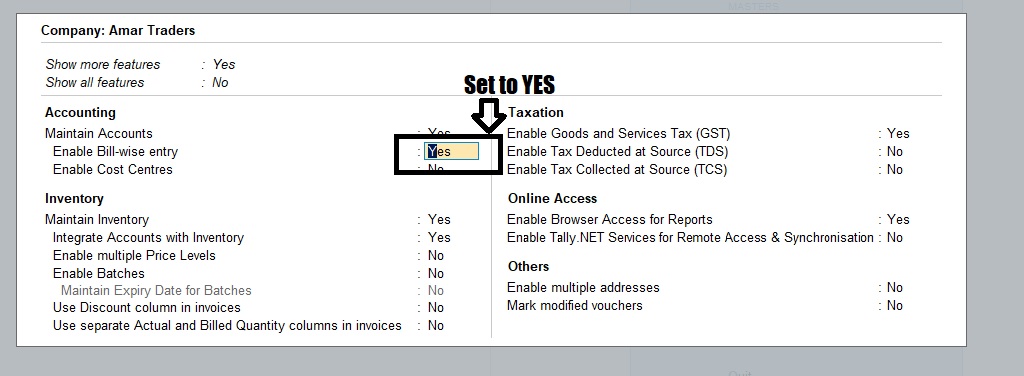

Maintain Bill Wise Detail In Tally Prime

Maintain Bill Wise detail is made in Tally Prime for maintaining outstanding and Pending bill of Sundry creditors and debtors

How to create bill wise detail in Tally Prime

- Go to the gateway of tally >Alt +K >F11

- Set enable Bill wise Entry >YES

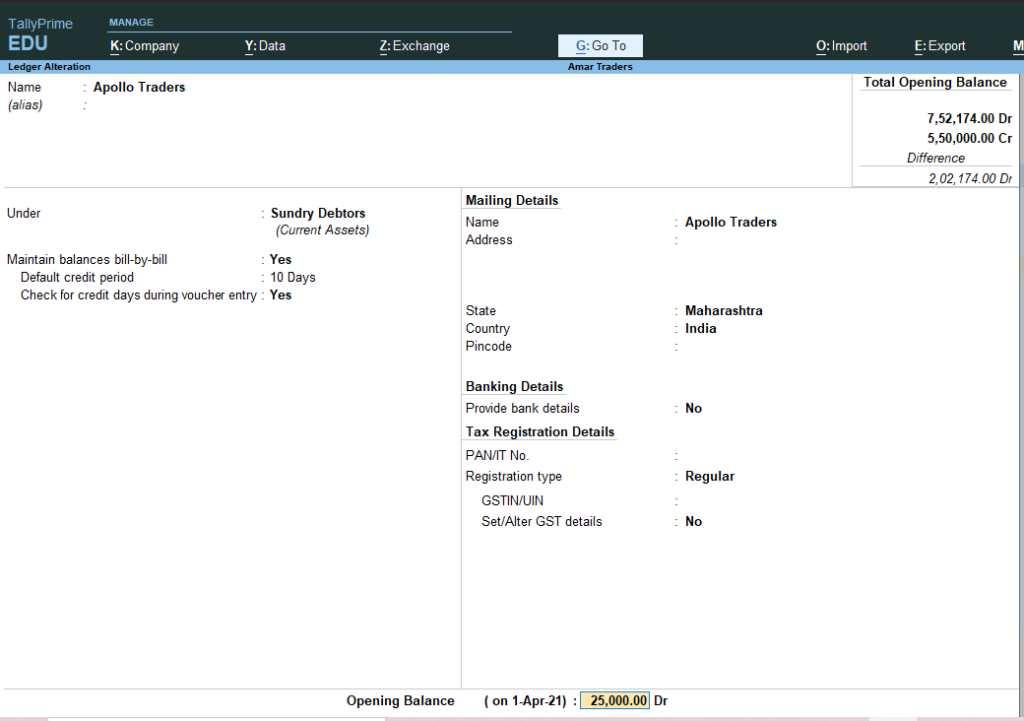

Now alter the ledger of the party

Go to gateway of Tally Prime>Alter>Ledger

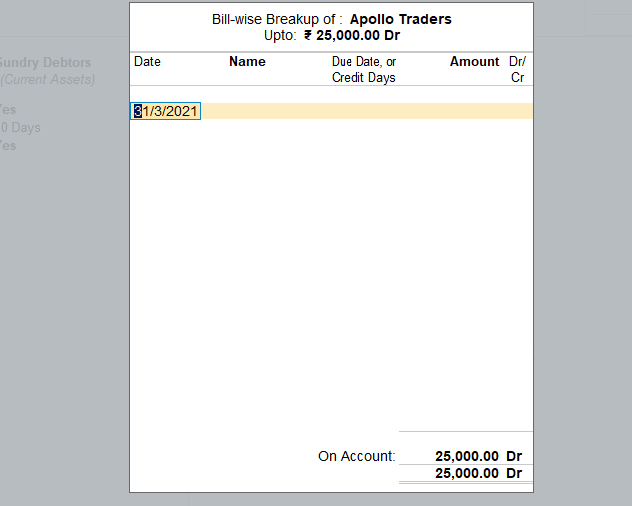

Select Appolo Trader

Maintain Balance Bill by bill set to YES

Default credit period: 10 days

Check the credit days during voucher entry YES

Similarly alter ledger of following parties and give credit days

Name of Party | Credit days |

Dhanlaxmi Provision | 25 days |

Dhruv traders | 27 days |

National Distributors | 28 days |

Also, Alter Hindustan Ltd and set Maintain bill wise detail Set to YES

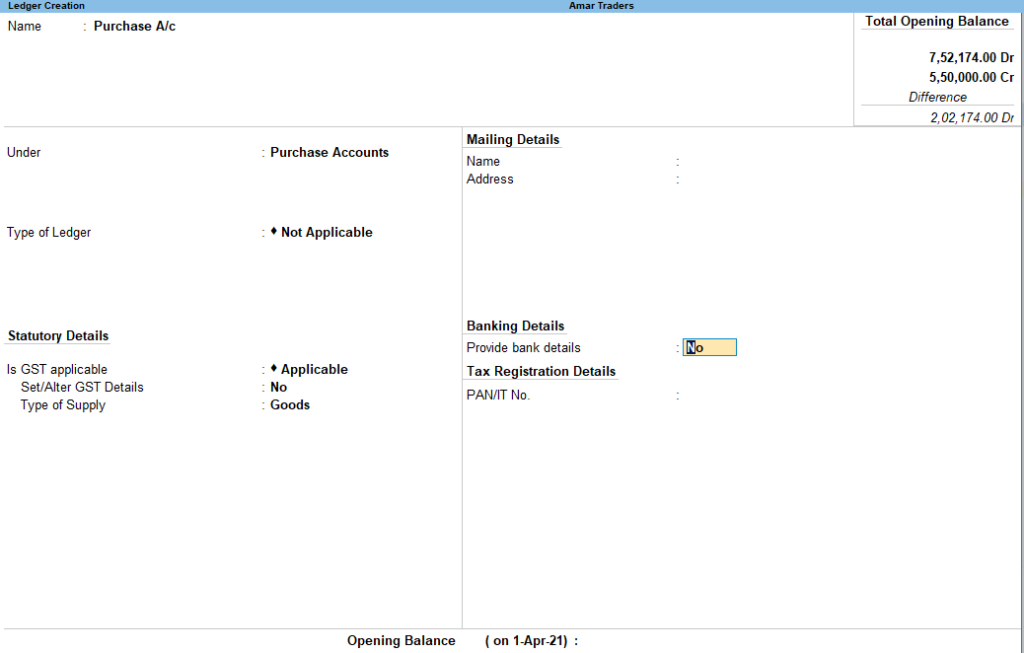

Now create Ledger of Purchase

- Gateway of Tally >create >Ledger

- Name :Purchase

- Under :Purchase

- Type of Ledger : Not Applicable

- Is GST applicable >Applicable

- Set /Alter GST detail :NO

- Type of Supply :Goods

- Opening Balance :skip the filed

- press Y or enter to Accept the screen.as figure shown belwo

Ledger Input CGST and Input SGST

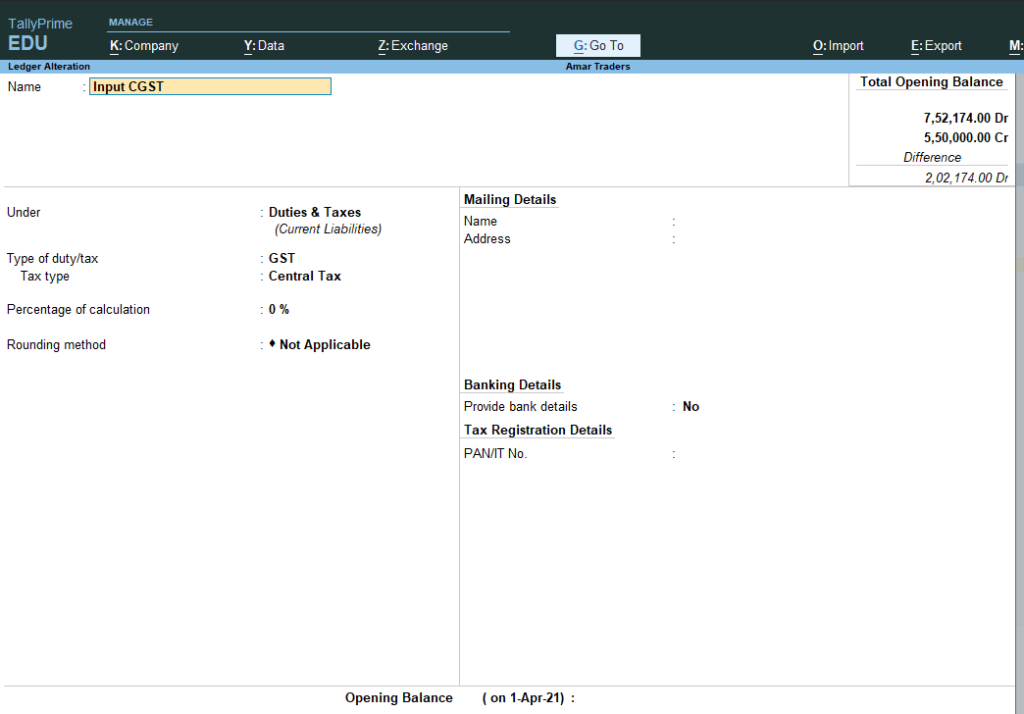

To create a ledger of Input CGST

- Go to the gateway of tally > Create> Ledger

- Name : Input CGST

- Under Duties and taxes

- Type of Duties: Central Tax

- percentage of calculation :0%

- Rounding method not applicable

- Press Yes to save

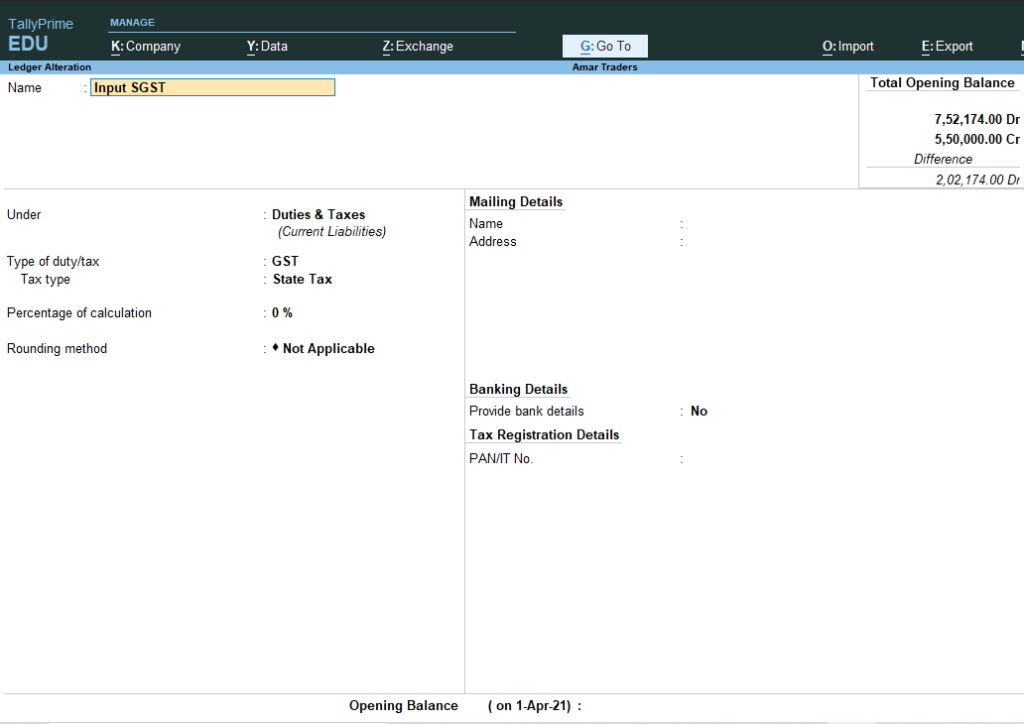

To create a ledger of Input SGST

- Go to the gateway of tally > Create> Ledger

- Name : Input SGST

- Under Duties and taxes

- Type of Duties: state Tax

- percentage of calculation :0%

- Rounding method not applicable

- Press Yes to save

Make a transaction in Purchase Voucher.

Note: Alter Hindustan Ltd and set maintain bill by bill to YES.

- Go to Gateway of Tally >vouchers >

- Press F9 purchase Voucher press CTRL +H and select Item invoice mode

- Supplier invoice number HU01

- Date:1/5/2021

- Party Name: Hindustan Lts A/c

- Purchase Ledger: Purchase A/c

- Name of item: Taj Mahal Tea 250 Gm

- Godown: Warehouse

- Quantity:80

- Rate:80 Automatically

- comes