Journal Entry of Bill of Exchange in Accounting

Table of Contents

ToggleJournal Entry of Bill of Exchange in Accounting

Example

Bills of Exchange Journal Entries

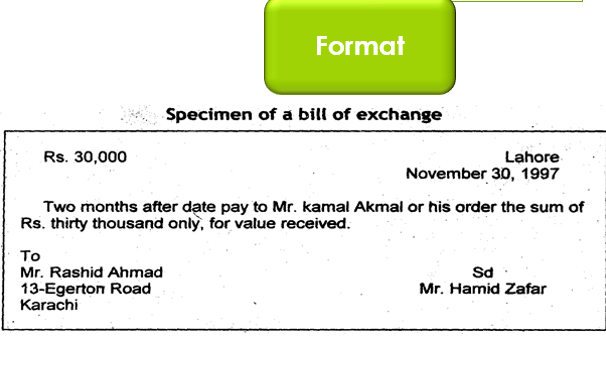

On 1 may 2015 Mr A sold of goods to Mr B for 50000 on Credit. Mr B ask for 3 month time .Mr A ask for security .Mr B say he ready to sign any document you like as security.Mr A on White paper an write following phrase.

“Pay to in the order of Mr. A rs 50000 3 month after the date.

He also write date and place of preparing th e bill signature on the paper.

Mr a send this paper and asked him sign on the revenue stamp. Mr b sign on the revenue stamp and writes the word accepted across the face of the bill.Paper now become valuable document called as bills of exchange.Mr A keeps the bills with him for next 3 month after that he goes to Mr B ask for payment.

Points to remember

- Mr A is called as drawer of the bill.

- Mr B is called as drawee of the bill.

- Bill is an asset.

When A sold on credit to B Rs. 50000

BOOKS OF A | BOOKS OF B | ||

B Dr. | Xxxx | Purchase A/c Dr. | Xxxx |

To sales A/c | Xxxx | To A | Xxxxx |

Being goods sold to B | Being goods purchased from A | ||

When A draws a bills on B

BOOKS OF A | BOOKS OF B | ||

Bills Receivable A/c

| Xxxx | A

| Xxxx |

To B | Xxxx | To Bills Payable A/c | Xxxxx |

Being bill to received | Being being bill to paid | ||

After 3 month Mr. A goes to Mr B and take payment. Mr. B honors the bills

BOOKS OF A | BOOKS OF B | ||

Cash A/c

| Xxxx | Bills payable a/c

| Xxxx |

To Bills Receivable A/c

| Xxxx | To Cash A/c | Xxxxx |

Being cash received | Being cash paid | ||

Journal entry of endorsement of Bill

Ram sold goods on credit Rs 50000 to Rahim On 1 april2014.Out of these goods Rahim sold some of the goods to on credit to Rajiv. Rs 50000.Rahim Drew a Bill on Rajiv for 50000 on the same day.Rajiv accepted it and return it to Rahim. On 4 may 2014 when Ram demanded payment Rahim endorsed the in favor of Ram.

Endorsement

- Rahim is called as the endorser

- Ram is called as the endorsee.

On the due date Rajiv honored the bill.

Ram sold goods on Credit to Rahim,

RAM BOOKS

| RAHIM BOOKS

| RAJIV BOOKS

| |||

Rahim A/c To sales

| Xxx xxx | Purchase A/c To Ram

| Xxxx xxxx | NO Entry

|

|

Being goods sold to Rahim | Being goods purchased from Ram |

| |||

When Rahim sold goods to Rajiv

RAM BOOKS

| RAHIM BOOKS

| RAJIV BOOKS

| |||

No Entry | Rajiv To sales | Xxxx xxxx | Purchase A/C To Rahim | xxxx | |

| being goods sold to Rajiv | Being goods purchased from Rahim | ||||

When Rahim drew a bill on Rajiv

RAM BOOKS

| RAHIM BOOKS

| RAJIV BOOKS

| |||

No Entry |

| B/R a/c To Rajiv

| Xxxx xxxx | Rahim A/C To B/P A/c

| Xxx xxxx |

| Being bill receivable from Rajeev | Being bill payable to Rahim | |||

When Rahim endorsed the bill in Favor of Ram

RAM BOOKS

| RAHIM BOOKS

| RAJIV BOOKS

| |||

B/R To Rahim

| Xxxx xxxx | Ram A/c B/R

| Xxxx xxxx | No entry

| Xxx xxxx |

| being bill endorse to Ram |

| |||

On 4 may 2014 Rajiv Honors the bill

RAM BOOKS

| RAHIM BOOKS

| RAJIV BOOKS

| |||

Cash A/c To B/R

| Xxxx xxxx | No Entry

|

| Bills Payable A/c To cash A/c

| Xxx xxxx |

Being cash received |

| Being cash paid | |||

Mr A sold goods on credit to B 1 April 2014 on the same day A drew a 3 month bill and A accepted it and return it.On 4 May 2014 A was in urgent requirement of money he approached bank and discounted the bill. Bank discounted the bill and charge a discounting @ 12% pa.

When A sold goods on credit to B

A Books

B

To sales

(being goods sold to B)

B Books

Purchase A/c

To A

(being goods purchased from A)

When A drew a bill on B

A Book

B/R A/c

To B

B Books

A

To B/P

When A Discounted the bill

A Books

Bank A/c

Discount A/c

To B/R

B Book

No Entry

4 July 2014 when B honors the bills

A Books

No Entry

B Books

B/P A/c Dr

To Bank A/c