Salary outstanding journal entry in Accounting

Table of Contents

ToggleSalary outstanding journal entry in Accounting

What is salary?

Salary is an expense for the business. It is to pay to an employee in exchange for services taken from him.

When salary is not paid on time its becomes outstanding therefore it needs to show in the balance sheet as it is now a liability for the firm.

now when salary is paid on time its an expense an we have to make journal entry

Salary A/ dr | Xxxx |

To cash / Bank A/c | Xxxx |

Being salary | |

Rules follow when salary is paid .

Salary A/ | Dr all expenses and losses Salary is expense by nature |

cash A/c | Cr what goes out Cash is real accounts by nature

|

Bank A/c | Cr. The giver and bank is giver in this case. |

| |

Outstanding salary journal entry

Journal entry for salary outstanding

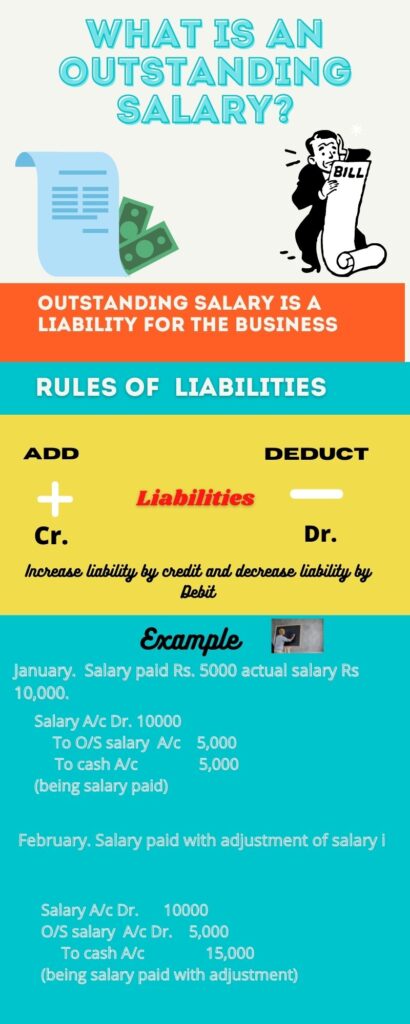

What is an outstanding salary?

An outstanding salary is a salary due or not paid.

outstanding salary is a liability for the business, therefore, it is shown on the liability side of the balance sheet.

The rule for assets and liability

Accounts | ADD | Deduct |

Assets | Debit | Credit |

Liability | Credit | Debit |

- it means + Assets in business we have to debit it.

- When we have credit assets then we have to deduct – it from the business.

- It means that when we have to Add means + liability in business we have credited it.

- When we have Debit Liability then we have to deduct – it from the business.

Outstanding expense journal entry example

Suppose salary to be paid Rs 10000 but not paid the salary.

here our due date of payment of salary has arrived but the salary is not paid therefore we have shown our liability which is the outstanding salary in the books of Accounts.

Journal entry will be .

Salary A/c | 10,000 |

To Outstanding Salary A/c | 10,000 |

Being salary not paid on due date. | |

Salary A/ | Salary is expense and Dr all expense and losses Nominal Accounts |

Outstanding salary | Outstanding salary is a liability and we are Increasing our liability therefore credit O/S Salary. |

When outstanding salary is paid

Outstanding salary in Profit and Loss Accounts

Note: only when outstanding salary not paid.

If outstanding salary not paid then it will be shown on the debit side of Profit and loss and loss accounts as it occurs in the current year and expense of this year not paid.

Particular | Amount | Particular | Amount |

Outstanding salary | 10000 |

Outstanding salary in balance sheet

outstanding salary is liability by nature, therefore, it is shown in the liability side of the balance sheet.

Liabilty | Amount | Assets | Amount |

Outstanding salary | 10000 |

|

|

Understand the outstanding salary with an example

January

- Salary paid for the month Rs 5,000 actual salary Rs 10,000.

February

- Salary paid for the month with adjustment of last month salary.

January

Note : Salary paid for the month is Rs 10,000 but we are paying only Rs 10,000 therefore Rs 5000 is salary payable or outstanding salary.

Journal entry for the same will be .

Salary A/c | 10,000 |

To Cash A/c | 5000 |

To outstanding salary /Salary payable A/c | 5000 |

(being salary paid and salary payable | |

Adjustment of Outstanding salary

February

In February we need to adjust the salary of January therefore we have to pay more cash in February as we pay less in January .

Journal entry for the same will be .

Salary A/c | 10,000 |

Outstanding salary /Salary payable A/c | 5000 |

To cash A/c | 15000 |

(being salary paid and salary payable adjusted | |

When outstanding salary is paid

Adjustment of Outstanding salary

Now when we pay our outstanding salary then we have to make a new journal entry to deduct our liability which is on books with the name Outstanding salary.

Journal entry will be .

Outstanding Salary A/ | 10,000 |

To cash A/c | 10000 |

Being outstanding salary paid | |

Outstanding salary in Trial Balance

If outstanding Salary is given in the trial balance.

Suppose if the outstanding salary is given in the Trial balance.

Example.

Trial Balance

Particular | Amount | Amount |

Outstanding salary | xxxxx |

If outstanding salary is given in the balance sheet under such condition it will be shown only in the balace sheet .It means it already adjusted .

Outstanding salary FAQ

Oustanding salary is under which account?

Answer: Outstanding salary is a personal representative account. As per the matching concept, salary is due but not yet paid. So, Unpaid salary to be shown as liability under ‘Expenses Payable’ or ‘Salary Payable’ in the Balance sheet on liabilities side and on another aspect of dual entry to be placed in Profit & Loss Account.

Where Outstanding Salary appearing in Trial Balance are shown:

Answer: On the liability side of the balance sheet.Its means its already adjusted no need to shown in Profit and loss Accounts.

What is the definition of outstanding salary?

Outstanding salaries are salaries that are due and have not yet been paid.

For example, the staff of Amar Traders has worked for the month of April.

It is now the 3rd of May and they still have not been paid,

so the salaries are “payable” or “owing” or “outstanding” (all the same thing) .

Outstanding salary vs prepaid Salary

the difference between outstanding salary and prepaid salary in a table:

Criteria | Outstanding Salary | Prepaid Salary |

Definition | Unpaid wages/salaries for completed work | Advance payment for anticipated work |

Financial Statement | Liability | Asset |

Nature | Money owed to employees | Money owed to the company (from employees) |

Occurrence | After work is performed | Before work is performed |

Adjustment Requirement | Decreases profit (expense) on the P&L | Increases profit (revenue) on the P&L |

Treatment in Accounts | Shown as a liability in the balance sheet | Shown as an asset in the balance sheet |

It’s essential for businesses to keep track of both outstanding and prepaid salary to ensure accurate financial reporting and proper cash flow management.

Unfortunately, this quiz has a limited amount of entries it can recieve and has already reached that limit.