What Profit & Loss Account why and How it is prepared?

Table of Contents

ToggleWhat is Profit and Loss Accounts ?

Profit and Loss Account is a type of financial statement which shows the result of business activities during an accounting period (i.e. Profit or loss).

It directly related and considers reported income and expenses to an organization measuring the performance in terms of profit & loss.

Trading Accounts only reveal the gross profit earned because of buying and selling of goods .

However, a business owner has to carried out number of expenses which are not taken trading account.Hence, organization is more interested in knowing the net profit earned or loss incurred during a year.

A profit-and-loss account is prepared, which comprises all the items of losses and gain relating to the accounting period .

Why to prepare Profit and Loss Accounts

It determines the Net Profit or Net Loss ;

A trading account only revealed the Gross Profit or Gross Loss because of trading activities, whereas the profit-and-loss accounts revealed the net profit or ne loss available to the proprietors and credited to his capital accounts. if profit or debited to his capital if loss .

It helps to analyze with the preceding year’s Profit.

We can compare the net profit of the present year with that of the previous year .It facilitates the organisation to know whether the business is being managed effectively

It facilitates to control of expenses :

Profit and loss accounts help to compare various expenses with the expenses to net profit .It calculates and compared with the similar ratio of the previous year .Such relation will be helpful in taking concrete steps for managing the unnecessary expense.

It helps in preparing balance sheet .

We can only prepare a balance sheet after ascertaining the Net Profit on preparing profit-and-loss account.

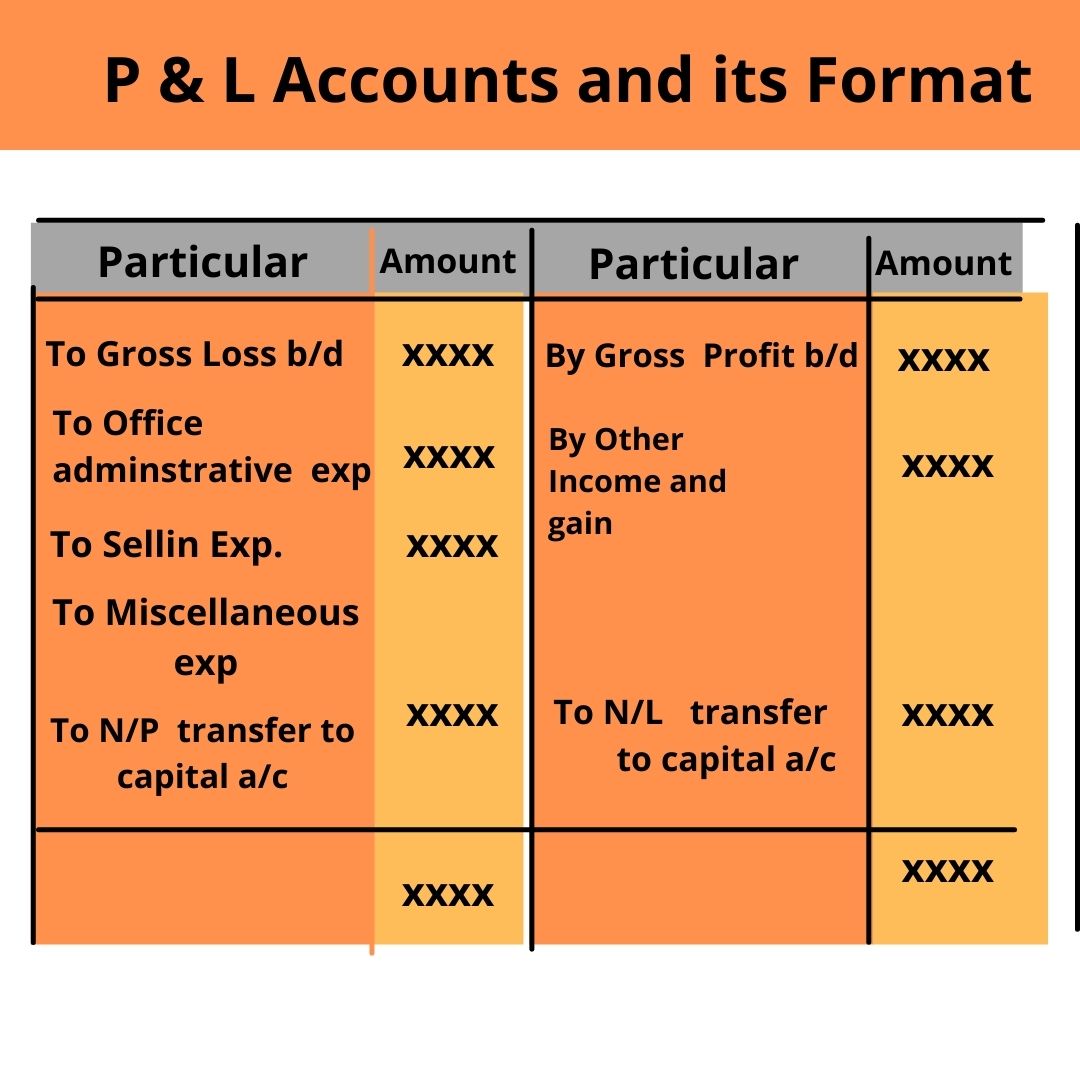

Format of a Profit and Loss Account

Profit and Loss Account for the year ending ……………..

Particular | Amount | Particular | Amount |

To Gross Loss b/d (Transfer from Trading (account) | Xxxx | By Gross Profit b/d (Transfer from Trading (account) | Xxx |

Office expense |

| By Rent from Tenant | Xxxx |

To salary | xxx | BY rent (Cr.) | Xxx |

To salary and Wages | Xxx | By discount received | Xxx |

To rent rates and taxes | Xxx | By discount (Cr.) | Xxx |

To printing and stationary | Xxx | By commission received | Xxx |

To postage and telegram | Xxx | By interest on Investment | Xxx |

To lighting | Xxx | BY Dividend on shares | Xxx |

To insurance premium | Xxx | By bad debts recovered | xxx |

To telephone charges | Xxx | By apprentice premium | Xxx |

To legal Charges | Xxx | By profit on sale of assets | Xxx |

To lighting | Xxx | By dividend on shares | Xxx |

To insurance premium | Xxx | By bad debts recovered | Xxx |

To Audit fees | Xxx | BY apprentice premium | xxx |

To travelling expenses | Xxx | By profit and sale of assets | Xxx |

To establishment Expense | Xxx | By income and other source | Xxx |

To trade expense | Xxx | By miscellaneous receipts | Xxx |

To general expense | Xxx | By loss (if any) Transfer to capital a/c | xxx |

Selling and distribution Expense | Xxx |

|

|

To carriage outward | Xxx |

|

|

To carriage sale | Xx |

|

|

To advertisement | Xxx |

|

|

To commission | Xxx |

|

|

To brokerage | Xx |

|

|

To bad debts | Xxx |

|

|

To export duty | Xxx |

|

|

To Packing charges | Xx |

|

|

To delivery charges | Xx |

|

|

To stable expense | Xxx |

|

|

Miscellaneous expense |

|

|

|

To discount | Xxx |

|

|

To repairs | Xxx |

|

|

To depreciation | Xxx |

|

|

To interest (Dr.) | Xxx |

|

|

To bank charges | Xxx |

|

|

To entertainment expenses | Xxx |

|

|

To conveyance expense | Xxx |

|

|

To donation and charity | Xxx |

|

|

To loss on sale of Assets | Xxx |

|

|

To net profit (transfer to capital a/c) |

|

|

|

| xxxx |

| xxxxx |

How to prepare Profit and loss accounts

A profit-and-loss account opened with the amount of gross profit or loss carried down from the trading account.

After ,preparation of trading account, all expenses and losses which are not debited in trading account are now written in Profit and loss accounts .These expenses include administrative expense, selling expense and distribution expense.

Similiary All income not credited in trading account are now credited to profit-and-loss accounts.

We call these indirect expenses.

Expenses or Loss which are written on Debit side of Profit and Loss accounts.

- Gross Loss: If trading accounts reveal Gross Loss.The Gross Loss is recorded on Debit side of Profit and loss accounts.

- Office and administrative expense : Such as salary of office employees office rent ,lighting ,postage ,printing ,legal charges audit fee etc.

- Miscellaneous expense : These expense includes such as interest on loan ,,interest on capital, repair charges ,depreciation etc.

- Selling and distribution expense : Such as advertising charges , commission ,carriage on sales or carriage outward, etc.

Income or gain written on credit side of Profit and Loss Accounts.

- Gross Profit : If trading accounts reveal Gross profit, it is to be transferred to Credit side of Profit and loss accounts.

- Other incomes and Gains : All items of incomes and gain are shown on the credit side of profit and loss accounts such as income from shares or investment , Bad debts recover, rent , divident received ,commission received , discount allowed, etc.

Difference between Profit and Loss account and Balance sheet

Profit and Loss Accounts | Balance Sheet |

The Profit and Loss Account is a depiction of the entity’s revenue and expenses. | A Balance Sheet gives an overview of the assets, equity, and liabilities of the company, |

The Profit and Loss account discloses the entity’s financial performance. | The Balance Sheet reveals the entity’s financial position |

The Profit and Loss account is prepared for a particular period. | The Balance Sheet is prepared at a particular date, usually the end of the financial year |

The Profit and Loss account balance transfer to Balance sheet | The Balance sheet is prepared on the basis of the balances transferred from the Profit and Loss account. |