What is Outstanding Expense in Accounting ?

Table of Contents

ToggleOutstanding expenses meaning

Outstanding Expenses

What is an Outstanding Expense in Accounting?

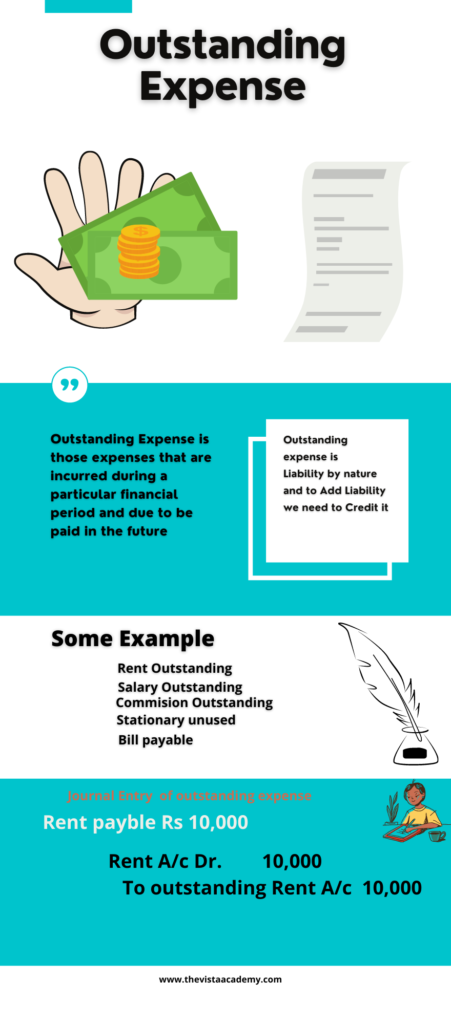

Outstanding Expense is those expenses that are incurred during a particular financial period and due to be paid in the future. However Outstanding expenses are recorded in books to show our liability to pay our due expense in the next financial period or year.

The recording of outstanding expenses helps to track the dues to be paid in the future.

Example of Outstanding Expenses

Example 1.

Suppose in Financial year 1 April 2019 to 31 Dec 2020 wages paid is Rs. 11000 but the last month wages not paid Rs 1000.

Therefore wages not paid in a particular financial year are outstanding.

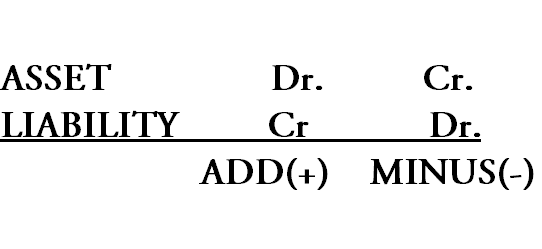

To record the entry of outstanding Expenses in books of accounts we should know that When we ADD Assets in Business we Debit our Asset Similarly, When we ADD Liability in Business we Credit our Liability And When we Minus or deduct Asset in business we Credit our Asset Similar when we Minus or deduct our Liability form business we Debit our liability ir can be more clear from the picture given below.

Now as per above example our liability to 1000 is created in the books of accounts, therefore, we have to book our liability by crediting it the journal entry for the above in the books of accounts will be

Outstanding expenses journal entry

wages outstanding journal entry

Wages A/c Dr. 1000

To O/S Wages A/c 1000

(Being wages due )

When outstanding wages is paid .

Outstanding Wages A/c Dr. 1000

To cash 1000

Outstanding Rent journal entry

Example 2

Rent

Rent paid during the year is Rs 1,10,000 rent for the year is Rs 120,000.

Under such condition

When Rent is Paid

Rent A/c Dr. 1,10,000

To Cash A/c 1,10,000

(being rent paid )

Journal entry for outstanding rent will be

Rent A/c Dr 10,000

To O/S Rent A/c 10,000

(being Rent Outstanding)

Some examples of outstanding expenses

Question 1.

A loan is taken from Bank Rs 100000 on 1 Dec 2019. interest payable 12% per annual. FY close on 31 March 2020.

Case 1

If Interest paid Rs 2000.

Answer

Year loan 100000 X 12% = 12000

4 month interest 12000/12= 1000 int.=1000X4 = 4000

Loan taken from Bank Rs 100000 on 1 Dec 2019. interest payable 12% per annual. FY close on 31 march 2020.

Case 1

Interest paid | 4000 |

To cash A/c | 2000 |

To Interest on loan payable A/c | 2000 |

here interest payable is an outstanding expense

Question 2.

A loan was taken from Bank Rs 100000 on 1 Dec 2019. interest payable 12% per annual. FY close on 31 march 2020.

Case 2

Interest paid Rs 8000.

Int. on Loan | 4000 |

Prepaid | 4000 |

To Cash | 8000 |

Question 3.

A loan is taken from Bank Rs 100000 on 1 Dec 2019. interest payable 12% per annual. FY close on 31 March 2020.

Case 3

No interest paid

Int. on Loan Dr | 4000 |

To Interest on loan payable A/c | 4000 |

(outstanding expense)

Outstanding expense in case of the bill received not paid.

Suppose we received a bill of mobile Phone Rs 10,000 on 1 December 2020 and paid on 15 December 2020.

When a bill is received on 1 Dec. we have to note it down in books of accounts.

Mobile Phone exp. Dr. 10,000

To Mobile phone bill payable A/c 10,000

(being mobile phone bill received and payable )

When a bill is paid on 15 December.

Mobile phone bill payable A/c 10,000

To Cash A/c 10,000

(being bill paid)

Ledger of Outstanding expense

Outstanding expense is liability by nature therefore its have credit balance means its credit side is more than the debit side lets understand it with the example given below

Suppose Salary not paid for the month is Rs 10,000

Journal entry for the above will be

Salary A/c Dr. 10,000

To outstanding Salary A/c 10,000

(being salary not paid)

when we post the entry in the ledger of outstanding expense then

Outstanding Expense Ledger

Particular | Amount | Particular | Amount |

By salary A/c | 10,000 | ||

To balance C/d | 10,000 | ||

10000 | 10000 |

Therefore Oustanding expense is liability because it has credit balance.

Outstanding Expense in Profit and loss accounts or Income statement

Outstanding expense is an expense not paid for this year therefore it is added to debit side of the expense made.

Example salary not paid during the year 5000 that need to be added to salary 12000.

Particular | Amount | Particular | Amount |

To salary 12000 + outstanding Salary 5000 | 17000 |

Outstanding expense in BalanceSheet

Outstanding expenses is asset or liability.

Outstanding Expense is liability therefore it is shown in the liability side of balance sheet and therefore it transferred to next accounting year

Liability | Amount | Assets | Amount |

O/S Expense | XXXX | ||

Adjustment of Outstanding Expense

Understand with example

January Salary paid Rs 5000 actual salary Rs .10000.

It means Salary 5000 is not paid it is outstanding or payable.

Salary A/c Dr. | 10000 |

To Cash A/c | 5000 |

To outstanding Salary A/c | 5000 |

Being salary paid and outstanding written | |

February salary paid with adjustment of last month salary.

In this month we pay salary with outstanding salary not paid last month.

The journal entry for the above will be.

Salary A/c Dr. | 10000 |

Outstanding Salary A/c | 5000 |

To Cash A/c | 15000 |

Being salary paid with outstanding | |

outstanding expenses are current liabilities

they are those debts or obligations that are due to be paid to creditors within one year

Differentiate between outstanding expense and prepaid expense

Outstanding expense | Prepaid expense |

Outstanding expense are expense not Paid. | Prepaid expense is expense Paid in advance |

Outstanding expense are credited when due. Like Salary A/c Dr. xxxx To outstanding salary or salary payable A/c xxx (Being salary due) | Prepaid expense is debited when paid in advance Like Advance salary / prepaid salary A/c xxx To cash A/c xxx (Being salary paid in advance) |

Adjustment of outstanding expense | Adjustment of prepaid expense |

When outstanding expense is paid it is debited | When prepaid expense is paid it is credited |

Outstanding salary A/c xxx To cash A/c xxx (Being due paid ) | Salary A/c xxxx To advance salary A/c xxxx (Being advance salary adjusted) |

Outstanding expense is liability | Prepaid expense is Assets |

Outstanding expense have Credit balance | Prepaid expense have debit balance |

Outstanding expense is added to trading or profit and loss accounts | Prepaid expense is deducted in the debit side of trading or profit and loss accounts. |

The key points about outstanding expenses

- Outstanding expenses are also known as accrued expenses or accrued liabilities.

- They represent expenses that a company has incurred but has not yet paid as of the end of the accounting period.

- Outstanding expenses are recorded under the accrual basis of accounting, recognizing expenses when incurred, not when paid.

- Examples of outstanding expenses include unpaid salaries, utility bills, rent, and interest on loans.

- They are recorded as a current liability in the balance sheet and as an expense in the income statement.

- Adjusting entries are made at the end of the accounting period to record outstanding expenses accurately.

- Failure to record outstanding expenses can lead to understating expenses and overstate profits.

- Outstanding expenses are eventually paid in a subsequent accounting period, reducing the liability.

- Proper recognition of outstanding expenses ensures accurate financial reporting.

- The company’s financial statements should disclose the nature and amount of outstanding expenses.

FAQ of outstanding Expense

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

What is the Balance of outstanding expenses?

The outstanding expense has a credit balance means when we create a ledger of outstanding expenses its Credit side is more than the Debit balance.

Why outstanding expense is a liability and why it is shown in the profit and loss accounts?

Outstanding expense it liability because it’s our obligation to pay in near future We cannot keep it pending for a long time and we have to pay them.

It is shown in the Profit and loss accounts and added to expense because it is the expense of Accounting which are for one year and to find the true or actual profit we need to add it in particular expense.

what if outstanding expenses are shown in the Trial balance?

If outstanding expense is shown inside the trial balance it means the outstanding expense is already adjusted and we need not to show them in the profit and loss account we can show them only in the Balance sheet on the Liability side.

Short MCQ outstanding Expense quiz

Time is Up!

Time’s up