Complete Tutorial on Payroll Accounting in Tally Prime

Table of Contents

ToggleComplete Tutorial on Payroll Accounting in Tally Prime

What is Payroll Acounting?

Payroll, is a process. where businesses generally compute and withhold government taxes like social security and individual income taxes from an employee’s salary. Many companies also have benefit plans like health insurance, which include deductions of premiums from its employees’ salaries according to employee customization, adding another layer of activity for payroll processing.

Components of Payroll process

Allowances

Allowances are categories of expenditures in India that are not taxable, provided they match certain specifications and do not exceed a certain amount.

Allowances in India include those for:

- House rent

- Transport

- Medical

- Meals

- Leave travel

- Education

- Special allowance.

Component of salary

Basic salary

Basic salary is a fixed amount paid to employees by their employers in return for the work performed or performance of professional duties by the former. Base salary, therefore, does not include bonuses, benefits or any other compensation from employers. As the name suggests, basic salary is the core of the salary of an employee.

Allowances

Dearness Allowance

Dearness Allowance is cost-of-living change allowance which the government pays to the employees of the public sector as well as pensioners of the same. DA component of the salary applies to both employees in India and Bangladesh.

House Rent Allowance

HRA or House Rent Allowance is a salary component paid by employer to employees for meeting the accommodation expense of renting a place for residential purposes. HRA forms an integral component of a person’s salary. HRA is applicable to both salaried as well as self-employed individuals.

They account HRA for salaried people for under section 10 (13A) of the Income Tax Act under rule 2A of Income Tax rules. Similarly, self-employed individuals are not considered for HRA exemption under this section but can claim tax benefits under section 80GG of the Income Tax Act.

Conveyance Allowance –

Conveyance allowance, also known as transport allowance, is a kind of allowance offered by employers to their employees to compensate for their travel expense to and from their residence and workplace. Note – In Union Budget 2018, a standard deduction of Rs. 40,000 has been introduced instead of transport (Rs 19,200) and medical (Rs 15,000) allowances.

Leave Travel Allowance –

Leave travel allowance is eligible for tax exemption. It is offered by employers to their employees to cover the latter’s travel expense when he or she is on leave from work. The amount paid as leave travel allowance is exempt from tax under Section 10(5) of Income Tax Act, 1961. Leave travel allowance only covers domestic travel and the mode of travel needs to be air, railway or public transport.

Medical Allowance –

Medical allowance is a fixed allowance paid to the employees of an organization to meet their medical expenditure. Note – In Union Budget 2018, a standard deduction of Rs. 40,000 has been introduced in lieu of transport (Rs 19,200) and medical (Rs 15,000) allowances.

Books and Periodicals Allowance –

Books and periodicals allowance is a type of allowance provided to employees for helping them meet the expenses associated with purchase of books, periodicals and newspapers. It is tax exempt to the extent of actual expenditure incurred towards purchase of books and periodicals.

Professional Tax

Professional tax is a tax levied on the income earned by salaried employees and professionals, including chartered accountants, doctors and lawyers, etc. by to the state government. Different states have varying methods of calculating professional tax. The maximum amount that is payable in a year is Rs. 2,500.

Gratuity

Gratuity is a lump sum benefit paid by employers to those employees who are retiring from the organization. This is only payable to those who have completed 5 or more years with the company. The gratuity amount is paid in gratitude for the services rendered by the individual during the period of employment. According to the Payment of Gratuity Act, 1972, gratuity is calculated as 4.81% of the basic pay. Most firms with a workforce of 10 or more employees come under the Act.

PF Contribution

The employer’s contribution is divided into the below mentioned categories:

- Employees Provident Fund 3.67

- Employees’ Pension Scheme (EPS) 8.33

- Employee’s Deposit Link Insurance Scheme (EDLIS) 0.50

- EPF Admin Charges 1.10

- EDLIS Admin Charges 0.01

It is mandatory for the employee and the employer to make a EPF contribution. Each make a 12% contribution of the employees’ dearness allowance and basic salary towards EPF. Given below are the details of the employees’ and employers’ contribution towards EPF.

- The employer deducts employee’s contribution towards EPF – 12% of the employee’s salary on a monthly basis for contribution towards EPF. The entire contribution goes towards the EPF account.

- Employer’s contribution towards EPF – The employer also contributes 12% of the employee’s salary towards EPF.

To understand methodology employed in the ET EPF Calculator, let us take the following case:

1. Employees’ Basic Pay + DA: Rs 50000

2. Employee contribution towards EPF: 12%*50000 = Rs 6000

3. Employer contribution towards EPF = 3.67% of 50000 = 3.67%*50000 = Rs 1835…. (A)

4. Employer contribution in Employee Pension Scheme (EPS): 8.33% * 50000 = Rs 4165 …. (I)

5. Employer contribution in EPS on the threshold income of Rs 15000: 8.33% of 15000 = Rs 1249.50 …. (II)

6 Excess contribution of employer towards EPS above the threshold (I) – (II): Rs 4165 – Rs 1249.50 = Rs 2915.50 …. (B)

7. The excess amount in (B) is added to the employer contribution towards EPF in (A) = 2915.50+ 1835 = Rs 4750.50

Hence, the final employer contribution towards EPF will be Rs 4,750 (the result is rounded off to the nearest decimal place as stipulated by EPFO).

What is ESIC scheme

What is esic sheme

If a company has 10 or more employees (20 in case of Maharashtra and Chandigarh) whose gross salary is below Rs. 21,000 per month, then the employer is required to avail ESIC scheme for such employees. The employer’s contribution will be 4.75% of gross salary, whereas the employee’s contribution will be 1.75% of gross salary.

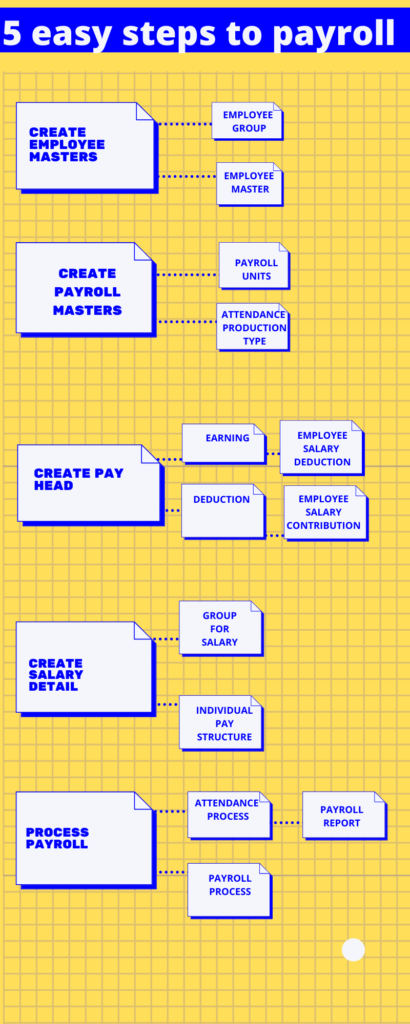

5 Steps to Payroll

Payroll in tally prime

How to maintain payroll in Tally prime

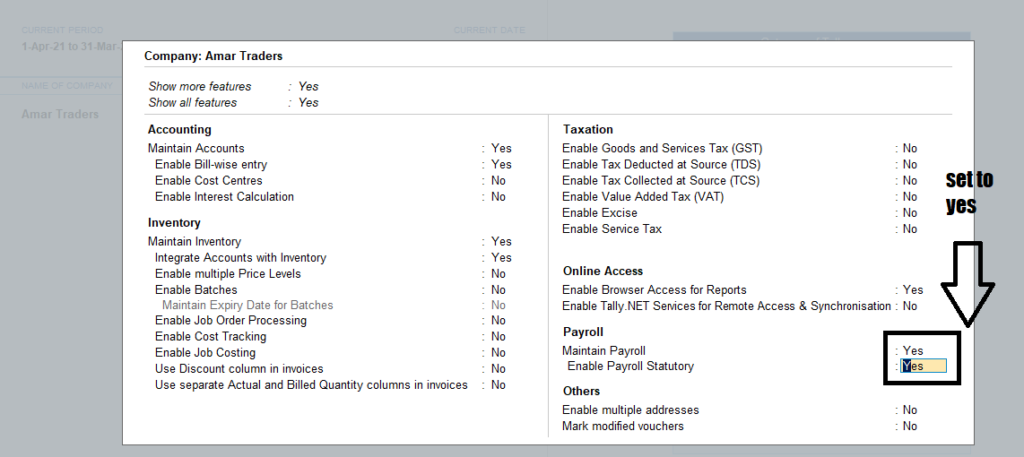

How to enable payroll in tally prime

- Go to gateway of tally prime>Press Alt+K >F12

- Show all features >Set to YES

- Maintain Payroll >Yes.

- Enable payroll statutory> Yes

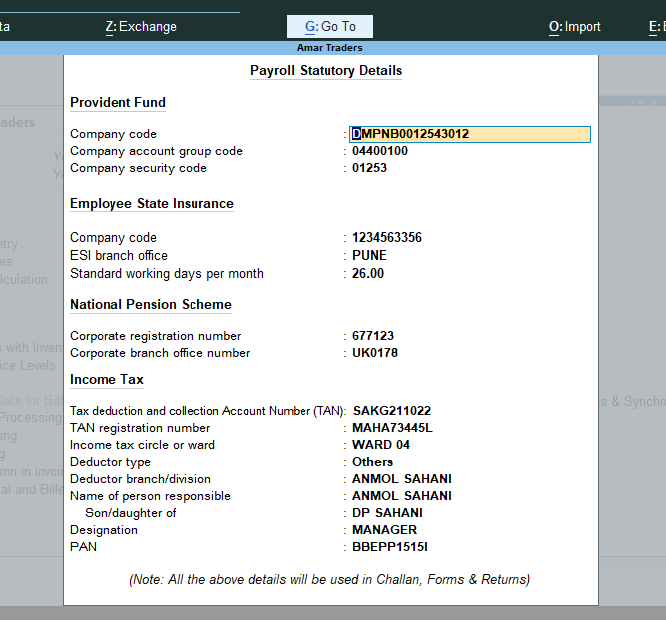

Statutory details Screen

1)Company Code :Enter provident fund code no of the company issued by the department.

Company Account Group Code :Enter the provident fund code of the company issued by the department.

Company Security Code : Enter the security code of the company issued by the department.

Employee state insurance :

3) company code :Enter the ESI code of the company issued by the department.

4)ESI Branch Office : Enter the nearest ESI office under whose authority the company is located.

5) Standard working days per month .Enter the constant pay period to be considered for ESI calculation .If this field is left blank the calculation is done based on the calendar day sin each month.

6)tax deducted and collected account number :specify th e10 digit TAN assigned to the employer .

7 Income tax circle /ward specify the name of the Income tax circle to which the employer is associated.

- Diductor type : Select Government for a company belonging to central or statement government for all others select other.

9Name of person responsible :Enter the name of the person Responsible for TDS deduction in the company

11

Destination specify the official Destination of the person responsible for TDS deduction.

Press Enter to Accept the Screen.

Press Y or Enter to Accept the Screen.

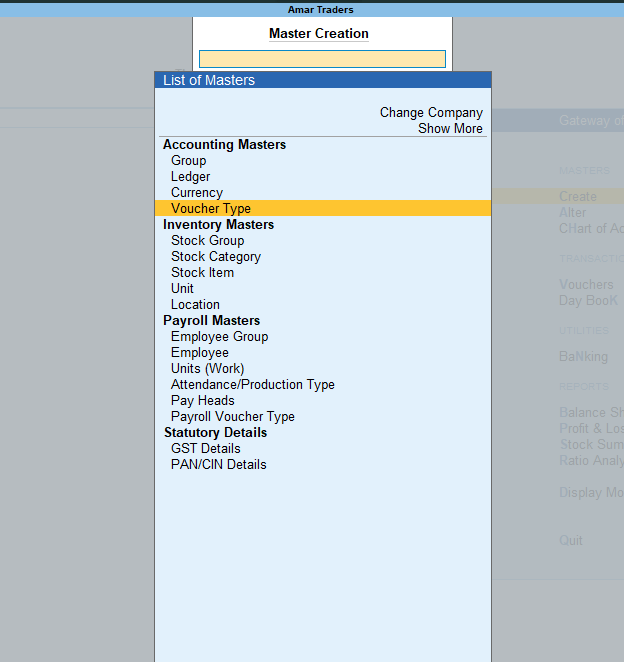

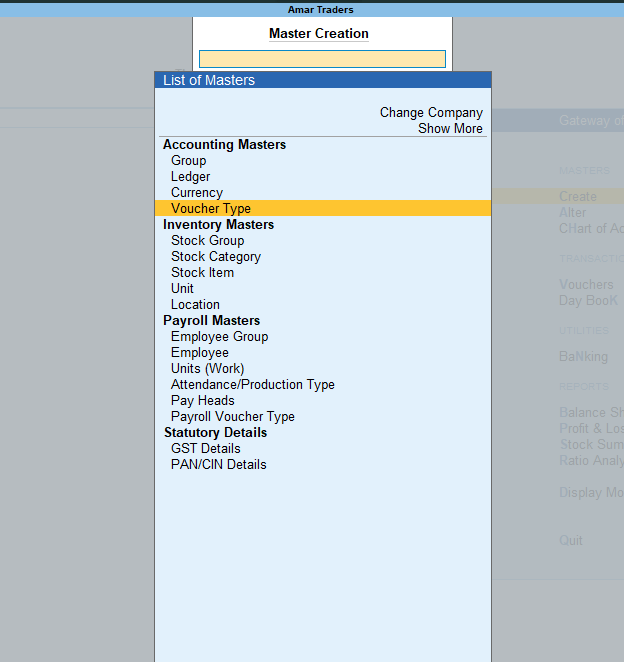

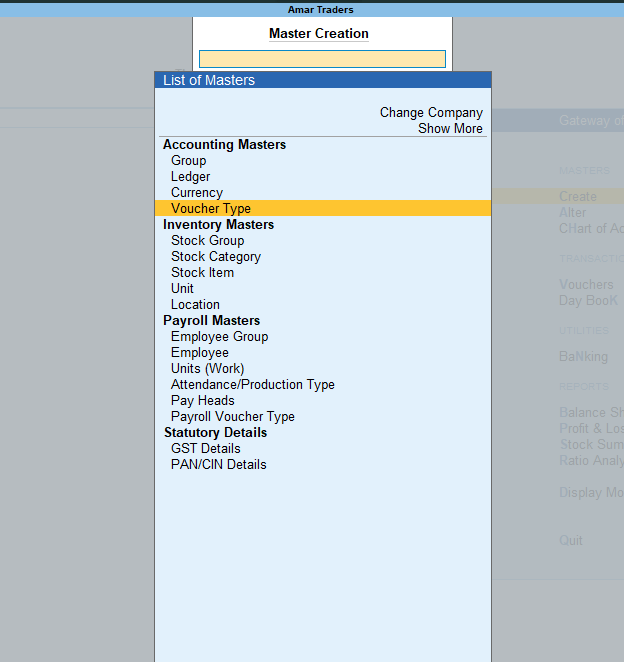

How to create payroll Masters

Go to gateway of Tally>Create>payroll Master

Create Payroll Masters

Employee Group Master

Business with multiple Department Division function or Activities may create the required employee group and classify individual employees under specified group .Production marketing stores .Support or particular group of employees such as managers supervisors sub staff and so on.

To create sales Employee Group

Go to gateway of Tally > Create

- Payroll Master >Employee group

- In name Type : Supervisor Highly skilled

- Under : Primary

- Define salary detail : Set to Nl

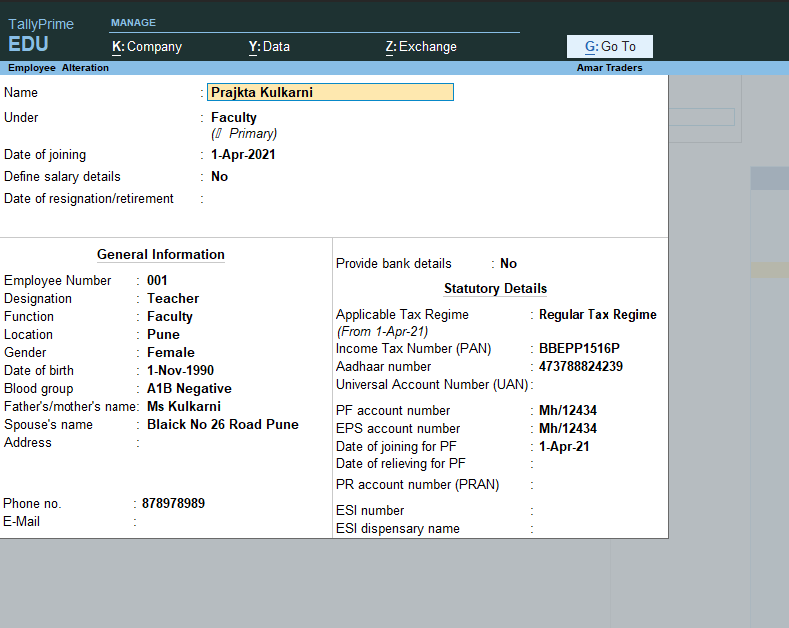

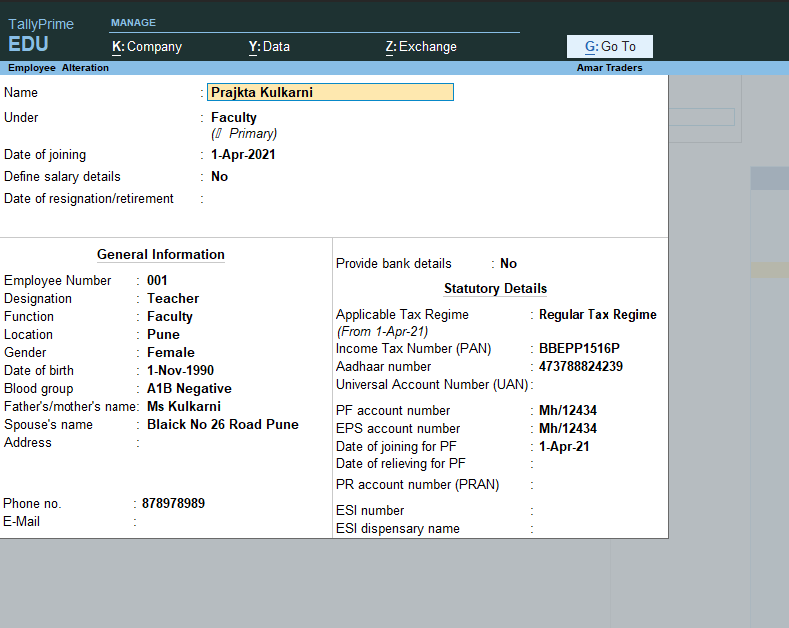

Create Employee Masters In Tally Prime

S.no | Employee Name | Department | Date of joining |

1 | Prakta Kulkarni | Supervisor (Highly Skilled) | 1/4/2020 |

2 | Shubham Negi | Security Guard (skilled) | 1/5/2020 |

3 | Mahesh Kumar | Administration | 1/5/2020 |

|

- Go to Gateway of Tally > create > in Payroll Masters> Employee

- Create the employee as mention in screen above

- Press enters accept the screen

- Similarly create the employee masters for other employees with their department.

Payroll Units

- As per the company requirement Unit of Measurement are created for the calculation of pay head. The unit can be created into two types 1) Simple Unit 2)compound Unit

Simple unit contains day week, month hours pcs etc. Compound Units include the unit which combination of two simple units like hours of 60 minutes. The month of 26 days Days of 8 hours etc.

Create the following unit as mention below

- Hours

- Minutes

- Hrs of 60 minutes

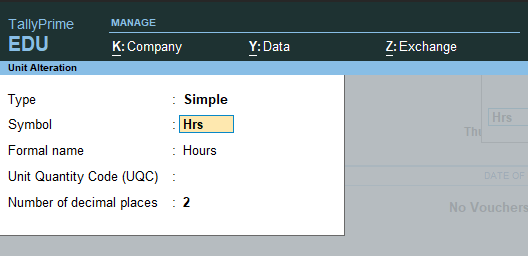

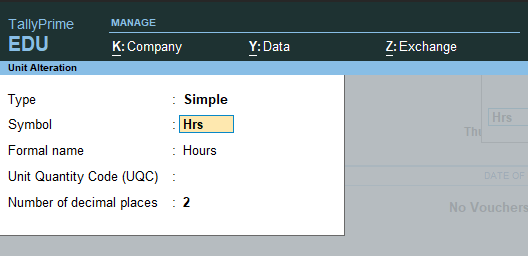

How to create a simple payroll unit in Tally Prime

- Go to the gateway of tally>payrioll info >Units(working period)>create

In unit creation Screen

- Type:Simple

- Symobol:hrs

- Formal Name :Hours

- Number of decimal places :2

Press enter to accept the unit creation screen

create Minutes as simple units

- Type: Simple

- Symbol: mins

- Formal: Minutes

- Number of decimal places :0

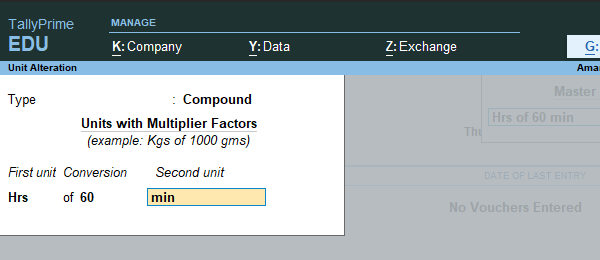

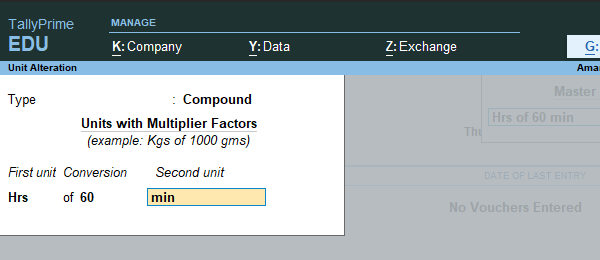

Create Compound Payroll Unit in tally Prime

Press Backspace and select compound as the type of Unit

- Type compound

- First unit: Hrs

- Of:60

- Second Unit:Mins

- the complete compound Unit screen appears as shown below

Attendance /Production Types

Attendance /Production types masters are used to record the nature of attendance production ie time and work rate . In tally prime, you can create attendance type based on time such as present and absent or based on work-based production units such as piece production.

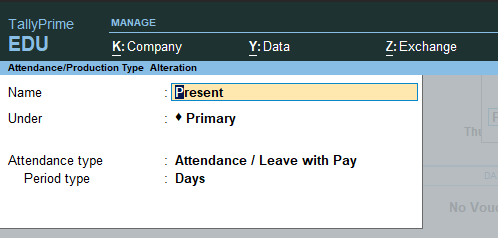

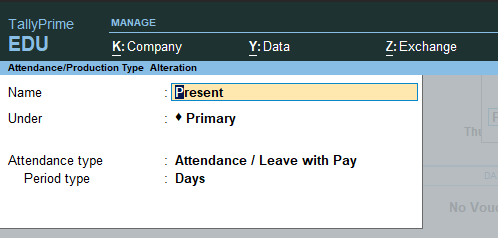

Create the following attendance type for company.

Name | Under | Attendance /production type | Period days |

Present | Primary | Attendance/leave with pay | Days |

Absent | Primary | Leave without pay | Days |

Overtime | Primary | Production | Hrs of 60 mins |

Calendar Month | Primary | User defined calendar Type | Days |

To create present attendance type

Go to the gateway of tally >create >attendance /production type

Under: Primary

Attendance Type : Attendance /leave with pay

Period type:days automatically selected

The completer attendance production creation screen appears as shown.

Press y to accept

Similarly, create remaining attendance and production as mentioned in table.

Pay heads

Pay heads are treated as expense liability with the employers point of view it is considered as Income /earning and deductions.

Example of pay head includes Basic pay ,Dearness Allowance ,House rent Allowance, Uniform allowance ,etc. It also includes deductions employee provident funds EPS employees state insurance ESI professional tax .

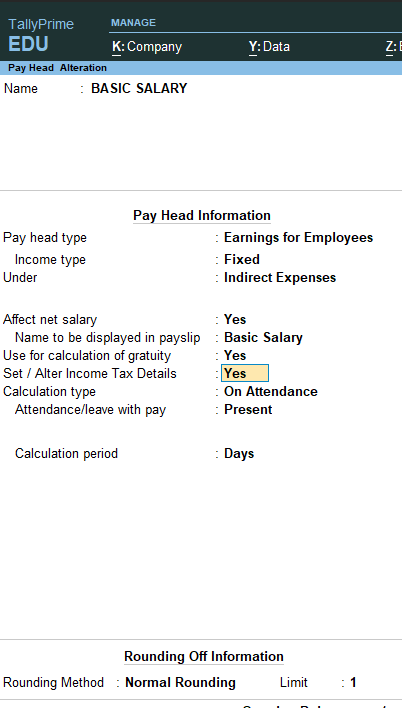

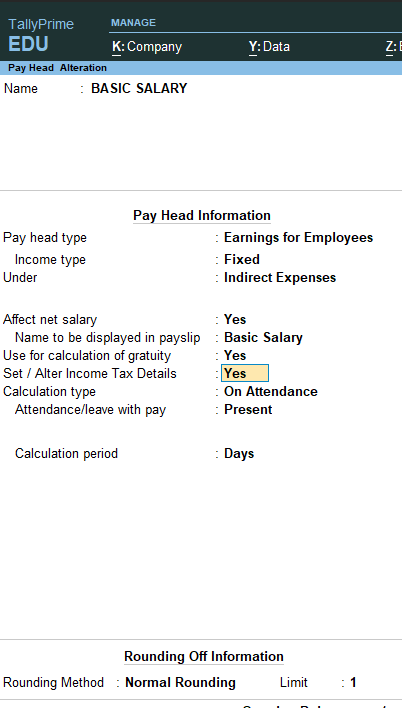

Basic Salary pay head in Tally prime

Percentage | Prajka Kulkarni | Mahesh Kumar | Shubham Negi | |

Basic pay | 1 day | 949.52 | 784 | 714 |

House Rent Allowance | 16% of Basic Plus VDA | |||

Bonus | 8.33% of Basic plus VDA | |||

Uniform Outfit Allowance | 5% of Basic Plus + VDA | |||

DA | 10% basic | |||

Uniform Washing Allowance | 3% of Basic Plus VDA | |||

Employee Provident Fund | 12% of basic + VDA | |||

Employer EPS @ 8.33% | Upto 15000 8.33% 15000 above 1249.5 | |||

Employer PF contribution 3.67% | 3.67% of basic + DA | |||

EDLI Contribution .5% | .5% of PF | |||

PF admin Charges | .5% of PF |

- Go to gateway of Tally >Create >Payroll Master > Pay head

- In name Type :Basic Salary

- In pay head Type :Earning from Employee

- Income Type :Fixed

- Affect net salary :Yes

- name to be displayed in payslip : automatic

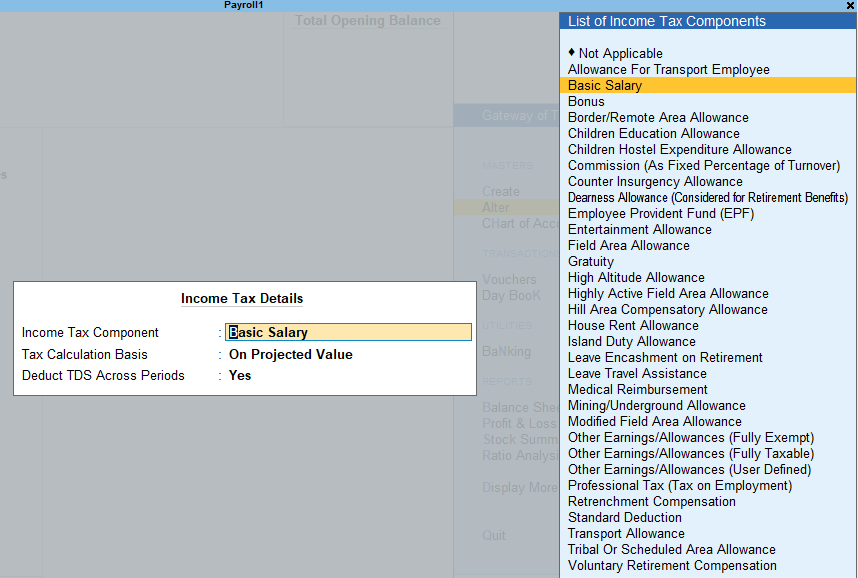

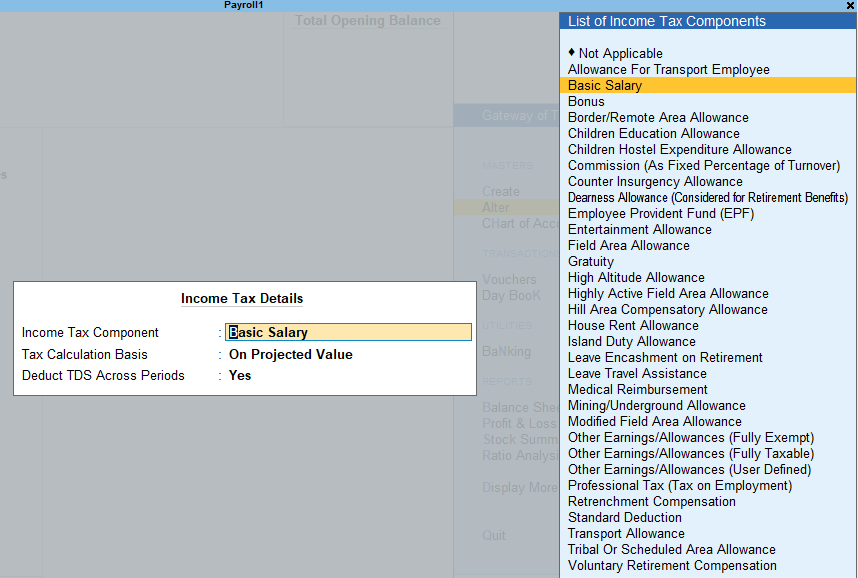

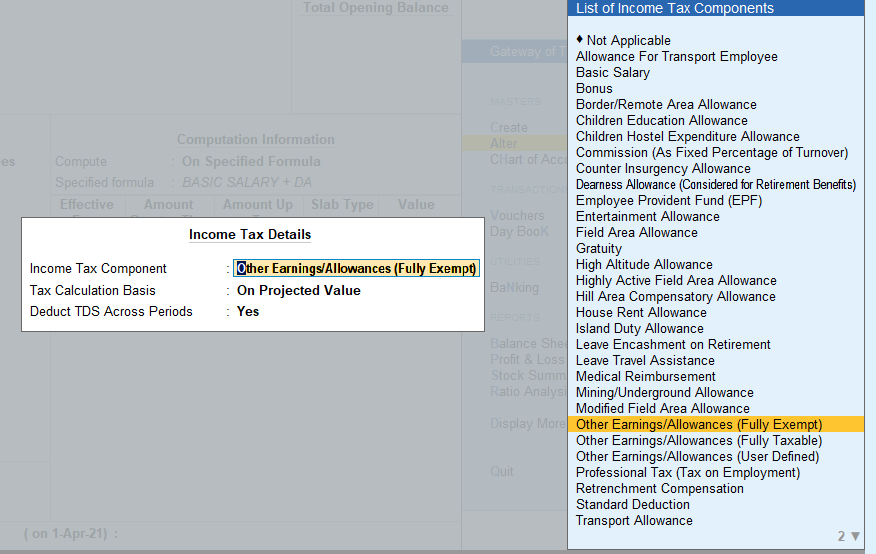

If income tax and gratuity applicable

- Use for calculation for gratuity Yes

- Set /alter income tax details :Yes

- A new screen appear

- Select Income tax component :Basic Salary

- Tax calculation basis :On Projected Value

- Deduct TDS across the period Yes

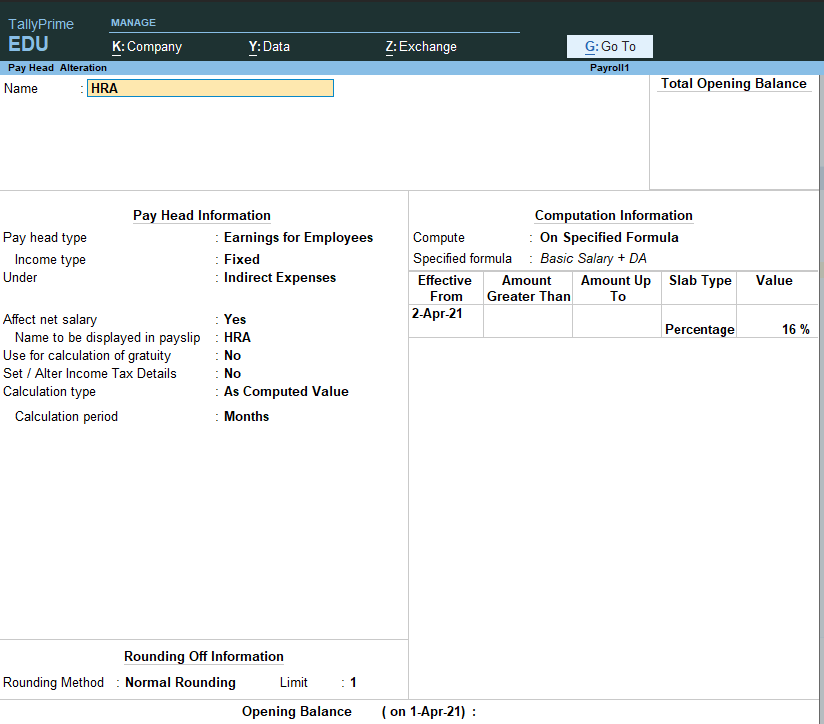

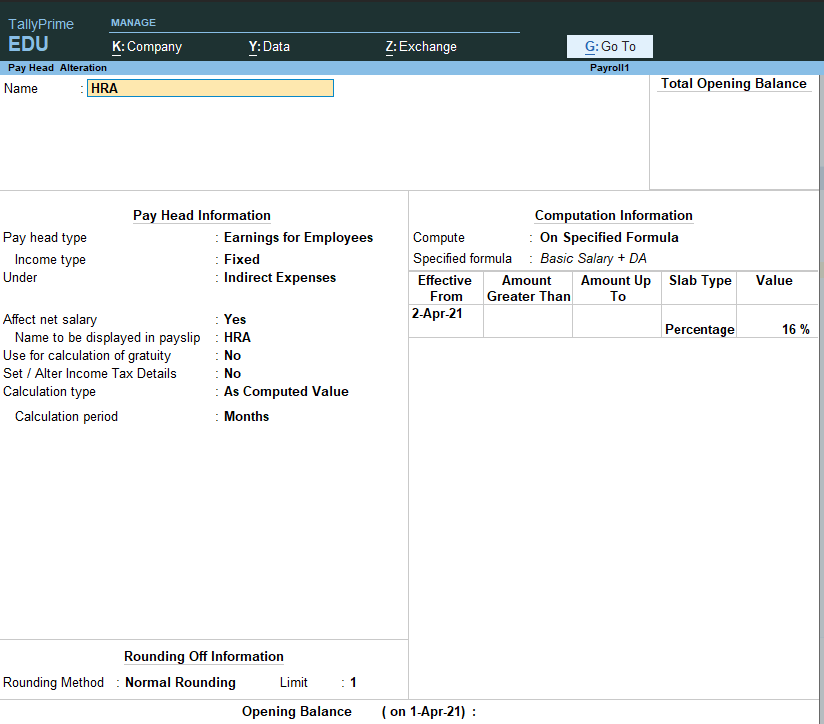

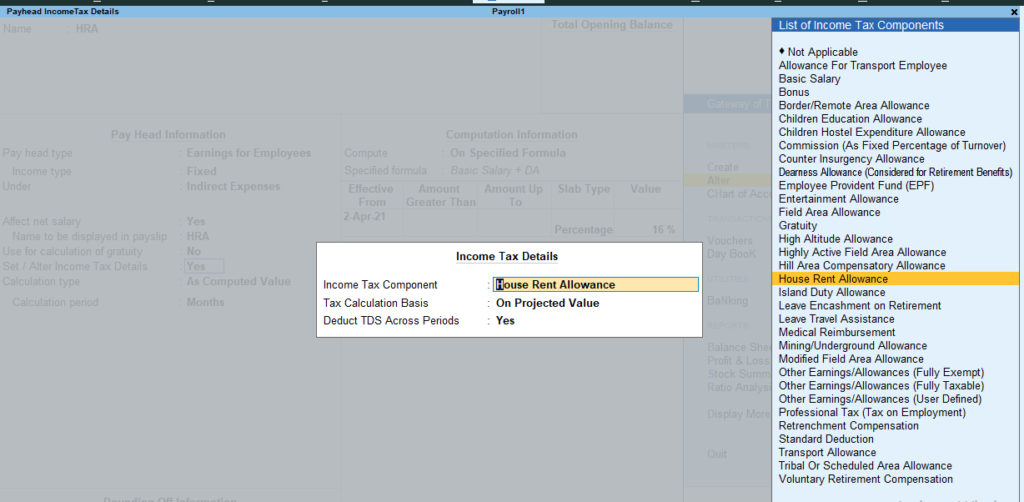

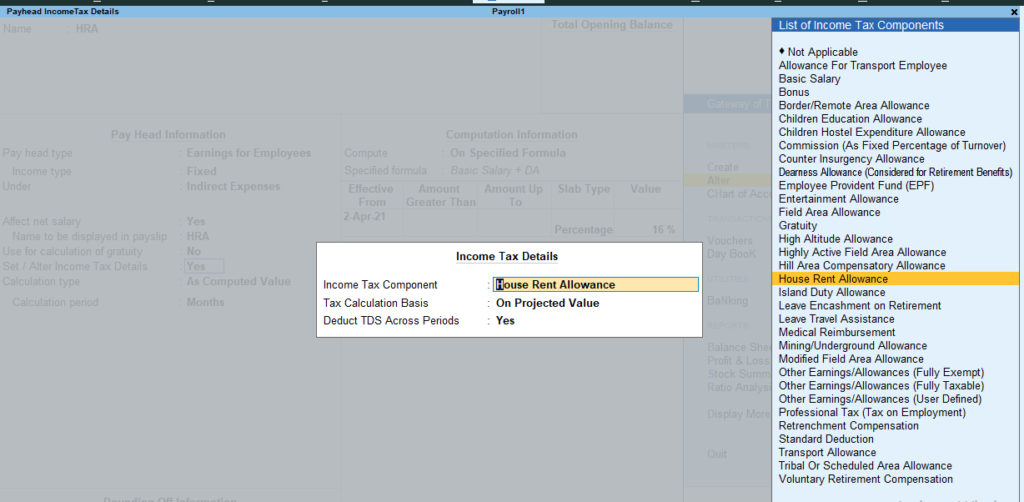

HRA pay head in Tally Prime

Go to gateway of Tally >Create >Payroll Master > Pay head

- In name Type :HRA

- In pay head Type :Earning from Employee

- Income Type :Fixed

- Income Type :Fixed

- Affect net salary :Yes

- name to be displayed in payslip : automatic

- Use for calculation for gratuity No

- Set /alter income tax details :Yes

A new screen appear

- Select Income tax component :House Rent Allowance

- Tax calculation basis :On Projected Value

- Deduct TDS across the period Yes

- Affect net salary :Yes

- Calculations Type :As computed Value

- Caluation period :Month :

- Normal rounding :limit :1

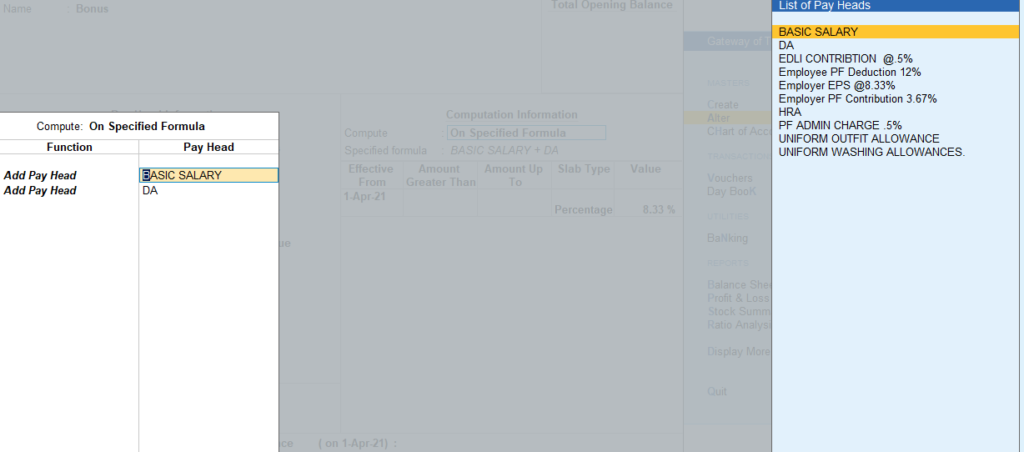

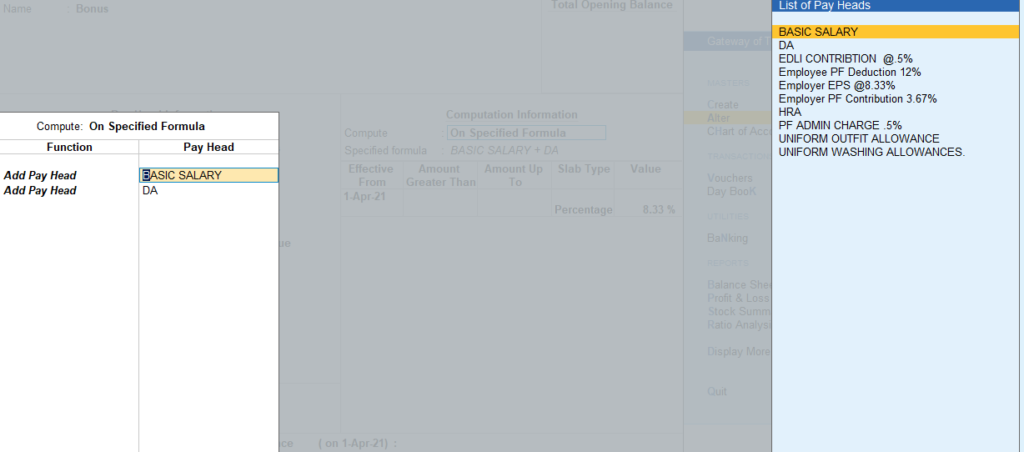

computation Information

Computer :On specific formula

Specified formula

a new screen appear

- Select :Basic Salary +DA

- Effective from :Mention date 1/4/2021

- In slap select :percentage

- Value:16%

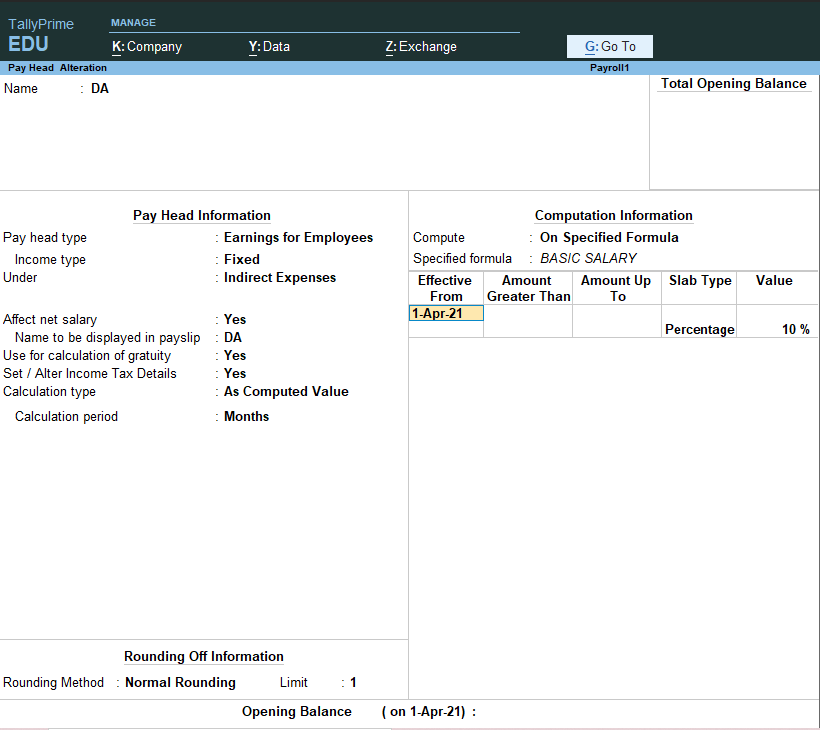

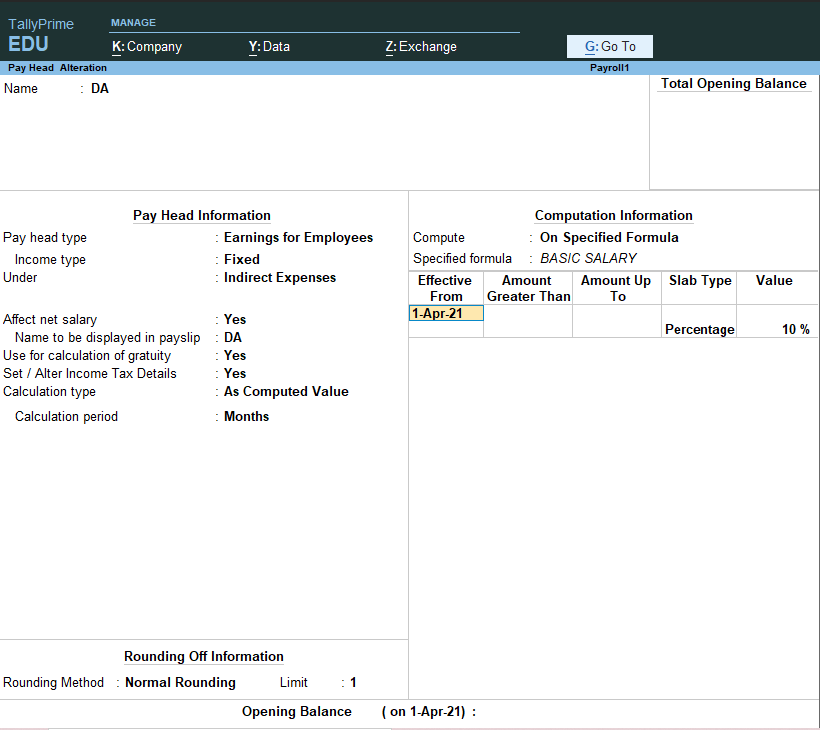

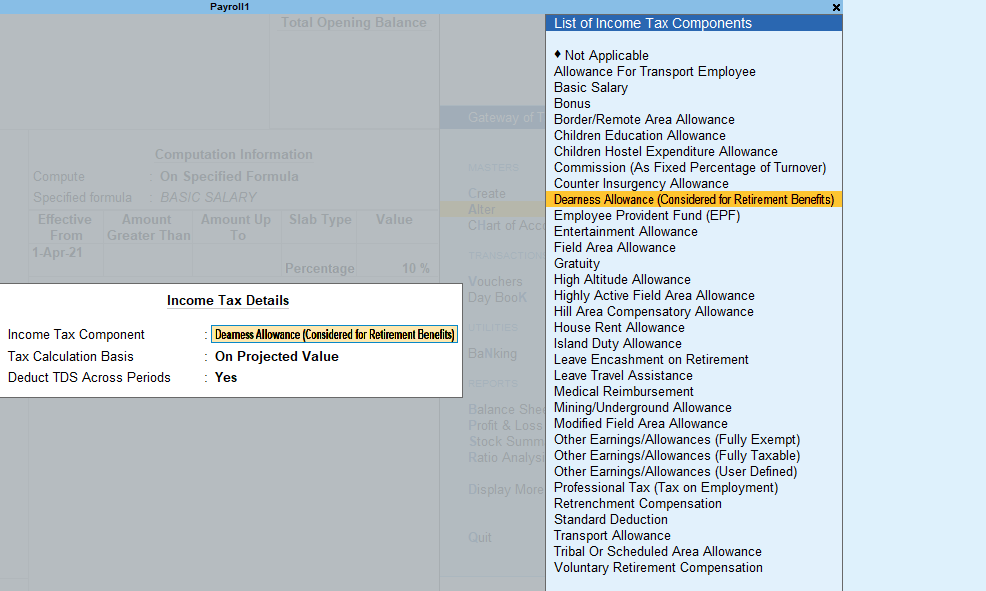

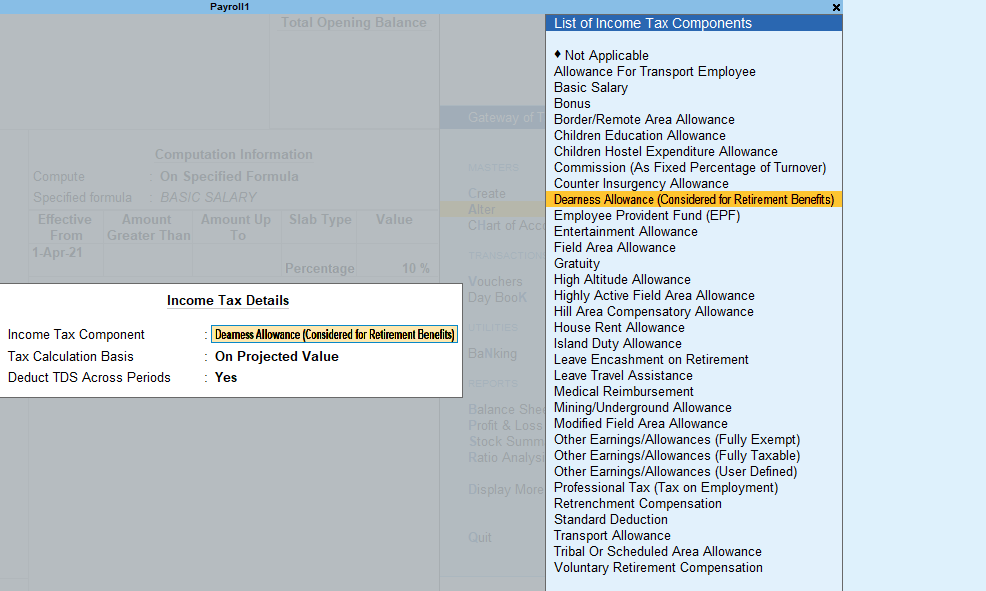

Dearness Allowance pay head

- Go to gateway of Tally >Create >Payroll Master > Pay head

- In name Type :DA

- In pay head Type :Earning from Employee

- Income Type :Fixed

- Under :Indirect

- Affect net salary :Yes

- name to be displayed in payslip : automatic

- Use for calculation for gratuity :yes

- Set /alter income tax details :Yes

A new screen appear

- Select Income tax component :Dearness Allowance (considered for retirement benefits)

- Tax calculation basis :On Projected Value

- Deduct TDS across the period Yes

- Affect net salary :Yes

- Calculations Type :As computed Value

- Calculation period :Month

- Normal rounding :limit :1

computation Information

- Computer :On specific formula

Specified formula

A new screen appear : Select : Basic salary

- Select :Basic Salary

- Effective from :Mention date 1/4/2021

- In slap select :percentage

Value:10%

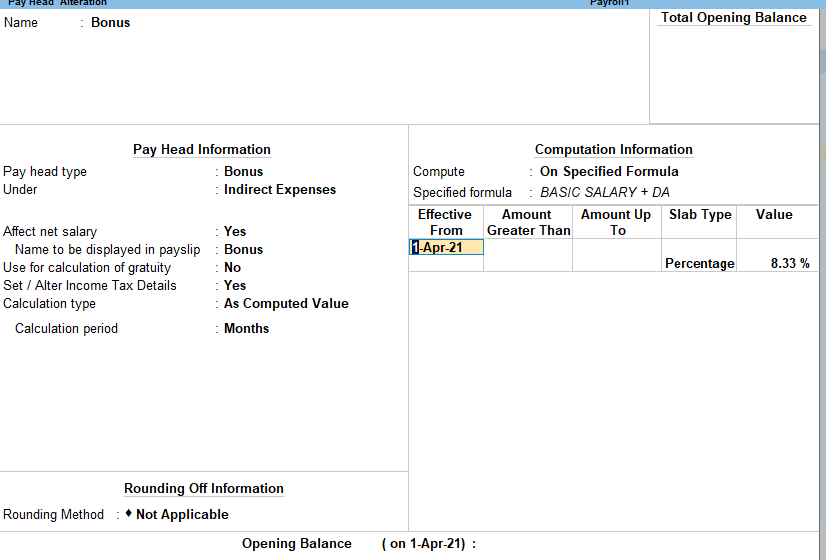

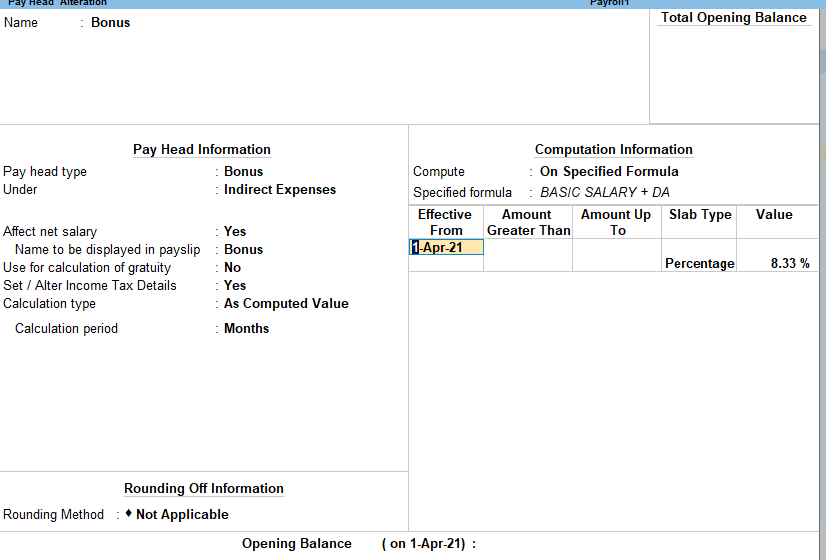

Bonus

- Go to gateway of Tally >Create >Payroll Master > Pay head

- In name Type :Bonus

- In pay head Type :Earning from Employee

- Income Type :Fixed

- Under :Indirect

- Affect net salary :Yes

- name to be displayed in payslip : Bonus Automatic

- Use for calculation for gratuity :no

- Set /alter income tax details :Yes

A new screen appear

- Select Income tax component :Bonus

- Tax calculation basis :On Projected Value

- Deduct TDS across the period No

- Calculations Type :As computed Value

- Calculation period :Month

- Normal rounding :limit :1

computation Information

- Computer :On specific formula

Specified formula

A new screen appear : Select : Basic salary

- Select :Basic Salary

- Effective from :Mention date 1/4/2021

- In slap select :percentage

Value:10%

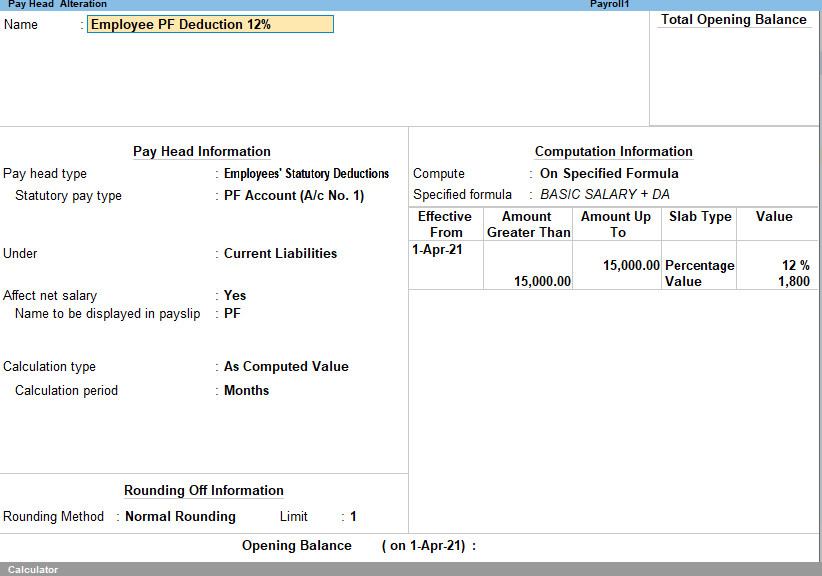

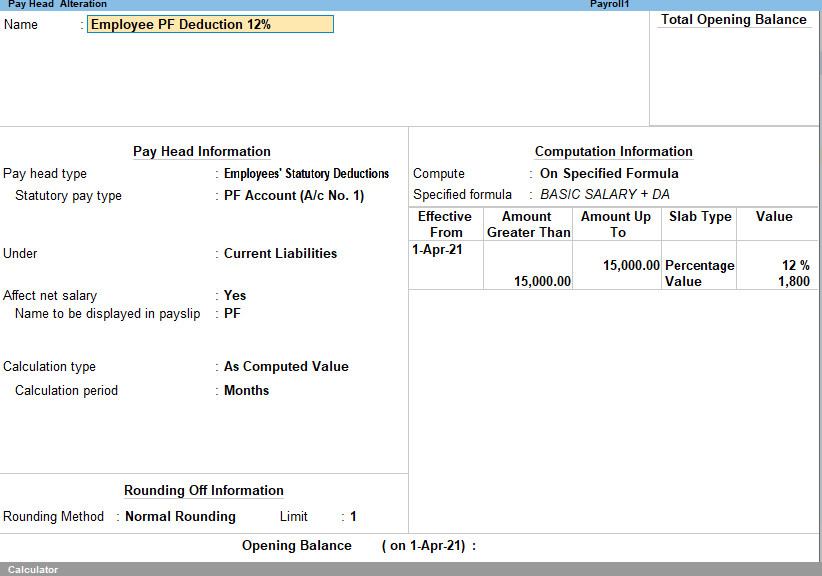

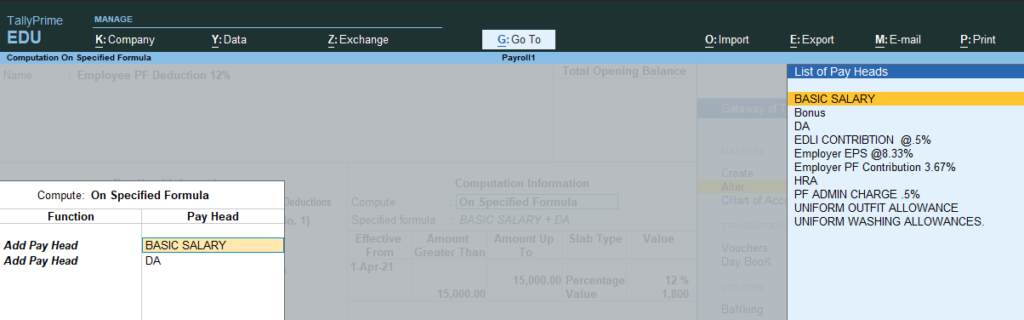

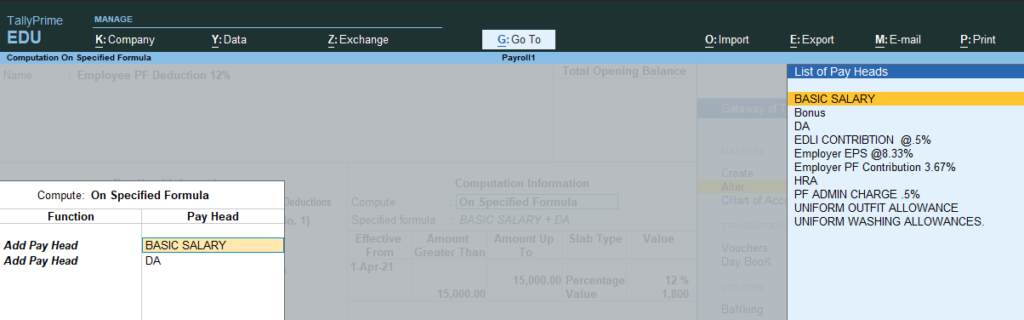

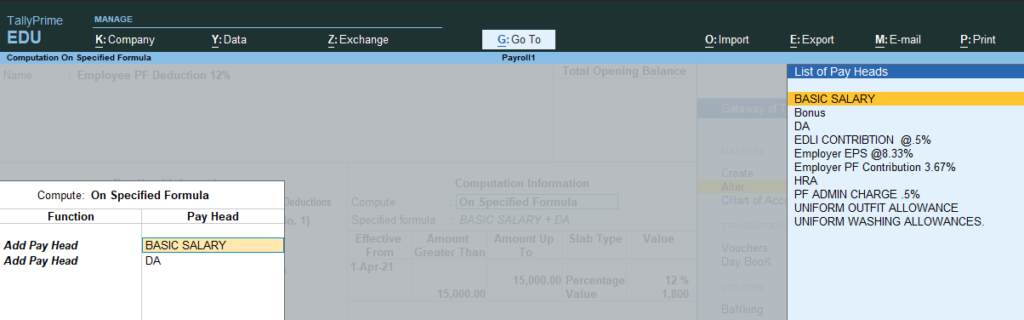

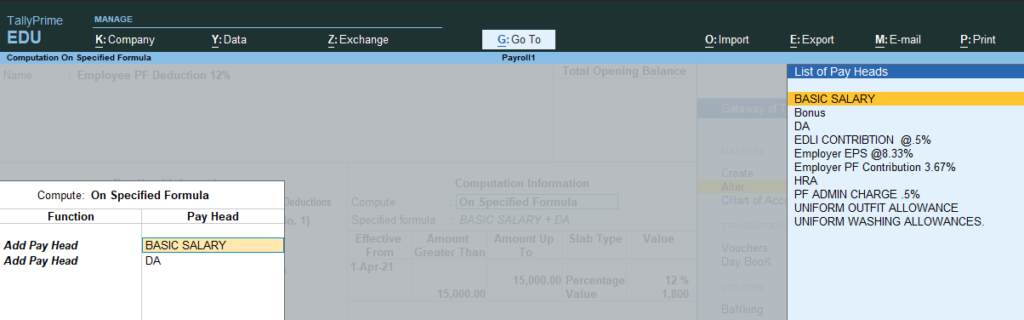

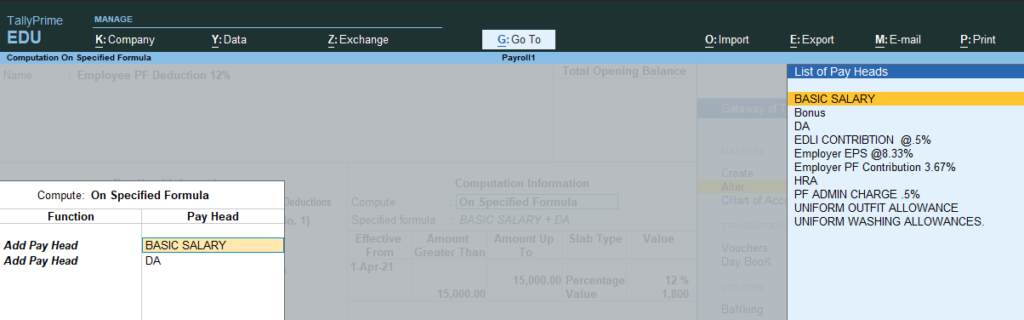

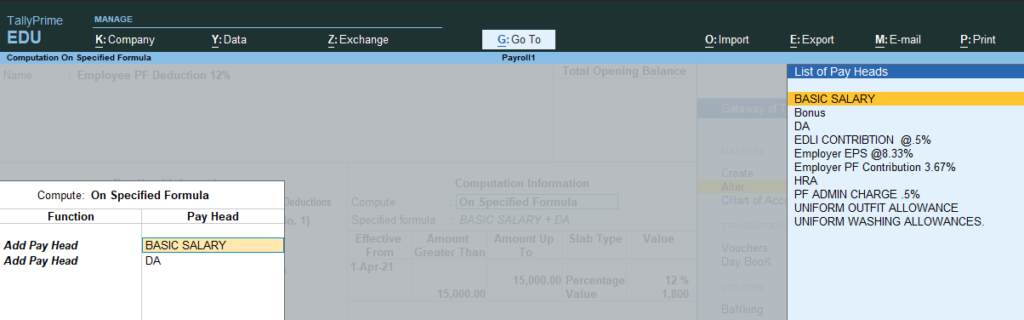

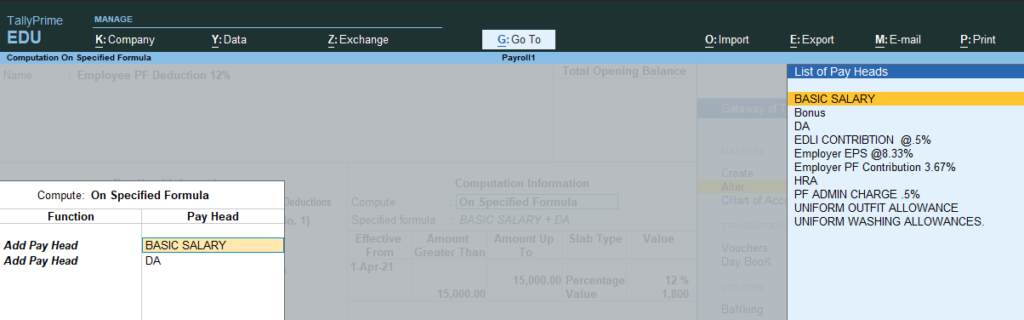

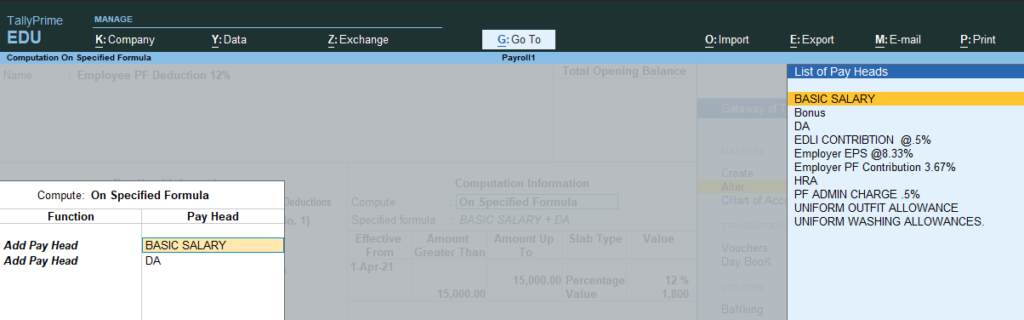

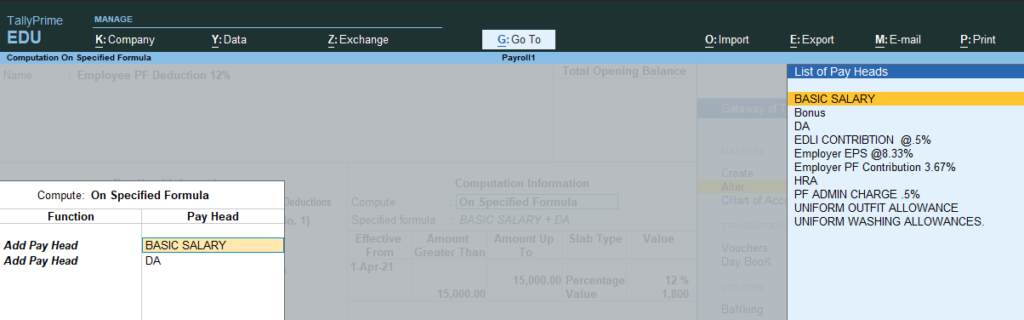

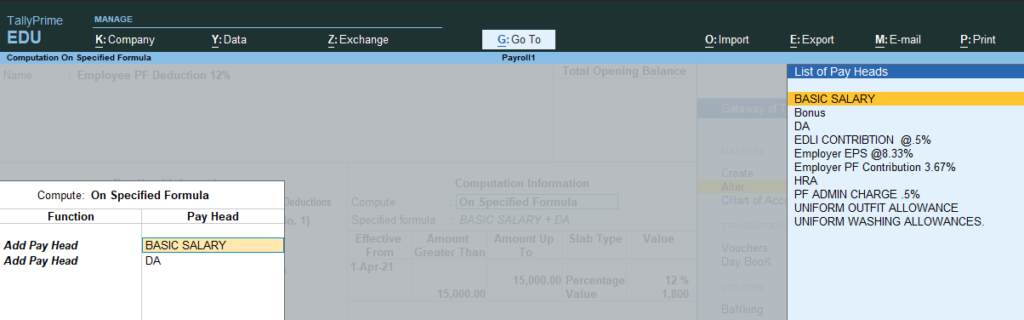

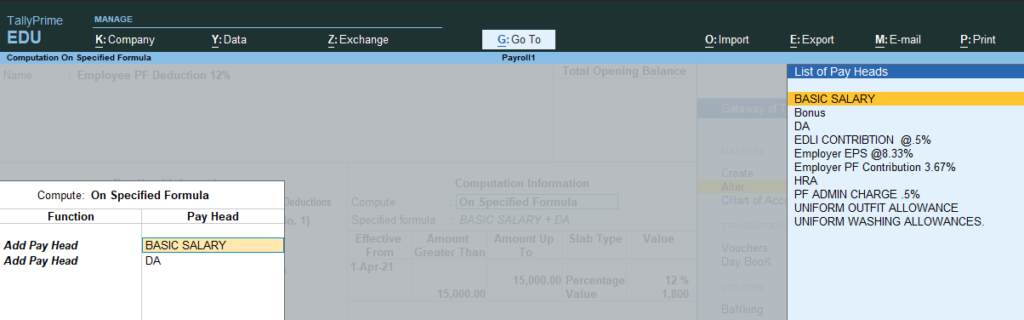

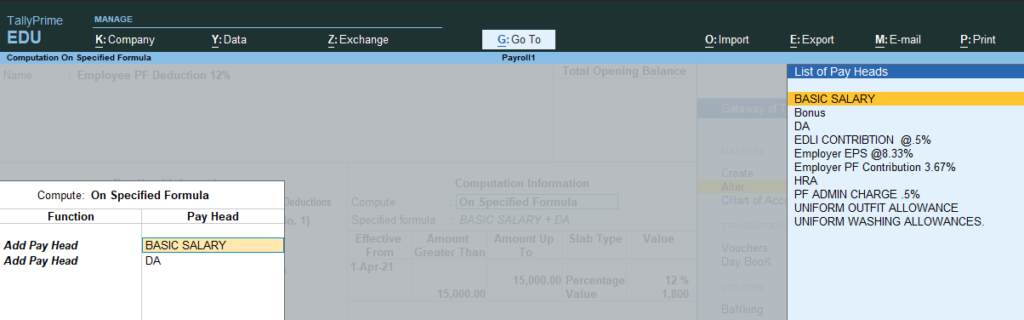

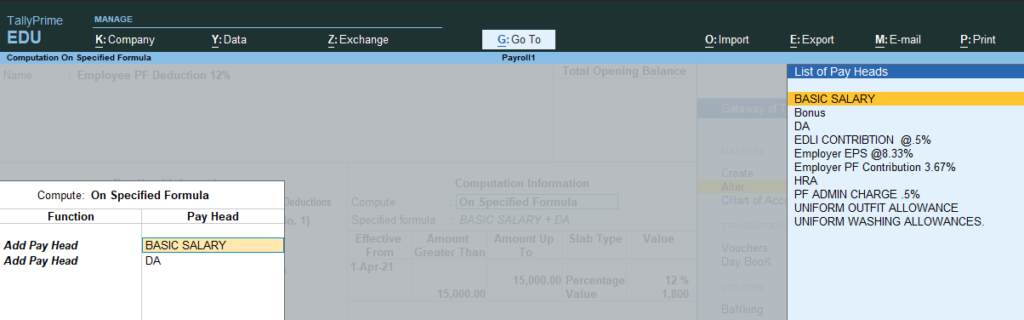

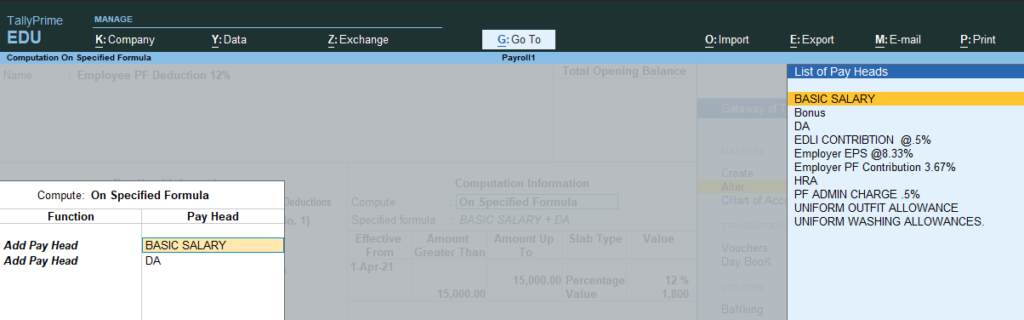

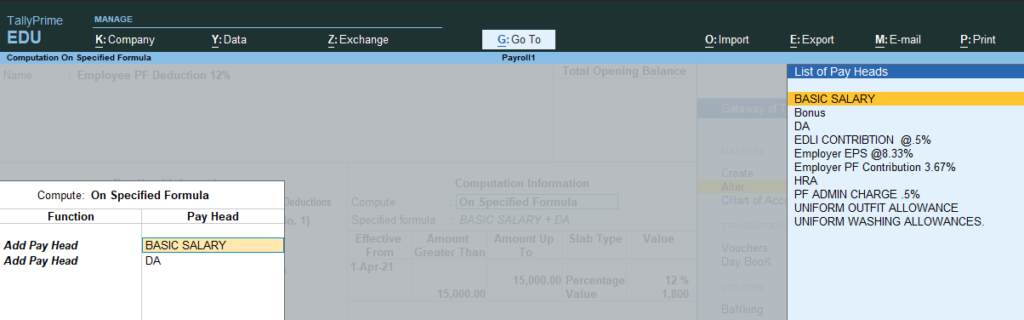

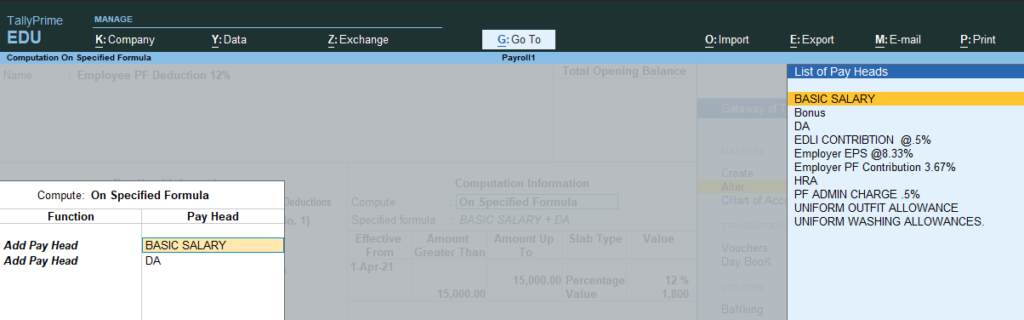

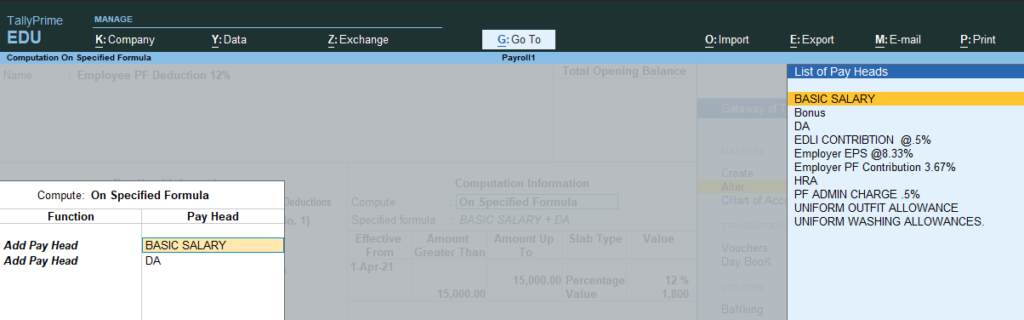

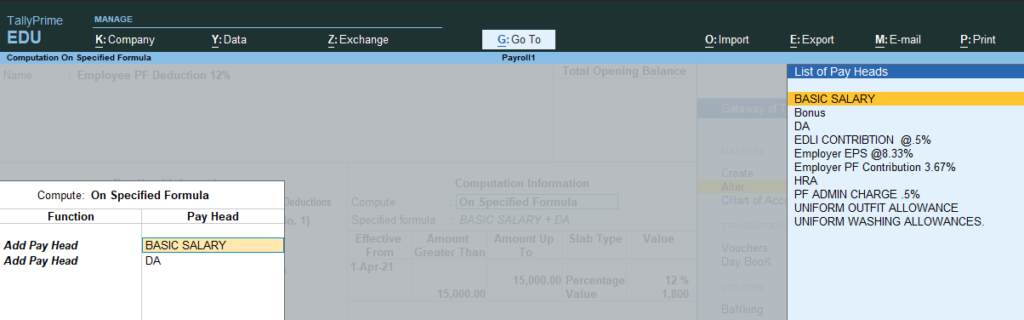

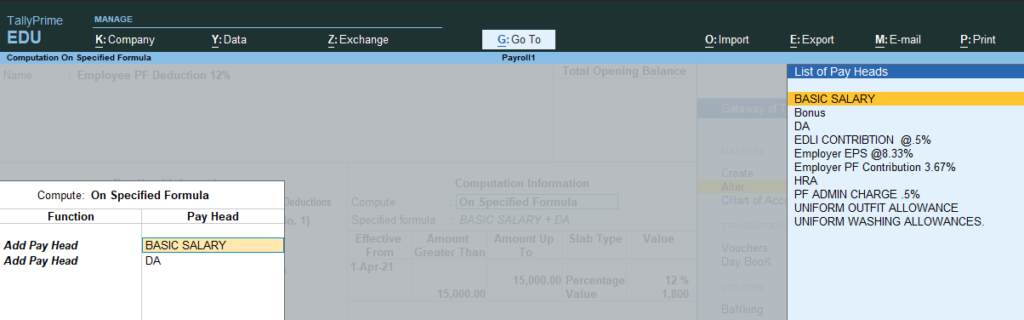

Employee PF deduction 12%

- Gateway of Tally > Create > type or select Pay Heads.

Alternatively, press Alt+G (Go To) > Create Master > type or select Pay Heads.

In case the master is inactive, you will be prompted to enable the payroll feature for your Company. Select Yes or press Y to proceed. - Enter the name of the Pay Head in the Name field.

- Select Employees’ Statutory Deductions as the Pay Head Type from the List of Pay Head Types.

- Select PF Account (A/c No. 1)

- in the Statutory Pay Type field.

Select Current Liabilities from the List of Groups in the Under field. - By default, Affect Net Salary is set to Yes. Type No,

- if you do not want this component to be included in the pay slip.

By default, the pay head component name entered in the Name field appears in the pay slip. - Enter the Name to be display in Payslip if you want to change the default pay head component name.

- By default, the Calculation Type field is set to As Computed Value, and the Calculation Period field is set to Months.

- Select Normal Rounding from the List of Rounding Methods, and type 1 as the rounding Limit.

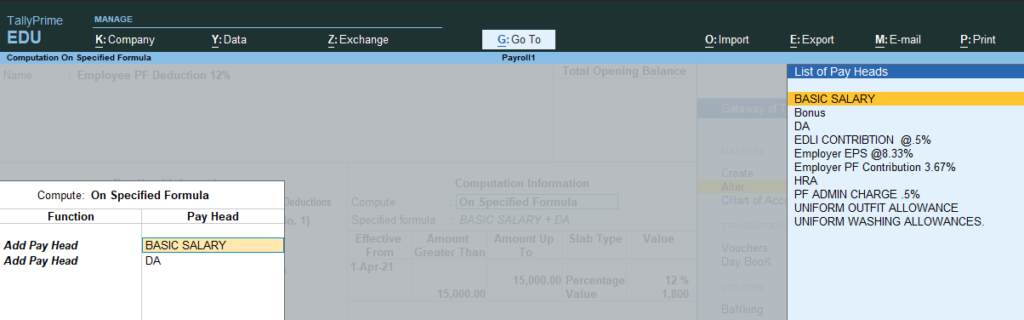

- Select On Specified Formula, from the Computation On list, in the Compute field.

- The Computation on Specified Formula sub-screen appears.

- In the Pay Head column, select Basic Pay from the List of Pay Heads and select End of List to return to Pay Head Creation.

- Enter the desired date in the field Effective Date field, when the PF deduction begins.

- Select Percentage from the List of Slabs in the Slab Type field.

- Enter the required percentage for PF in the Value Basis field.

- Accept the screen. As always, you can press Ctrl+A to save.

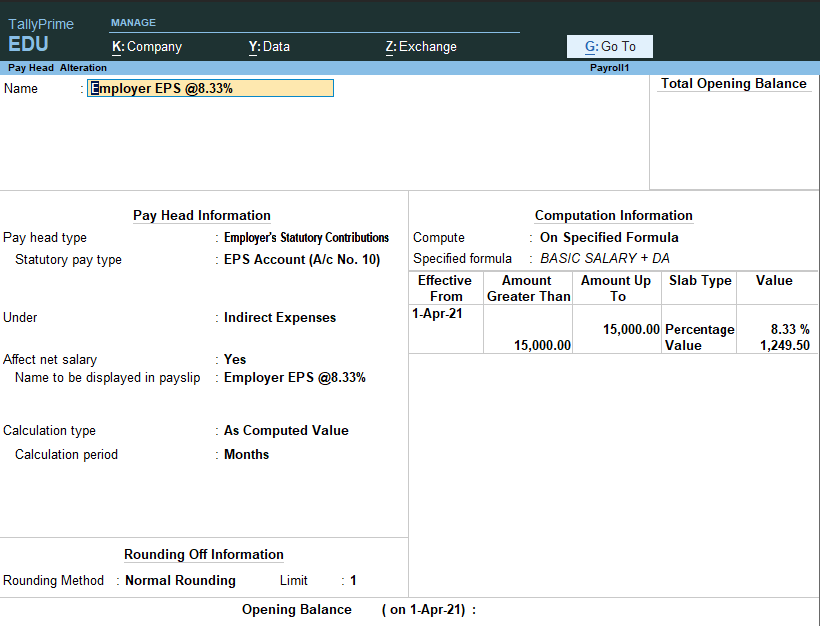

Employer EPS @ 8.33%

- Go to gateway of Tally >Create >Payroll Master > Pay head In name Type :Employer EPS @8.33%

- In pay head Type :Employer statutory Contribution

- Under :Indirect Expense

- Affect net salary :Yes

- name to be displayed in payslip : Employer EPS@8.33%

- Calculations Type :As computed Value

- Calculation period :Month

- Normal rounding :limit :1

computation Information

- Computer :On specific formula

Specified formula

A new screen appear : Select : Basic salary

- Select :Basic Salary + DA

- Effective from :Mention date 1/4/2021

- In slap select :percentage

Value:8.33%

1249

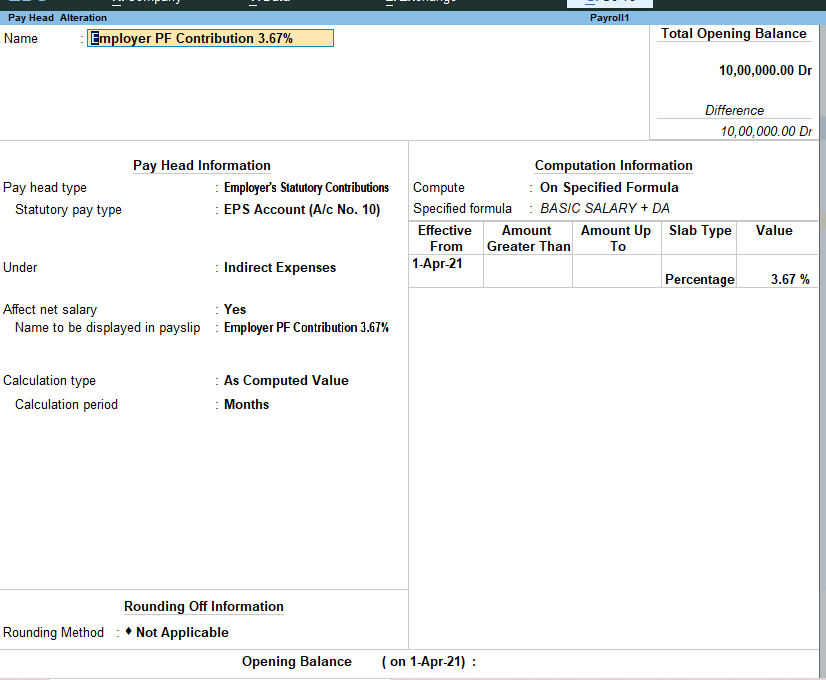

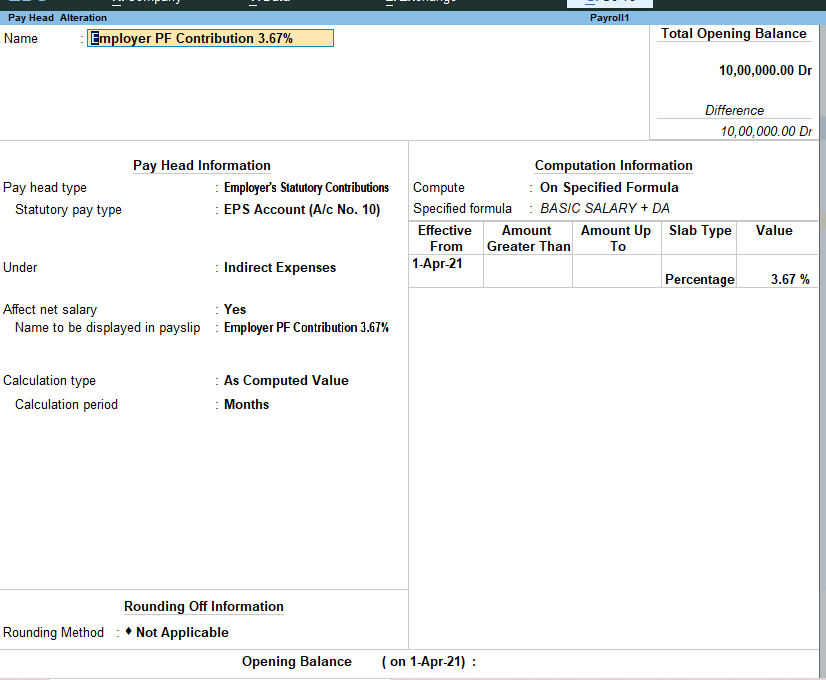

Employer PF contribution 3.67%

- Go to gateway of Tally >Create >Payroll Master > Pay head In name Type :Employer EPS @3.67%

- In pay head Type :Employer statutory Contribution

- Statutory pay type :EPF account(a/c no 10)

- Under :Indirect Expense

- Affect net salary :Yes

- name to be displayed in payslip : Employer EPS@3.67%

- Calculations Type :As computed Value

- Calculation period :Month

- Normal rounding :limit :1

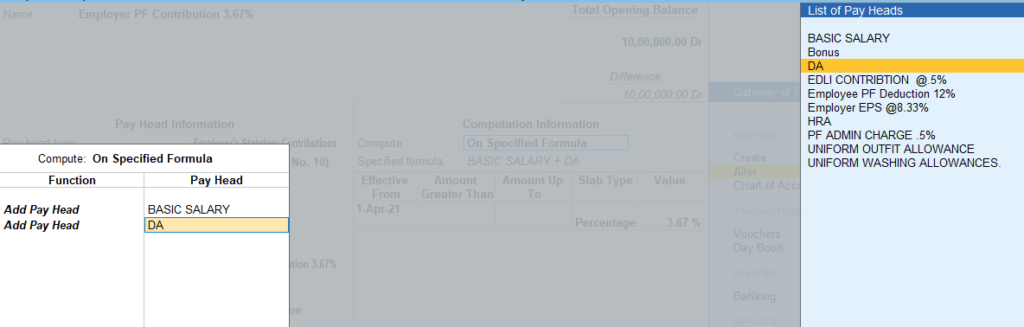

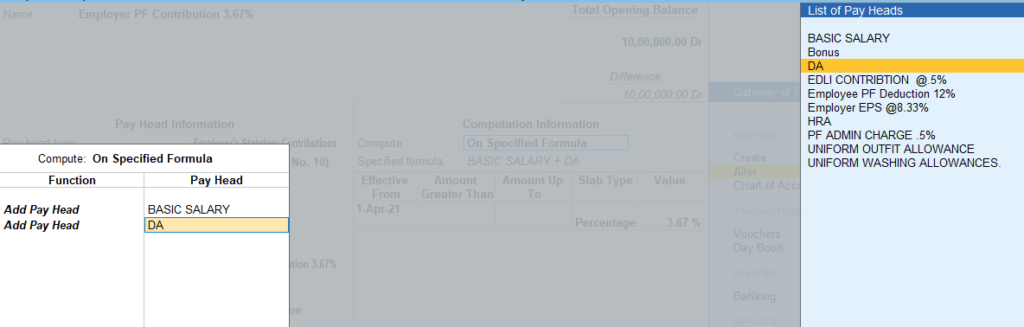

computation Information

- Computer :On specific formula

Specified formula

A new screen appear : Select : Basic salary

- Select :Basic Salary + DA

- Effective from : Mention date 1/4/2021

- In slap select :percentage

Value:3.67%

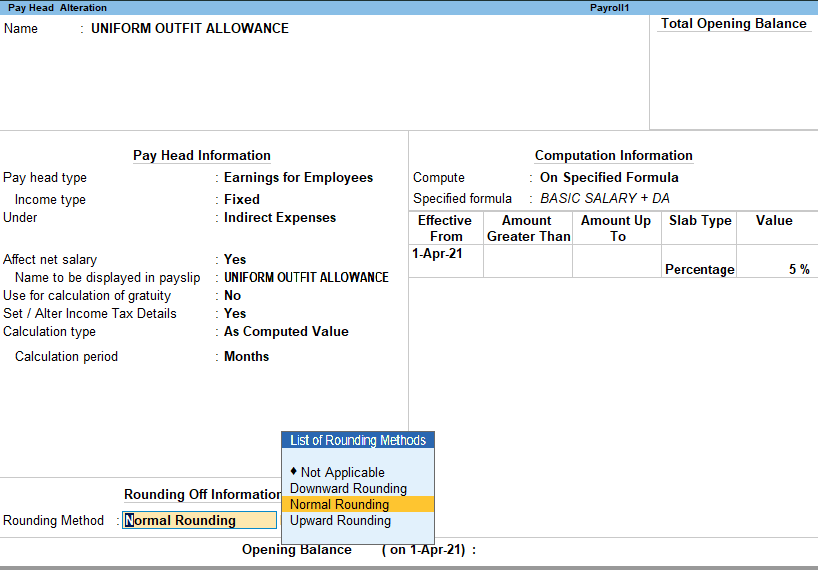

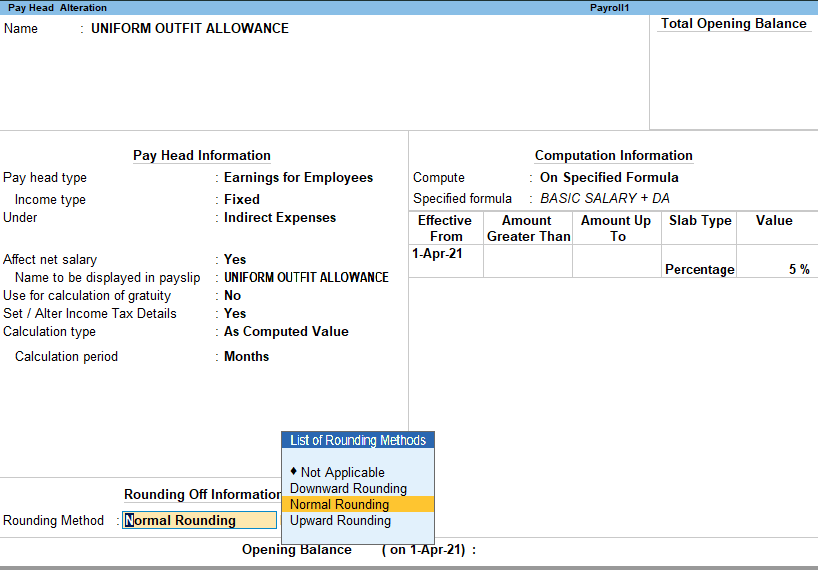

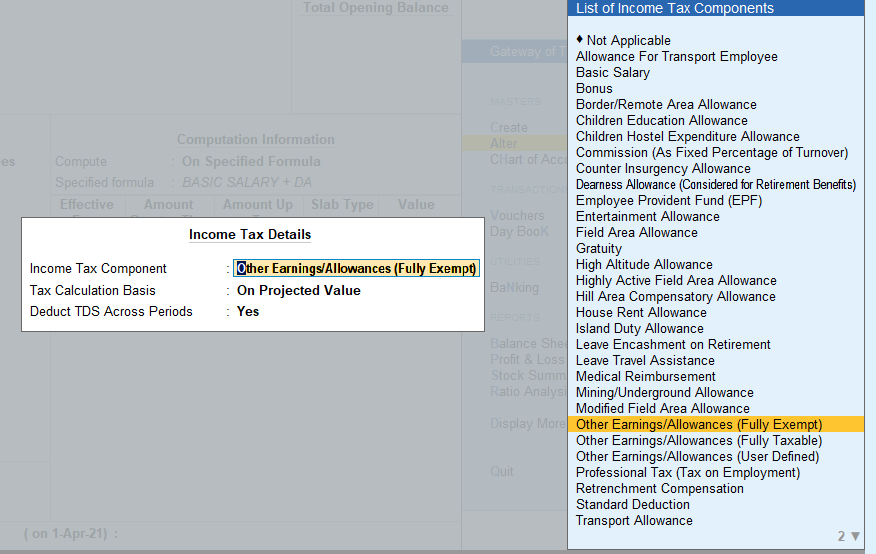

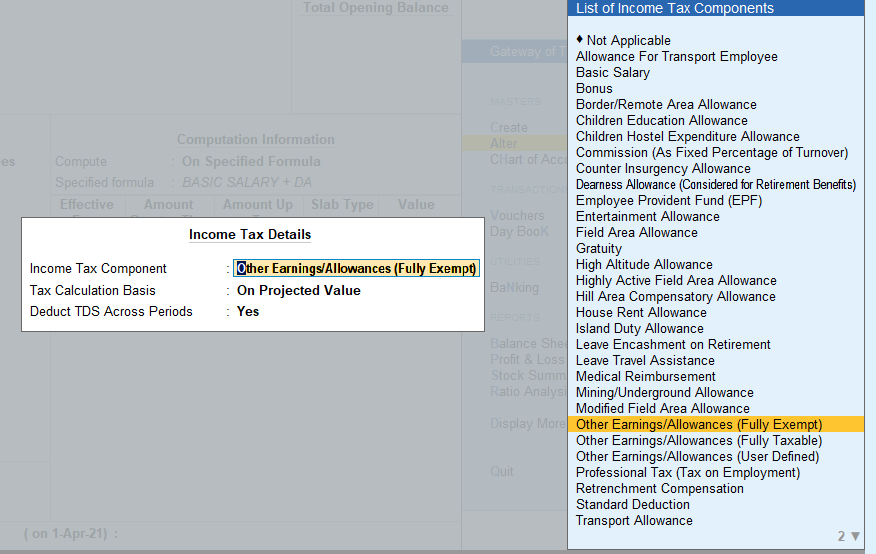

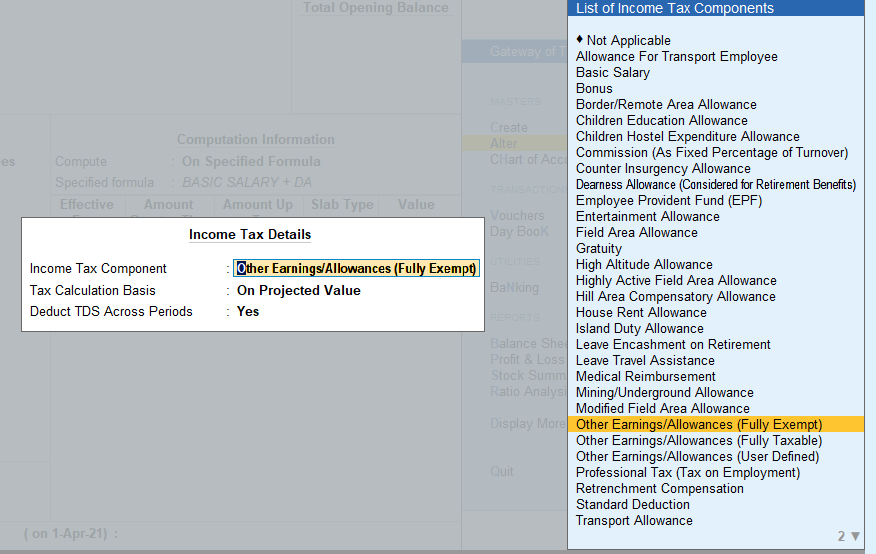

Uniform Outfit Allowance

- Go to gateway of Tally >Create >Payroll Master > Pay head In name Type :Uniform Outfit Allowance

- In pay head Type :Earning for Employee

- Under :Indirect Expense

- Affect net salary :Yes

- name to be displayed in payslip : Uniform Outfit Allowance

- Use calculation for gratuity : No

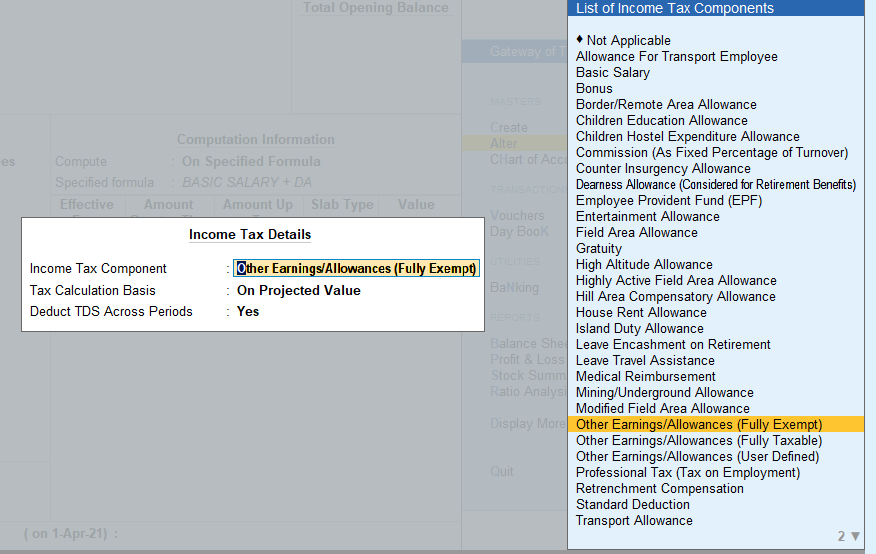

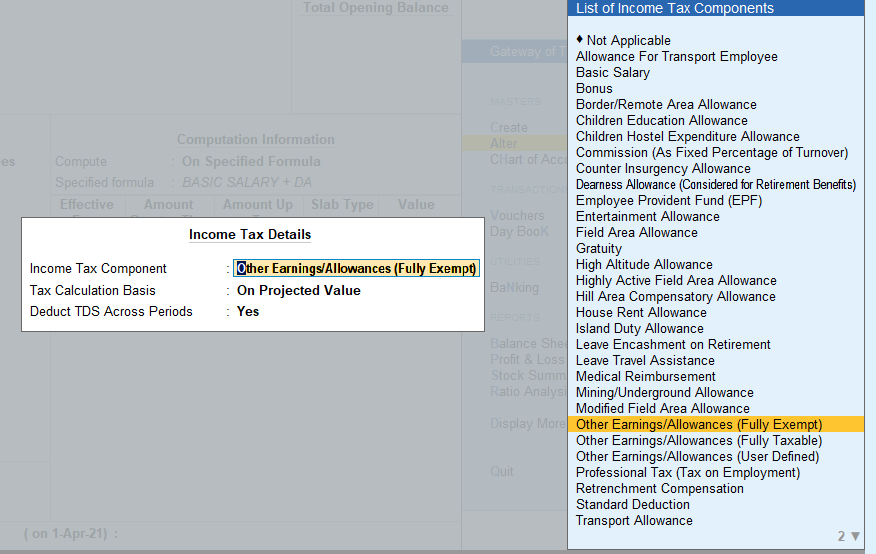

- Set Alter Tax detail :Yes

A new screen Appears

Select : Other earning Allowance (Fully exempted)

- Calculations Type :As computed Value

- Calculation period :Month

- Normal rounding :limit :1

computation Information

- Computer :On specific formula

Specified formula

A new screen appear : Select : Basic salary

- Select :Basic Salary + DA

- Effective from :Mention date 1/4/2021

- In slap select :percentage

Value:10%

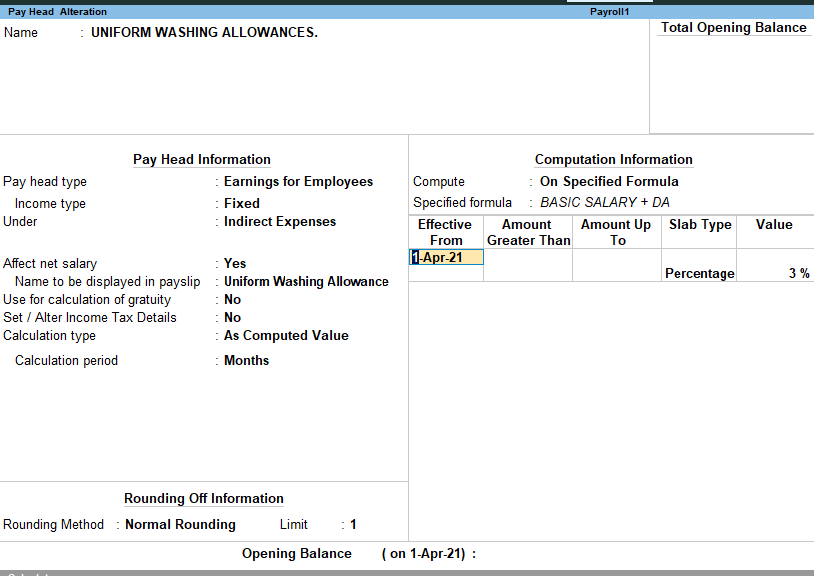

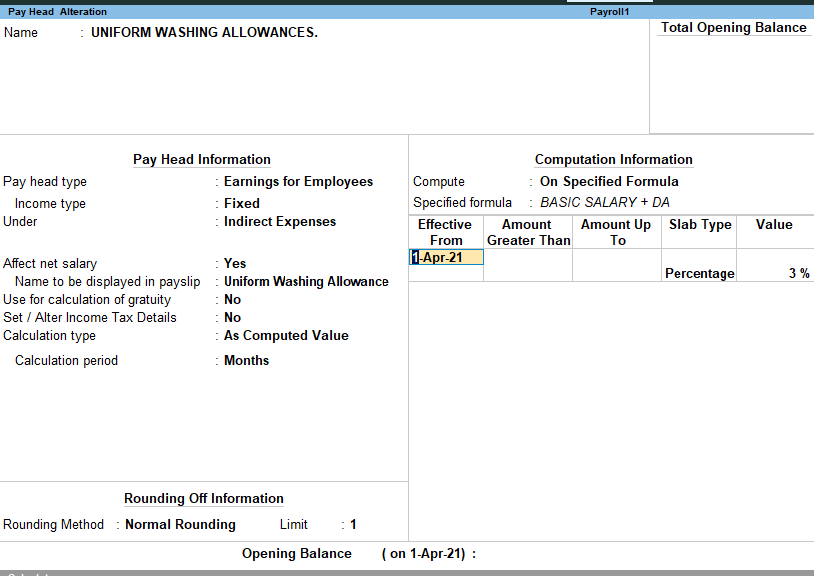

Uniform washing Alllowance

Go to gateway of tally > create > Now similarly as created Uniform outfit allowance create Uniform Washing Allowance the only difference is percentage which need to set 3%. For more see the picture s below.

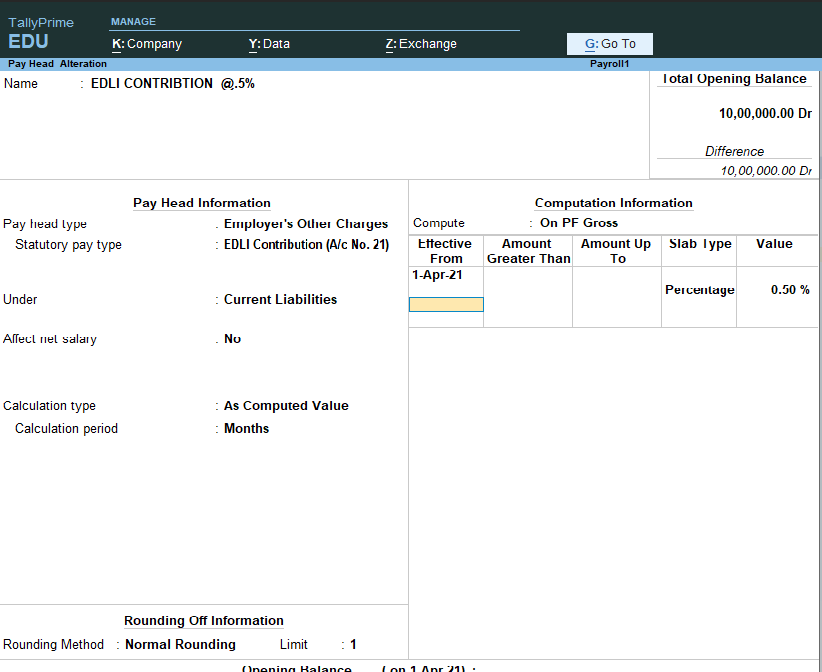

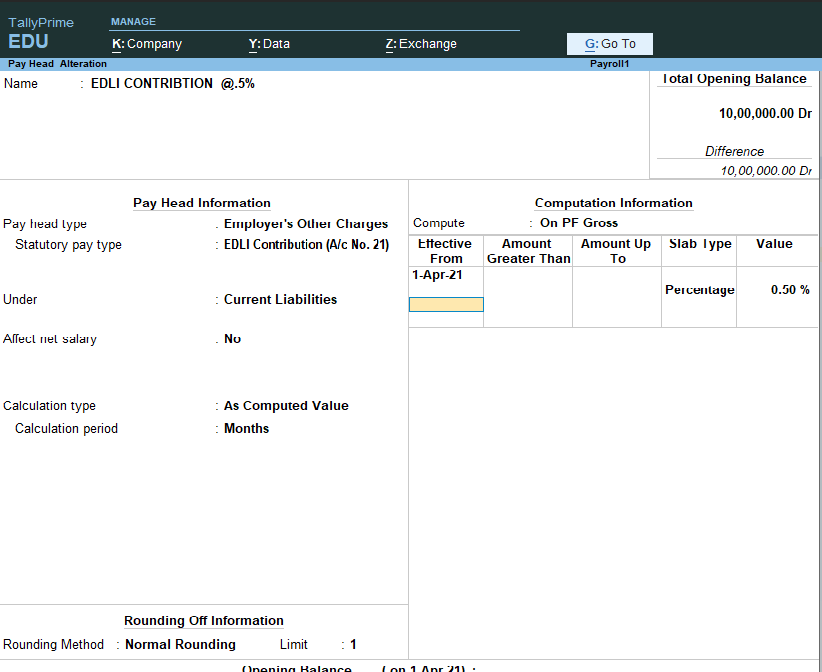

EDLI contribution 5%

- Go to gateway of Tally >Create >Payroll Master > Pay head In name Type : EDLI Contribution 5%

- In pay head Type :

- Employee others Charges

- Statutory pay Type :EDLI contibution A/c no 21

- Under : Current Liabilities

- Affect net salary : no

- Calculated Type :As computed Value

- calculation period :month

A new screen Appears

Select : Other earning Allowance (Fully exempted)

- Calculations Type :As computed Value

- Calculation period : Month

- Normal rounding:limit :1

computation Information

- Computational information :On PF gross

- percentage :.50%.

PF Admin Charges

- Go to Gateway of Tally >Create >Payroll Master > Pay head In name Type: PF admin Charges

- In pay head Type :

- Employee others Charges

- Statutory pay Type :Admin charges A/c (2)

- Under : Current Liabilities

- Affect net salary : no

- Calculated Type :As computed Value

- calculation period :month

A new screen Appears

Select : Other earning Allowance (Fully exempted)

- Calculations Type :As computed Value

- Calculation period : Month

- Normal rounding:limit :1

computation Information

- Computational information:On PF gross

- percentage :.50%.

Create Pay structure of Employer

| Percentage | Prajka Kulkarni | Mahesh Kumar | Shubham Negi |

Basic pay | 1 day | 949.52 | 784 | 714 |

House Rent Allowance | 16% of Basic Plus VDA |

|

|

|

Bonus | 8.33% of Basic plus VDA |

|

|

|

Uniform Outfit Allowance | 5% of Basic Plus + VDA |

|

|

|

DA | 10% basic |

|

|

|

Uniform Washing Allowance | 3% of Basic Plus VDA |

|

|

|

Employee Provident Fund | 12% of basic + VDA |

|

|

|

Employer EPS @ 8.33% | Upto 15000 8.33% 15000 above 1249.5 |

|

|

|

Employer PF contribution 3.67% | 3.67% of basic + DA |

|

|

|

EDLI Contribution .5% | .5% of PF |

|

|

|

PF admin Charges | .5% of PF |

|

|

|

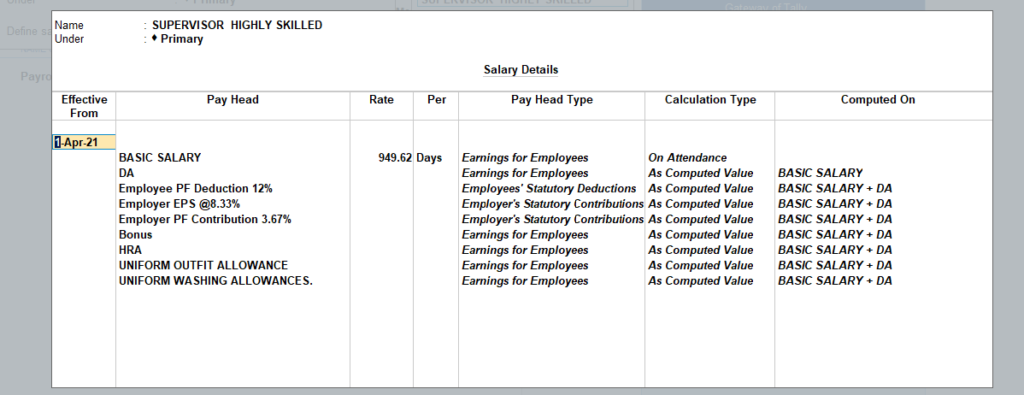

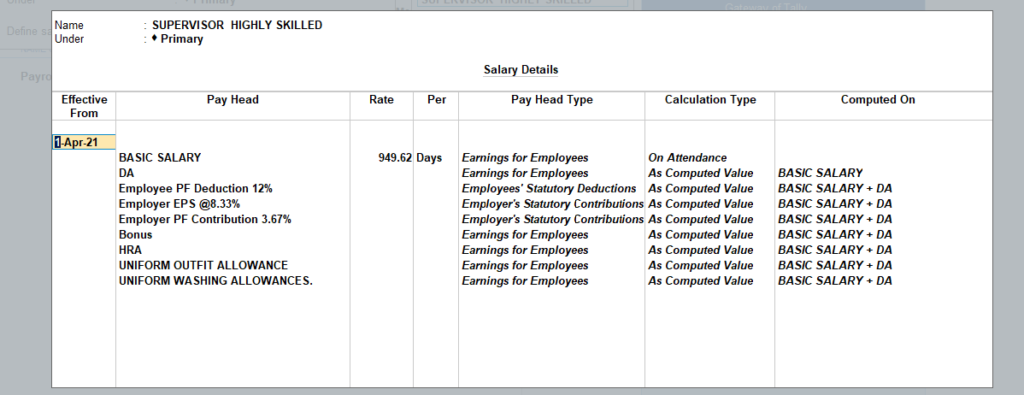

Salary Set up at Group Level

Go to gateway of tally >alter>

Name : Supervisor Highly Skilled

Under : Primary

Define salary :yes

a new screen will open

Type Effective date :1/4/21

Select :Basic Salary

Rate:949.69

similarly select other pay head as mention in the picture below.

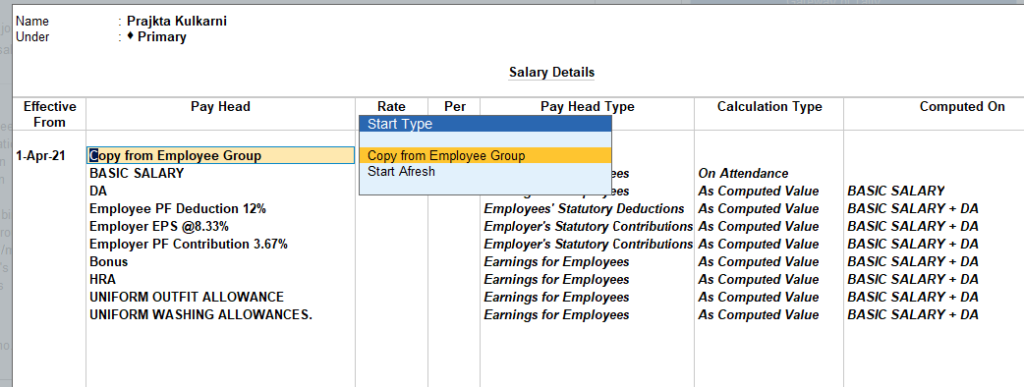

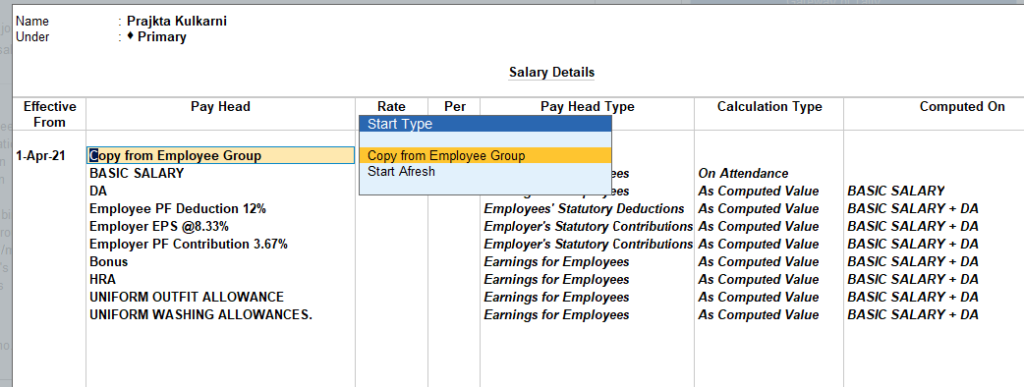

Salary set up at employee level

If you set up salary at group level then you can set up salary at employee level just to copy the detail from group as shown in the picture below.

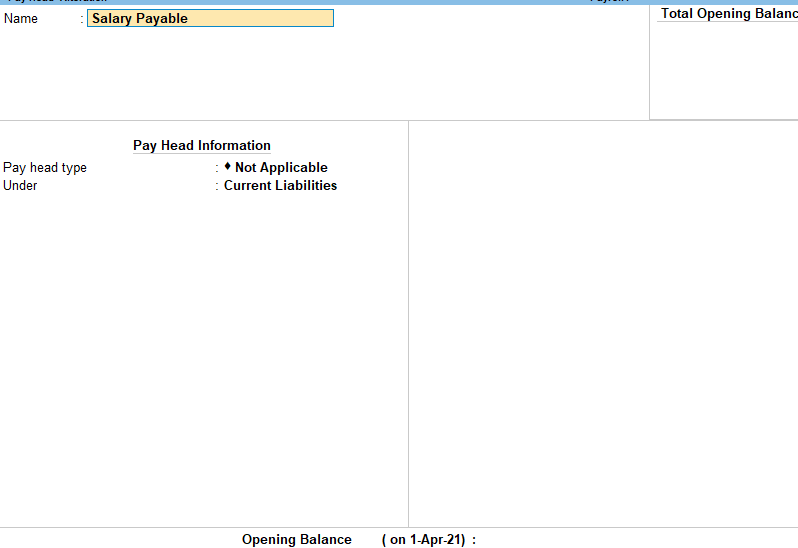

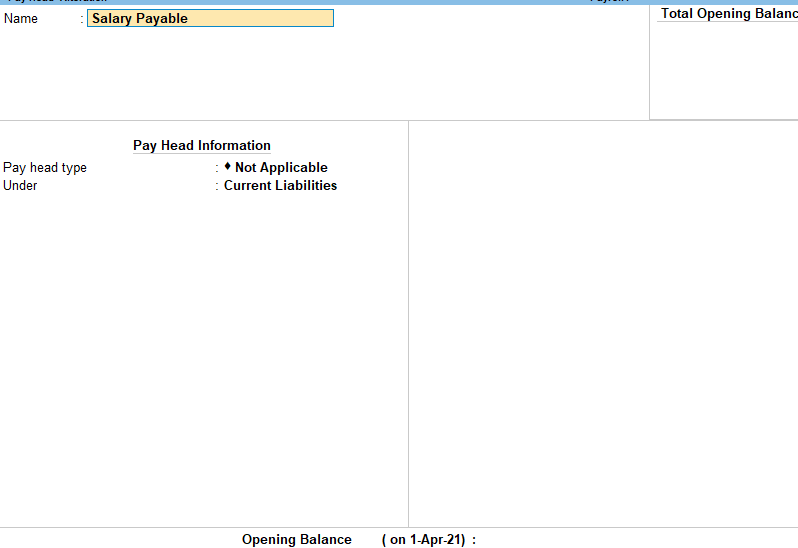

Create pay head Salary payable

- Go to gateway of tally >Payroll Master >Pay head >

- Create >Salary Payable >

- Pay head Types : Not Applicable

- Under Current Liability

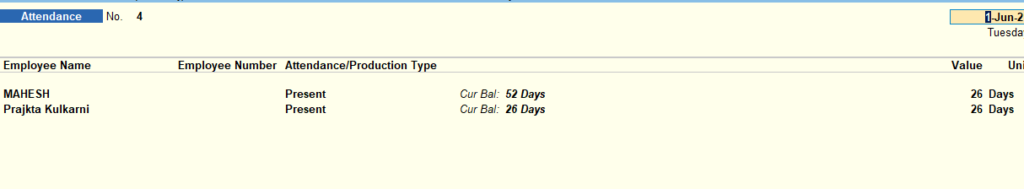

Attendance

- Gateway of Tally > Vouchers > press F10 (Other Vouchers) > type or select Attendance.

Alternatively, press Alt+G (Go To) > Create Voucher > press F10 (Other Vouchers) > type or select Attendance. - Press F2 (Date) to change the date.

- Select the employee whose attendance you want to record from the List of Employees.

- Select the Attendance/Production Type from the list.

- Enter the Value.

- Select End of List from the List of Employees.

- Accept the screen. As always, you can press Ctrl+A to save.

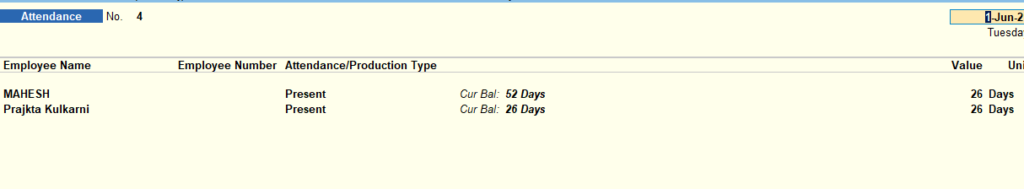

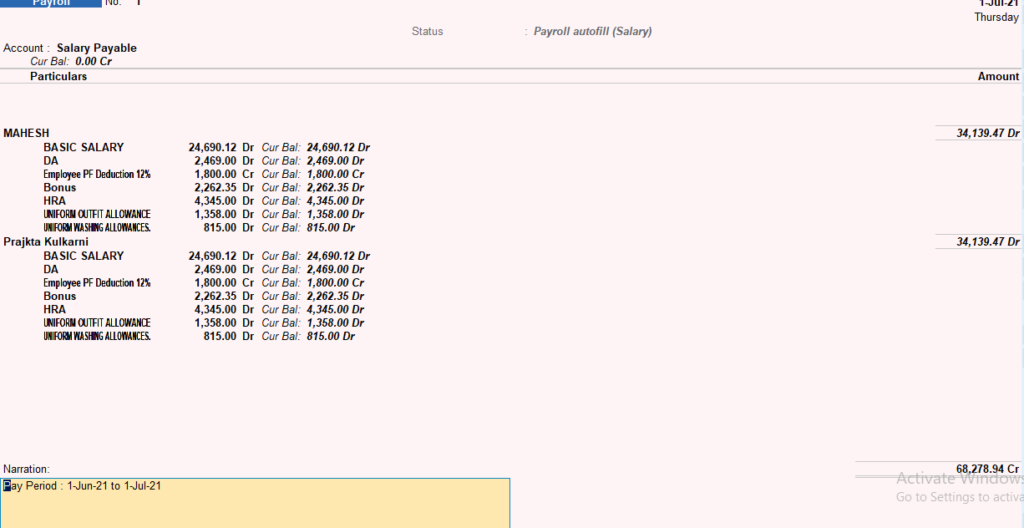

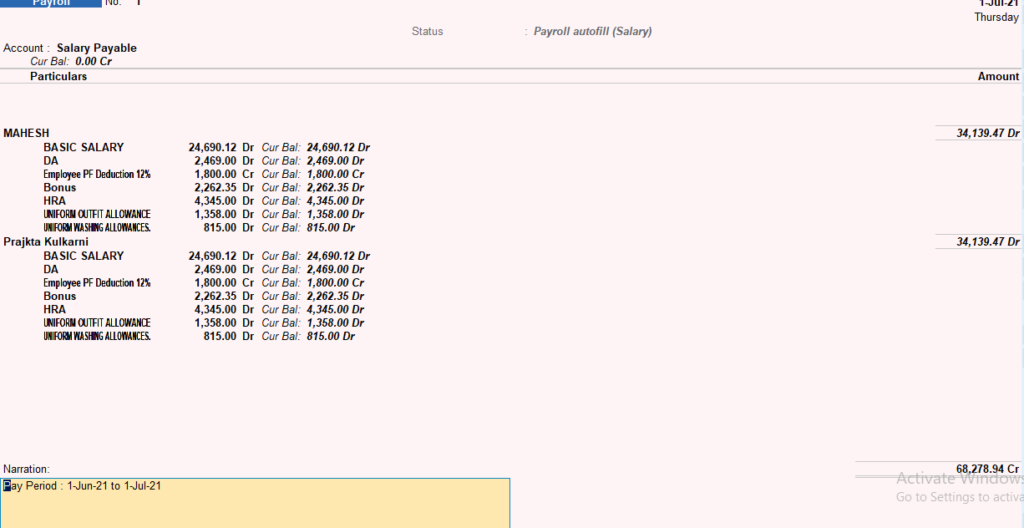

Processing Salary (Payroll)

- Gateway of Tally > Vouchers > press Ctrl+F4 (Payroll).

Alternatively, Alt+G (Go To) >Create Voucher > press Ctrl+F4 (Payroll).

Press F2 to change the Voucher Date. - Press Ctrl+F to select the Payroll Autofill in the Autofill screen.

- Type of transaction: select the Type of Autofill as Payroll Autofill.

- Process for: select the Salary in the Process for field.

From (blank for beginning): enter the From Dates.

To (Blank for end): enter the To Dates. - Employee/Group: select the Employee/Group from the List of Employees/Group, whose salary you want to process.

- Sort by: Select the sorting option in the Sort by field.

Payroll/Bank/Cash Ledger: Select the appropriate Payroll Ledger from the List of Ledger Accounts. - Note: If the salary payment is done through cash, you can select Cash as Payroll Ledger.

- Enter the User Defined Pay Head values. such as Variable Pay or Salary Advance Deductions.

- Enter the Narration, if any. By default, the payroll voucher shows the pay period in the Narration field.

- Accept the screen. As always, you can press Ctrl+A to save.

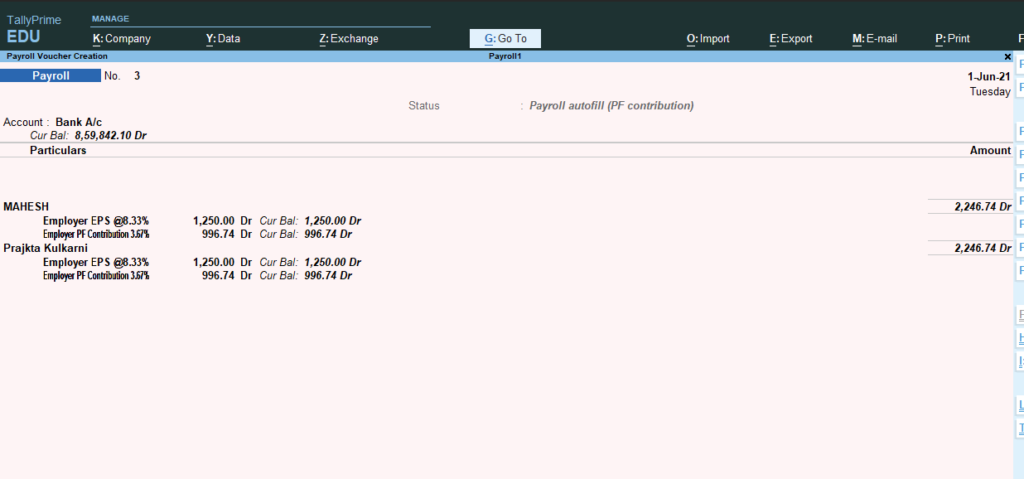

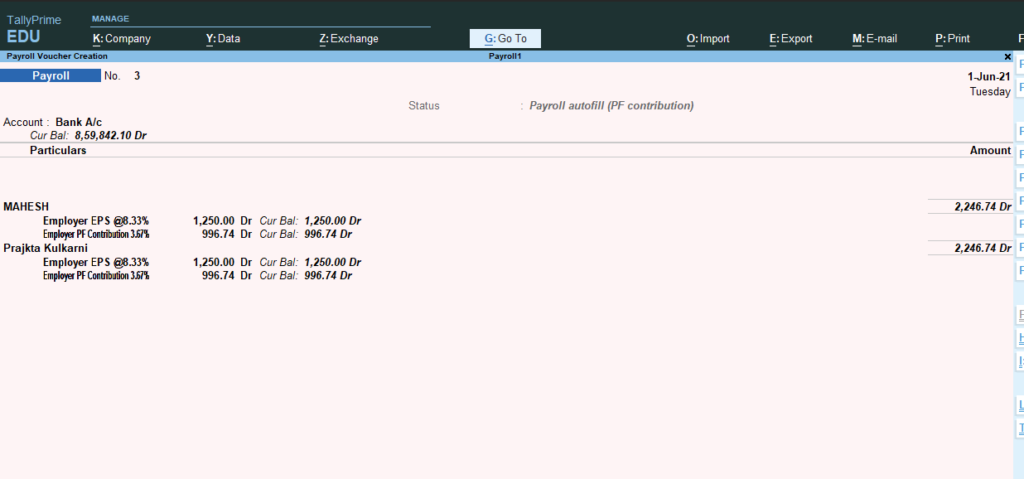

PF contibution Voucher entry

Go to Gateway of Tally >voucher entry

- Press CTRL +F

- A new screen appears

- Select: payroll auto fill

- process for: PF contribution

- select date

- sort by employee

- payroll: select bank