Journal entry of Advance received from Customer and advance paid to Supplier

Table of Contents

ToggleJournal entry of Advance received from Customer and advance paid to Supplier

Advance received form Customer

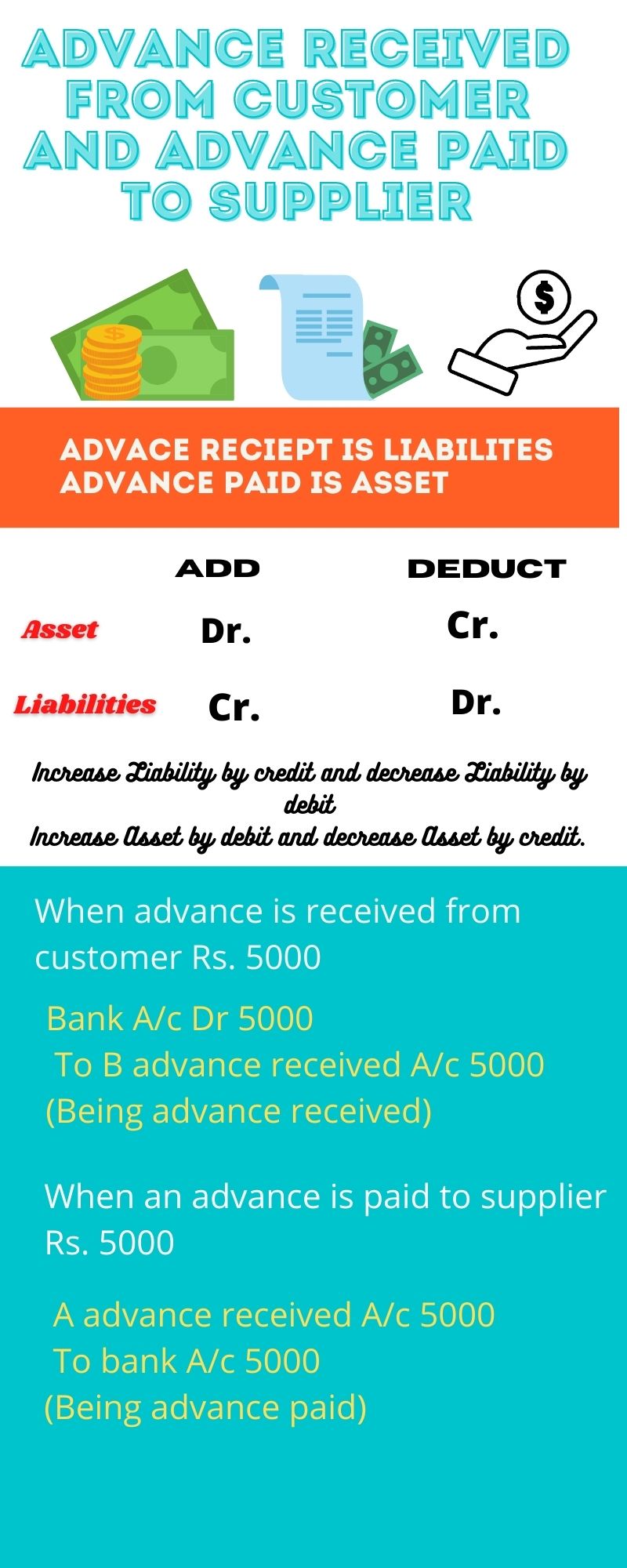

When Advance received from customers that is current liabilities as its our obligation for us to deliver goods and service in future. Before going further we have to understand what is Advance paid through the accounting rule of assets and libilities

When we have to ADD Asset in business, | we have Debit that accounts |

When we have to Deduct MINUS Asset in business | we have Credited that accounts |

When we have to ADD Liability in business | we have Credited that accounts |

When we have to Deduct MINUS Liability in business | we have Debit that accounts

|

A cash advance received from customer journal entry is required when a business receives a cash payment from a customer in advance of delivering goods or services. in return of it.

Advance paid to Supplier

When an advance is paid to the supplier in such condition we are adding our asset as in the exchange of our money the supplier will provide our goods and services in future .When Advance paid to supplier hat is current Asset as its our right to get deliver goods and service in future. Before going further we have to understand what is Advance paid through the accounting rule of assets and libilities as mention above table.

Example of advance received and advance paid journal entry

Example

A ltd sign a contract with B ltd for consulting services Rs 50,000 and received Rs 20,000 cash in advance.

Here things to be noted that we did not need to make a entry of contract only journal entry of advance need to be made in the book A ltd and B ltd.

In the books of A ltd

Journal Entry will Be

PARTICULAR | AMOUNT | AMOUNT |

Cash A/c Dr. | 20,000 |

|

To Advance from B ltd |

| 20,000 |

(BEING CASH RECEIVED IN ADVANCE FROM B LTD) |

|

|

Note : Advance from B ltd is liability as the money received in advance for service to be provided in future therefore its our obligation to provide service and as we are adding liabilty to our business therefore we are adding to our business.

Account | Implementation |

Cash | Debit as cash is coming in business |

Advance received form B Ltd | Credit as liability is added to business |

In the books of B Ltd

PARTICULAR | AMOUNT | AMOUNT |

Advance paid to A ltd | 20,000 |

|

To cash |

| 20,000 |

(BEING CASH PAID IN ADVANCE FROM A LTD) |

|

|

Note : Advance paid to A ltd is assets in the bookd of B ltd as he has to receive service in future hence we are increasing our asset in business therefore we are adding it .

Account | Implementation |

Advance paid to A ltd | Debit as Asset is added in business |

Cash | Credit as Cash is going out |

Adjustment of Advance received

Paid future remaining advance to B ltd Rs 30,000 and get a invoice from Party.

as mention above we have created our assets and libilities in the book of A

Journal entry In the books of A ltd

PARTICULAR | AMOUNT | AMOUNT |

Cash A/c Dr. | 20,000 |

|

To Advance from B ltd |

| 20,000 |

(BEING CASH RECEIVED IN ADVANCE FROM B LTD) |

|

|

Adjustment of advance in the book of A ltd

PARTICULAR | AMOUNT | AMOUNT |

Advance from B ltd | 20,000 |

|

To Consulting service A/c |

| 20,000 |

(BEING ADVANCE ADJUSTED AGAINST SALES) |

|

|

Comparison of Journal entry

ADVANCE RECEIVED FROM CUSTOMER | ADVANCE PAID TO SUPPLLIER |

B is our customer | A is our supplier |

When advance is received from customer Rs. 5000 | When advance is paid to supplier Rs. 5000 |

Bank A/c Dr 5000 To B advance received A/c 5000 (Being advance received) | A advance paid A/c 5000 To bank A/c 5000 (Being advance paid) |

When invoice is raised Rs 10,000 | When invoice is received Rs. 1000 |

B advance received A/c Dr. 5000 B Dr. 5000 To Sales A/c 10,000 (being sale made) | Purchase A/c Dr 10,000 To A 5000 To A advance paid A/c 5000 (being purchase made) |

Note :

- B advance received is our liability.

- A advance paid is our asset .

- When bill are raised and received we adjust our assets and liabilities .

Advance receipt and Advance paid in balance sheet

Liabilities | Amount | Asset | Amount |

Advance received from customer | Xxxx | Advance paid To supplier | xxxx |

Journal entry of Receipt on Advace in GST in service

Advance received from the customer with GST

Mohan received Advance Rs 118,000 on 1 Jan 2021. from Krishna Traders local trader.

Particular | Amount |

Bank a/c Dr. | 118,000 |

To Krishna Traders | 118.000 |

(being advance received from Krishna) | |

Now this advance include 18,000 GST amount which is

CGST 9000

SGST 9000

Now on 31 Jan 2021.

Particular | Amount |

Tax on Advance a/c Dr. | 18,000 |

To Output CGST | 9.000 |

To Output SGST | 9,000 |

(being tax paid in advance) | |

When a sale is made

Particular | Amount |

Krishna Traders Dr | 118,000 |

To Sales | 100000 |

To Output SGST A/c | 9,000 |

To Output CGST A/c | 9,000 |

(being sales made ) |

Particular | Amount |

Output CGST A/c Dr | 9,000 |

Output SGST A/c Dr | 9,000 |

To Tax on Advance A/c | 18,000 |

(being an adjustment of advance) | |

Note no GST on advance on goods under GST but on service, it is still applicable.

Thus, advance payment under GST made in respect of the supply of goods would not attract any GST liability. However, the liability of on the advance payments for supply of services would continue to exist.

Difference between Advance received from Customer and advance paid to Supplier

Aspect | Advance received from Customer | Advance paid to Supplier |

Definition | A prepayment received from a customer before delivering goods/services. | A prepayment made to a supplier before receiving goods/services. |

Perspective | Supplier/Service Provider receives the advance | uyer/Customer pays the advance. |

Nature | Recorded as a liability. | Recorded as an asset (prepaid expense). |

Accounting Treatment | Initially, recorded as a liability account (e.g., “Advance from Customers”) When goods/services are delivered, the liability is reduced, and revenue is recognized. | Initially, recorded as an asset account (e.g., “Prepaid Expenses”). When goods/services are received, the asset is reduced, and expenses are recognized. |

Purpose | Provides assurance to the supplier that the customer is committed to the purchase. | Ensures the supply of goods/services from the supplier or secures favorable terms. |

Example | A company receives $1,000 in advance from a customer for a future order. | A company pays $2,000 in advance to a supplier for an upcoming shipment of goods. |