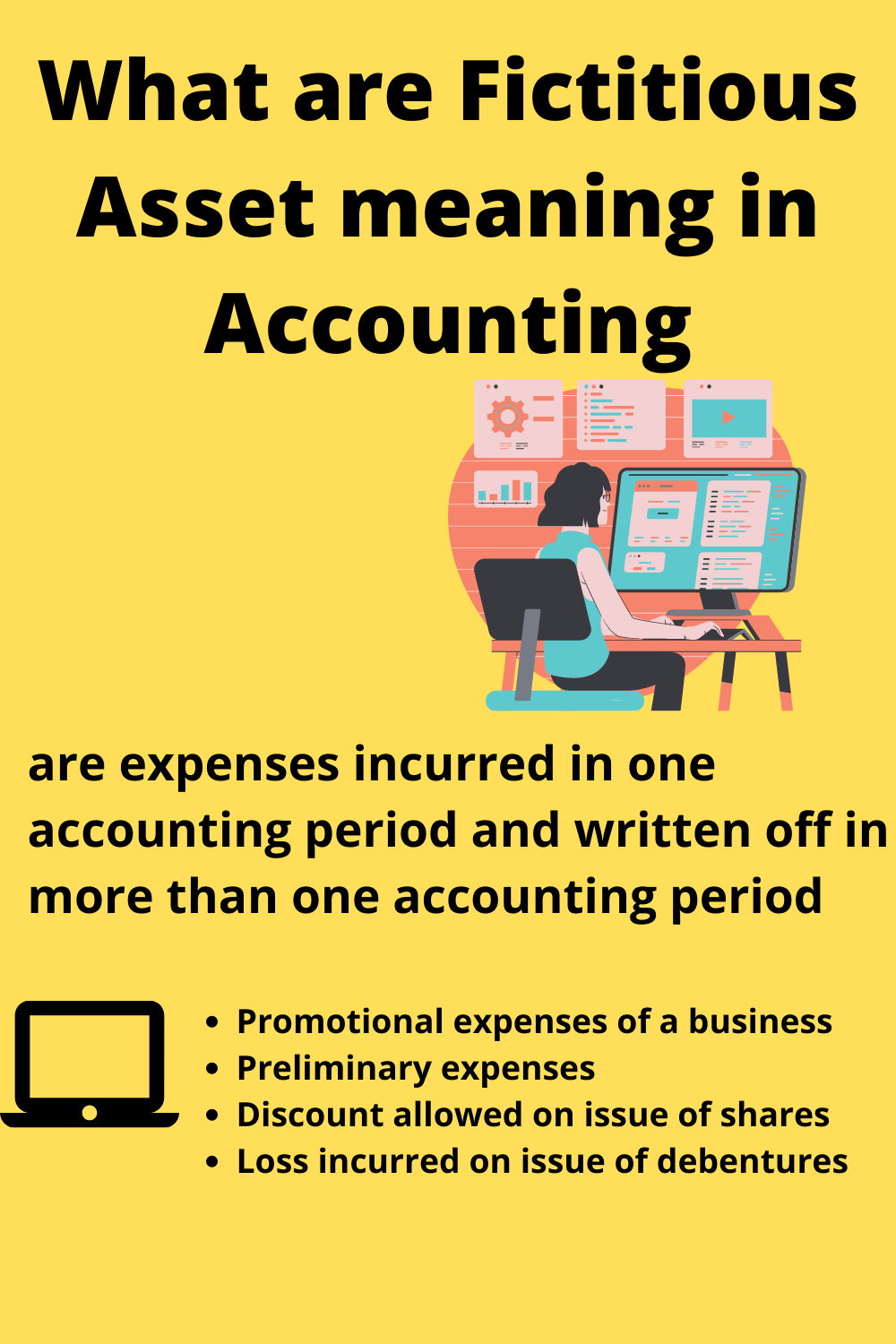

What are Fictitious Asset Meaning in Accounting

Table of Contents

ToggleWhat are Fictitious Asset ?

Fictitious Assets are not assets at all but shown however, they are shown as assets in the financial statements only for the time being.

Fictitious Assets are expenses incurred in one accounting period and written off in more than one accounting period.

Fictitious assets are expenses & losses which for some reason are not written off during the accounting period of their incidence

Fictitious assets meaning

In other words, fictitious means fake or not real,. Expenses incurred in starting a business.

Point to Understand

- Fictitious assets have no physical existence.

- No realisable value.

- They are amortised in one or more profitable financial years.

Example of Fictitious Assets

- Promotional marketing expenses.

- Underwriting commission.

- Preliminary expenses.

- Discount allowed on shares.

- Loss incurred (issue of debentures)

Fictitious assets are the deffered revenue expenditure as well as intangible assets i.e advertisement expenses, discount on issue of shares and debenture

Difference between fictions assets and Intangible Assets

Fictitious Assets vs Intangible Assets

Intangible assets are assets that do not have physical substance and we cannot see or touch.

The main examples of these tangible assets are goodwill , patent , trademarks. It represents the company’s reputation in terms of monetary valuation. In conclusion, goodwill is not a fictitious asset, but it is an intangible asset.

Fictitious assets

However, they meet the definition of assets while the fictitious assets just the expense which not yet reclass from the balance sheet.

FAQ

Q 1) Fictitious assets are shown on the asset side of the balance sheet of a company under the heading ________.

Answer :Miscellaneous expenditure

Fictitious assets are those assets which are not real but whose benefits are deduced by the company over a long period of time. Examples of fictitious assets are deferred revenue expenditure, preliminary expenses, etc.

These are shown on the asset side of the balance sheet under the head “Miscellaneous Expenditure”

Q2. Is goodwill a fictitious asset ?

Goodwill is considered as an intangible asset of the firm. It does not have any physical existence. … On the other hand, fictitious assets are neither tangible nor intangible assets. They are the expenses or losses which are still to be charged (debited) from the profit.

Q3) is patent a fictitious asset

The patent is seen as an intangible asset of the firm. It does not have any physical existence. It is not a fictions quality.

Example of fictitious Assets

Example: Brand Development Costs

Imagine a fictional company called “XYZ Electronics” that decides to create a fictitious asset called “Brand Development Costs.” This asset is created to capitalize on the costs incurred in developing their brand image and reputation, even though these costs cannot be objectively valued or sold.

XYZ Electronics spends a significant amount on marketing campaigns, advertising, and public relations efforts to build brand awareness and customer loyalty. Instead of expensing these costs as regular operating expenses, the company decides to list them as “Brand Development Costs” on the balance sheet.

On the balance sheet, it might look like this:

MCQ FICTITIOUS ASSETS

Time’s up