What is the journal entry for cheque dishonoured?

Table of Contents

ToggleWhat is the journal entry for cheque dishonoured?

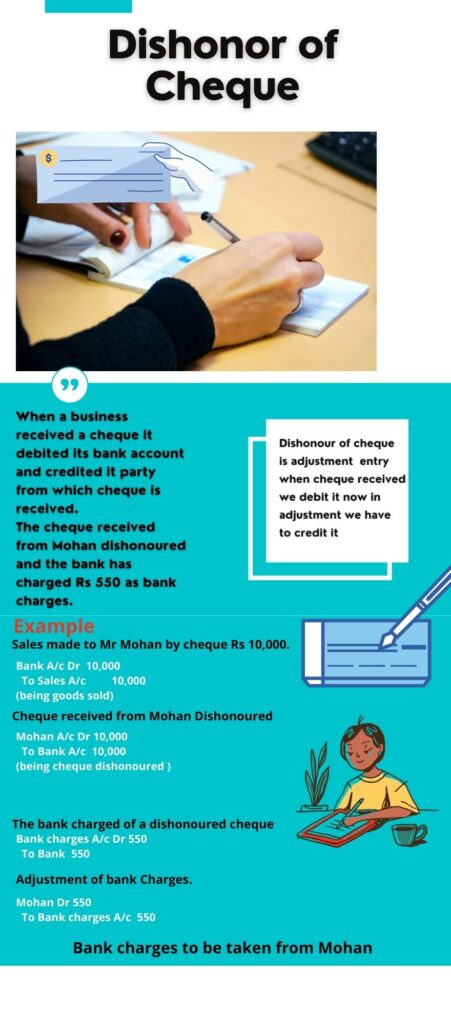

When a business received a cheque it debited its bank account and credited it party from which cheque is received.

Now understand it with example

Example 1

Sales made to Mr Mohan by cheque Rs 10,000.

Journal entry of same will be :

Bank A/c Dr | 10,000 |

To Sales A/c | 10,000 |

(being goods | |

Bank is Personal A/c as per Personal account Debit the receiver

Sales is Nominal A/c as per Nominal account Credit all income and

gains Sales is income.

Cheque Dishonored by Bank

The cheque received from Mohan dishonoured and the bank has charged Rs 550 as bank charges.

Now this Rs 550 charge is levied by the bank to us because of Mohan therefore that needs to be taken from Mohan with the cheque amount

Cheque amount entry

Mohan A/c Dr | 10,000 |

To Bank A/c | 10,000 |

(being cheque dishonoured ) | |

· This is an adjustment entry where we Debit Mohan as to make him our debtors.

· Bank is credited because we adjusted the bank which we debited earlier to credit it now to make adjustments in our bank account.

The bank charged of a dishonoured cheque need to taken from Mohan.

Bank charges A/c Dr | 550 |

To Bank | 550 |

(being cheque dishonoured charges ) | |

Adjustment of bank Charges.

Mohan Dr | 550 |

To Bank charges A/c | 550 |

(being cheque dishonoured charges to be taken from Mohan) | |

At the end Mohan is liable to pay us Rs 10,500.

Ledger of Party in Dishonoured cheque

| Particular | Amount | Particular | Amount |

| To Bank | 10000 | ||

| To bank Charges | 550 | ||

| By bal C/d | 10,550 | ||

| 10,550 | 10,550 |